MBSS

Mitrabahtera Segara Sejati Tbk.

1,725

-110

(-5.99%)

7.08 M

Volume

10.48 M

Avg volume

Company Background

PT. Mitrabahtera Segara Sejati Tbk (MBSS) bergerak dalam bidang penyediaan jasa pengiriman, baik kargo maupun penumpang, pengangkutan minyak dari kilang minyak, penyewaan kapal, biro pengiriman dari perusahaan pelayaran luar negeri, baik untuk pengiriman reguler maupun pengiriman non-reguler, dalam negeri dan luar negeri, agen pengiriman untuk perusahaan pelayaran, kapal tunda, penyewaan peralatan pengiriman dan pengiriman luar negeri. Perusahaan mulai beroperasi secara komersial pada tahun 1994. Perusahaan dimiliki oleh grup perusahaan yang dimiliki oleh PT. Indika Energy Tbk.

Kesepakatan dagang dengan AS dan Uni Eropa akan meningkatnya export/Import ke/dari Indonesia yang akan mengukung pertumbuhan bisnis Logistik/Jasa Pengiriman Barang Export/Import dari/ke AS dan Uni Eropa.

https://cutt.ly/ntQDRlll

$MBSS $SMDR

$MBSS

Ini saham kenapa volatilitas nya serem amat ya, padahal funda company nya bagus bgt..

Serasa maen trading forex Gbp-Usd ..😁

terima kasih ya udah dikasih entry lagi $MBSS. LK rilis jangan rebutan masuk.

best time to entry ketika lagi merah

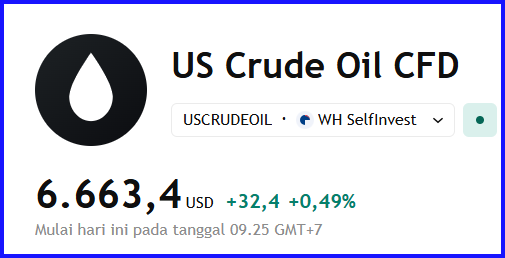

Saat ini Harga Minyak Mentah Dunia lanjut terbang tinggi....

$RAJA $SMDR $MBSS #ELSA #ENRG #RATU #MEDC

Harga Minyak Mentah Global ditutup menguat +2.64% pada penutupan tadi pagi.

$RAJA $SMDR $MBSS #ENRG #ELSA #MEDC