IPCC

Indonesia Kendaraan Terminal Tbk.

1,305

0.00

(0.00%)

1.39 M

Volume

2.19 M

Avg volume

Company Background

PT. Indonesia Kendaraan Terminal Tbk (IPCC) merupakan perusahaan kendaraan terminal yang beroperasi di Tanjung Priok. Perusahaan memberikan pelayanan Cargodoring, Stevedoring, Receiving & Delivery, Vehicle Processing Center (VPC), dan Equipment Processing Center (EPC). Perusahaan merupakan salah satu anak perusahaan PT. Pelabuhan Indonesia II (Persero).

Langka ini ada user di stream nulis daging wahyu A5 kaya gini

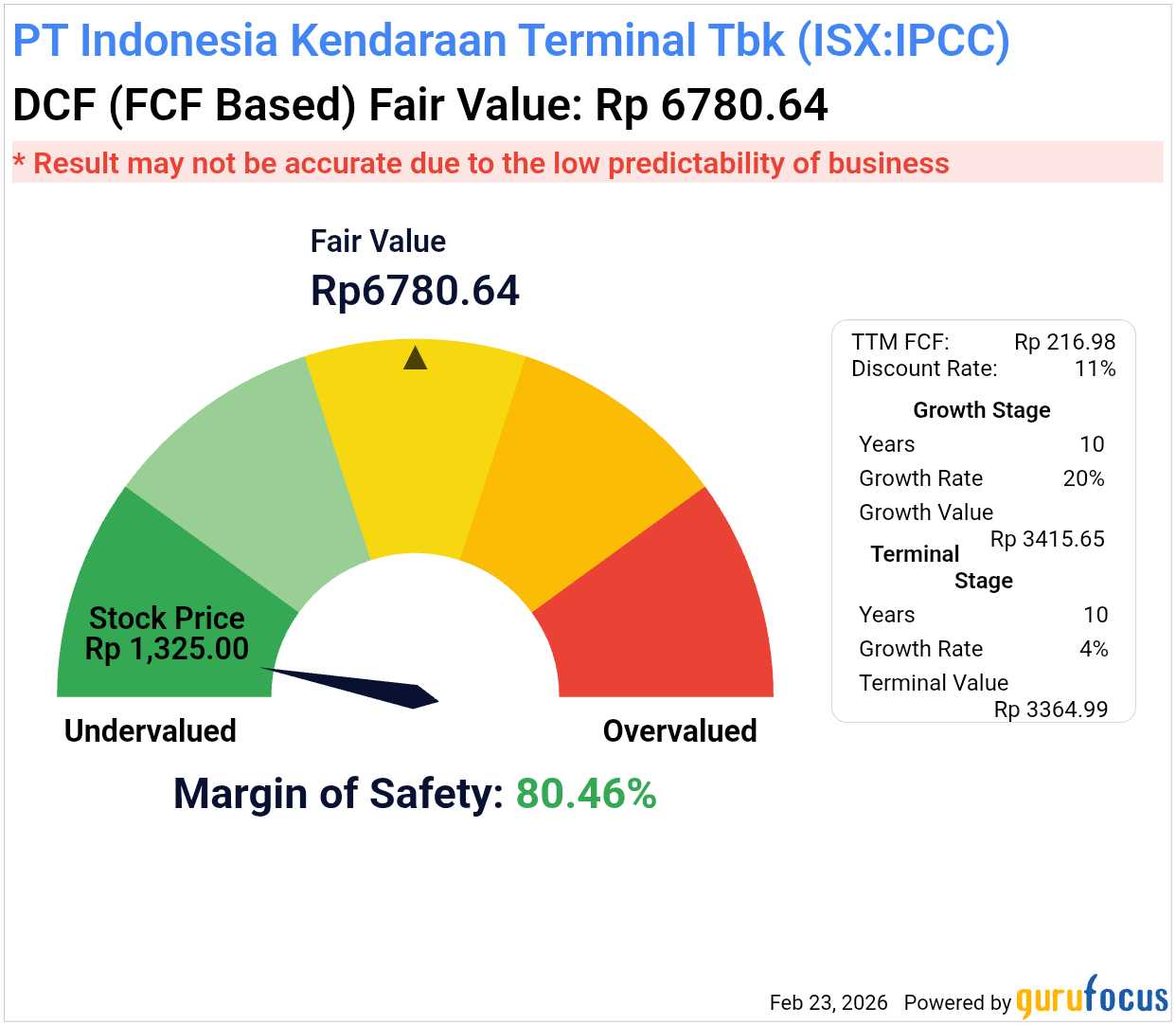

“Remember, cash is a fact, profit is an opinion.” – Alfred Rappaport

Mari kita tag emiten YDDA (yang DCF-DCF aja) dan YFFA (yang FCF-FCF aja) yang bisa ekspansi berdikari dari arus kas usahanya sendiri, NGGAK butuh raise funding dari aksi korporasi manapun apalagi ngutang dengan jaminan saham:

$LSIP $TOTL $IPCC

$IPCC

$IPCC: Direktur Utama Indonesia Kendaraan Terminal, Sugeng Mulyadi, mengatakan kepada Kontan bahwa pihaknya menargetkan pertumbuhan kinerja sekitar +10–15% YoY selama 2026. Target tersebut mempertimbangkan potensi penurunan volume impor kendaraan listrik (EV) pada tahun ini seiring berakhirnya insentif EV pada akhir 2025. Di sisi lain, IPCC akan fokus memanfaatkan posisi strategis Indonesia sebagai export hub otomotif, seiring ekspektasi adanya pergeseran pola dari impor secara completely built–up (CBU) menjadi produksi domestik yang berpotensi mendorong pertumbuhan ekspor EV.

https://snips.stockbit.com/snips-terbaru/-eskalasi-konflik-asiran-dampak-ke-ihsg?source=research

Salah satu framework sederhana yang sering saya gunakan adalah dividend yield + growth rate. Meskipun simple, ia tetap cukup konservatif.

1. Tentukan hurdle rate pribadi. Sebaiknya di atas 12%. Kalau saya pribadi pakai 15%.

2. 15 % = Dividend Yield + growth rate.

3. Screen perusahaan yang ROE-nya >= 15%.

4. Perhatikan juga ROIC-nya. Sebaiknya di atas 13%, meskipun terdapat pengecualian untuk beberapa perusahaan yang ROIC-nya rendah tapi punya income non-operasi rutin dari anak usahanya.

4. Estimasi growth rate. Ini bagian paling tricky, karena ada banyak faktor (internal maupun eksternal) yang dapat mempengaruhi. Secara matematis rumusnya adalah ROIC x reinvestment rate, di mana reinvestment rate adalah berapa % dari NOPAT yang dihasilkan tahun sebelumnya yang diinvestasikan kembali ke usaha. Tapi ga segampang itu, karena harus memperhatikan base rates, secular tail (head) wind, growth of market size, moat, dll.

5. Pelajari satu per satu mana yang DY + estimasi growth nya bisa memenuhi 15% itu.

6. Kalau sudah nemu, ya tinggal dibeli dan hold, lalu evaluasi berkala.

Kenapa konservatif?

*Karena aslinya hurdle rate itu rumusnya adalah FCFE Yield + growth. DI mana FCFE Yield adalah Dividend Yield + % of Retained Cash. Jadi kita mengesampingkan value of % of Retained Cash, yang mana fungsinya adalah untuk memperkuat balance sheet, sehingga risk lebih teredam. Cash ini suatu saat juga dapat direinvestasikan atau dikembalikan ke kita sebagai investor.

*Karena kita pakai hurdle rate 15%, yang mana itu sudah lebih tinggi 3% dari hurdle rate market. 3% ini berfungsi sebagai MOS, sekaligus sebagai ruang untuk capital gain ketika market bullish.

Kenapa ROIC dan ROE penting?

Semakin tinggi ROIC/ROE, tingkat reinvestasi yang dibutuhkan untuk mencapai sebuah level pertumbuhan semakin kecil, sehingga sisa uangnya (FCFE) semakin besar. Yang berarti potensi returning to shareholder juga semakin besar. Jadi ROIC/ROE itu memiliki dampak terhadap dua variable sekaligus, yaitu dividend yield dan juga growth rate.

Dengan framework ini, seharusnya investor akan lebih tenang ketika terjadi gejolak di market. Ketika harga saham rontok, tapi fundamental perusahaan belum berubah, kita malah senang. Karena, DY nya semakin besar, membuat kita semakin mudah mencapai hurdle rate 15% itu. Ketika harga saham naik, cuannya lebih banyak lagi dari capital gain. Mau naik mau turun tetap happy.

Mudah-mudahan sharing ini bermanfaat! Bisa dibaca juga beberapa contoh dalam post:

https://stockbit.com/post/27790477

https://stockbit.com/post/27881223

https://stockbit.com/post/28033189

https://stockbit.com/post/28044530

$TOTL $SMSM $IPCC

ANALISIS SEROK SAHAM – $IPCC

Harga Saat Ini : 1.345

1️⃣ KONDISI HARGA

Harga berada di area tengah setelah pergerakan naik sebelumnya.

Belum menyentuh zona bawah ekstrem.

Area sekarang cenderung area supply minor, bukan zona serok ideal.

2️⃣ MAPPING ZONA SEROK

Zona Serok 1 (Ringan)

1.260 – 1.300

Area support terdekat.

Cocok untuk cicil 20–30%.

Zona Serok 2 (Ideal)

1.150 – 1.220

Support kuat sebelumnya.

Risk–reward lebih sehat.

Cocok untuk tambah posisi utama.

Zona Serok 3 (Diskon Bandar)

1.000 – 1.100

Area panic selling / flush.

Entry agresif jika muncul reversal + volume.

3️⃣ TARGET PANTULAN

TP1 : 1.420

TP2 : 1.520

TP3 : 1.650 – 1.750 (jika momentum kuat)

4️⃣ STOPLOSS WAJIB

Jika tutup di bawah 980

Struktur rusak → wajib disiplin cut.

5️⃣ SIMULASI RISK : REWARD

(Contoh Entry Zona Ideal 1.180)

Risiko ±200 poin

Potensi TP1 ±240 poin

Potensi TP2 ±340 poin

Estimasi R:R

1 : 1,2 sampai 1 : 1,7

Masuk bawah = tekanan psikologis lebih kecil.

KESIMPULAN PASUKAN SEROK

Harga 1.345 bukan zona terbaik untuk serok maksimal.

Strategi terbaik menunggu ditekan ke 1.220 – 1.150.

Jangan beli karena FOMO naik.

Kita beli saat orang panik dan harga murah.

Yang sering nyangkut beli di atas.

Pasukan Serok hadir beli di bawah, Boss.

Nyangkut disaham apa Boss? Sini aku bantu $ADMR $BRMS

IPCC Incar Pertumbuhan Kinerja +10–15% YoY pada 2026

Direktur Utama Indonesia Kendaraan Terminal ($IPCC), Sugeng Mulyadi, mengatakan kepada Kontan bahwa pihaknya menargetkan pertumbuhan kinerja sekitar +10–15% YoY selama 2026. Target tersebut mempertimbangkan potensi penurunan volume impor kendaraan listrik (EV) pada tahun ini seiring berakhirnya insentif EV pada akhir 2025. Di sisi lain, IPCC akan fokus memanfaatkan posisi strategis Indonesia sebagai export hub otomotif, seiring ekspektasi adanya pergeseran pola dari impor secara completely built–up (CBU) menjadi produksi domestik yang berpotensi mendorong pertumbuhan ekspor EV.

[Sumber: Kontan]

------

Stockbit Sekuritas

Waktu, Kecepatan, dan Kendali yang Tak Terbeli

Tampaknya ada kegelisahan yang mendalam saat kita melihat angka di rekening dan merasa bahwa pertumbuhan yang wajar saja tidak akan pernah cukup. Sepertinya ada tekanan yang berat untuk segera melompat jauh, mengejar apa yang disebut sebagai 'pertumbuhan kilat', karena merasa bahwa menunggu dan membangun secara perlahan adalah sebuah pemborosan waktu yang sia-sia.

...Pemborosan waktu yang sia-sia?

Kedengarannya seperti... Anda sedang berada di persimpangan yang ramai. Di satu sisi, ada suara-suara lantang yang berkata, "Modal kecil? Jangan buang waktu dengan dividen. Kejar yang cepat. Dua minggu bisa multibagger." Di sisi lain, ada bisikan yang mengatakan, "Tapi aku tidak punya informasi istimewa. Aku tidak kenal bandar. Apa aku hanya ikut-ikutan?"

Sepertinya narasi tentang 'modal kecil harus berani' terdengar sangat heroik, seolah-olah pasar modal adalah satu-satunya tempat di mana nasib kita ditentukan. Rasanya sangat melelahkan jika kita dipaksa percaya bahwa setiap menit yang tidak kita gunakan untuk memantau pergerakan harga adalah peluang yang hilang.

Kedengarannya seperti ada keinginan besar untuk maju, untuk keluar dari keterbatasan, untuk merasakan bahwa uang Anda benar-benar bekerja. Dan di tengah desakan itu, muncul tawaran yang terdengar sangat meyakinkan: "Belajarlah dari orang yang berhasil kaya dari market. Mindset mereka pasti beda."

Itu benar. Wajar untuk mencari teladan. Wajar untuk ingin belajar dari yang sudah mencapai apa yang kita impikan. Dan wajar untuk merasa bahwa dengan modal terbatas, kita harus bergerak lebih cepat, lebih agresif, mengambil jalan pintas.

Namun, saya penasaran. Bagaimana perasaan Anda jika ternyata investasi yang paling memberikan hasil tertinggi bukanlah apa yang Anda klik di layar hari ini, melainkan apa yang Anda bangun pada diri Anda sendiri di dunia nyata saat pasar sedang tutup?

...Dunia nyata saat pasar sedang tutup?

Aset yang Paling Sering Terlupakan

Tapi ada satu hal yang tidak pernah disebut dalam semua tawaran itu. Tidak ada yang pernah bertanya: Siapa Anda sebenarnya?

Mereka tidak tahu dari mana Anda memulai. Mereka tidak tahu berapa banyak yang bisa Anda relakan tanpa mengganggu tidur. Mereka tidak tahu apa yang sebenarnya Anda inginkan—bukan untuk dipamerkan, tetapi untuk benar-benar Anda miliki. Dan karena mereka tidak tahu, mereka menawarkan resep yang sama untuk semua orang: "Kejar momentum. Ikuti arus. Yang penting cuan."

Sementara itu, di luar layar, ada aset yang paling sering diabaikan oleh para penjual resep itu: Anda sendiri.

Waktu Anda. Energi Anda. Kemampuan Anda untuk belajar, tumbuh, dan menjadi lebih berharga di dunia nyata. Tidak ada influencer yang bisa memberi Anda itu. Tidak ada momentum backdoor yang bisa menggantikannya. Itu adalah satu-satunya aset yang sepenuhnya—100%—berada dalam kendali Anda.

Bayangkan jika semua energi yang Anda habiskan untuk mengikuti drama pasar yang provokatif, dan mengejar saham yang sedang ramai, Anda alihkan untuk sesuatu yang lain. Satu keterampilan baru. Satu proyek kecil. Satu langkah nyata yang membuat diri Anda lebih bernilai besok daripada hari ini. Hasilnya mungkin tidak terlihat dalam dua minggu. Tapi hasil itu nyata, milik Anda, dan tidak bisa diambil oleh siapa pun—termasuk koreksi pasar.

Lalu, dari hasil itu, Anda menyisihkan. Sekecil apapun. Menabung di perusahaan-perusahaan yang bisnisnya Anda pahami, yang membagikan laba, yang tidak menjanjikan multibagger tapi memberi Anda ketenangan. Itu bukan strategi cepat kaya. Itu strategi membangun fondasi.

Tampaknya kita mulai menyadari bahwa mengikuti arus yang tidak kita pahami—hanya karena janji keuntungan besar dalam waktu singkat—sebenarnya adalah bentuk penyerahan kedaulatan kita kepada orang lain. Sepertinya ada pengakuan yang jujur bahwa kita tidak pernah benar-benar tahu apa kepentingan di balik ajakan tersebut, atau apakah mereka yang mengajak memiliki jaring pengaman yang jauh lebih kuat daripada yang kita bayangkan.

...Jaring pengaman yang tidak kita lihat?

Ada ketenangan yang mulai tumbuh saat kita berhenti membandingkan kecepatan kita dengan papan skor orang lain. Tampaknya kita sedang belajar bahwa memulai dari apa yang kita miliki, melakukan apa yang kita bisa, dan fokus pada peningkatan nilai diri kita di kehidupan sehari-hari adalah bentuk investasi yang paling jujur. Menabung hasil kerja keras di tempat yang aman, sekecil apa pun itu, adalah langkah kedaulatan yang tidak bisa diganggu gugat oleh bisingnya tren.

Jadi, dari semua yang ditawarkan kepada Anda hari ini—dari janji multibagger tiap dua minggu, dari resep mindset orang kaya, dari tekanan untuk ikut arus dan momentum—ada satu pertanyaan yang mungkin hanya bisa Anda jawab sendiri, di luar keramaian:

"Berapa banyak dari waktu dan energi saya hari ini yang benar-benar saya investasikan untuk membuat diri saya lebih berharga di dunia nyata, dibandingkan untuk sekadar mengikuti ke mana arah angin bertiup?"

Jika pada akhirnya Anda adalah satu-satunya orang yang akan menanggung setiap risiko dari modal yang Anda kumpulkan dengan susah payah, bagaimana cara Anda memastikan bahwa strategi yang Anda ikuti hari ini benar-benar dirancang untuk masa depan Anda, dan bukan sekadar untuk memenuhi kebutuhan narasi orang lain?

$IPCC $UNTR $ADRO

Kinerja Indeks Toko Kelontong Rakyat Jelata 2M2026

(Terlampir Isi Portofolio)

Start: Rp. 165.544.107,-

Net Top up (WD) : Rp. 0,-

Net Profit (Loss) : Rp. (109.259,-)

End: Rp. 165.434.848,-

Performance (NAV) : -0,07% vs IHSG YTD -4,76%

CAGR Since January 2023: +27,51%

Mudah-mudahan bulan-bulan berikutnya portofolio kita semua cuan...!!!

$TOTL $SMSM $IPCC

1/3

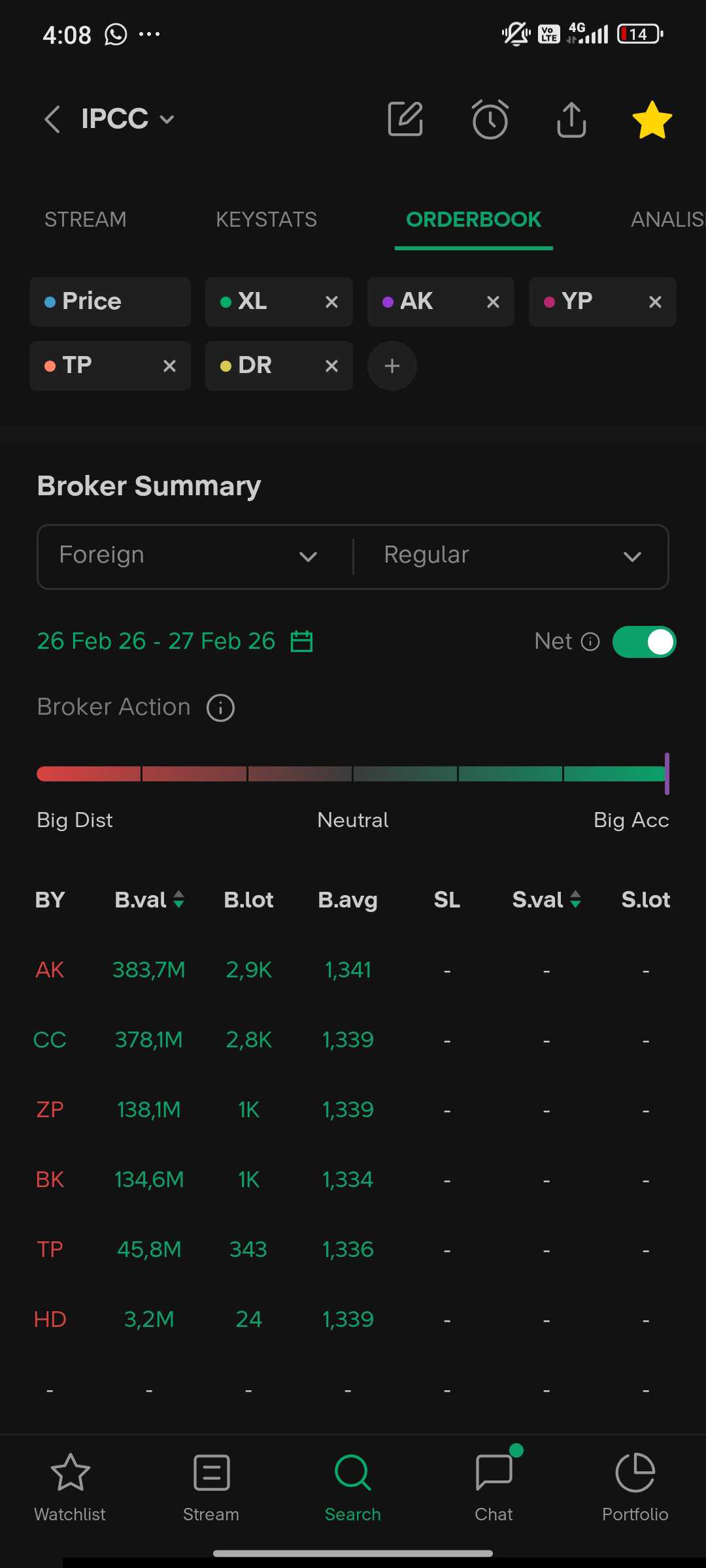

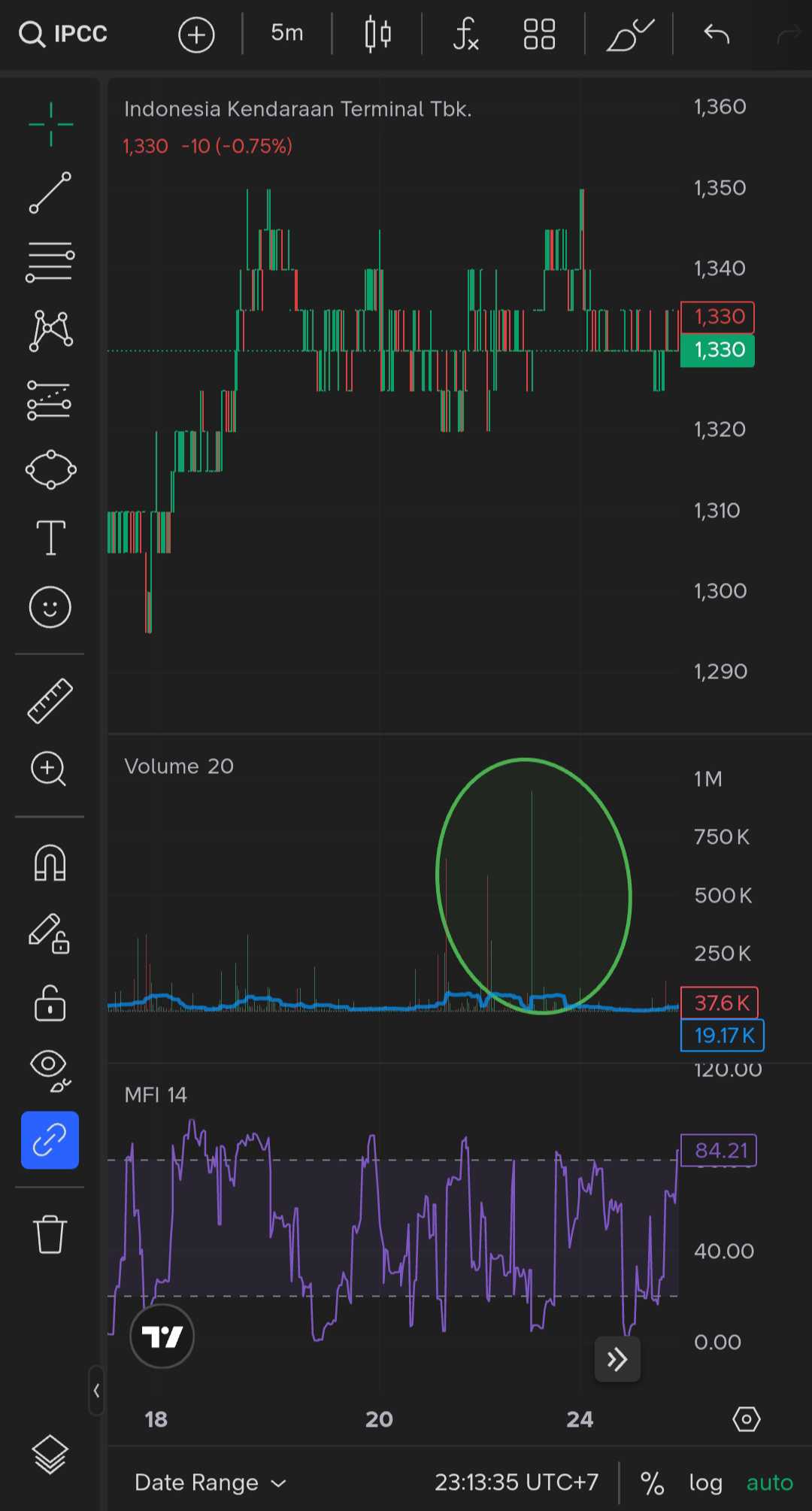

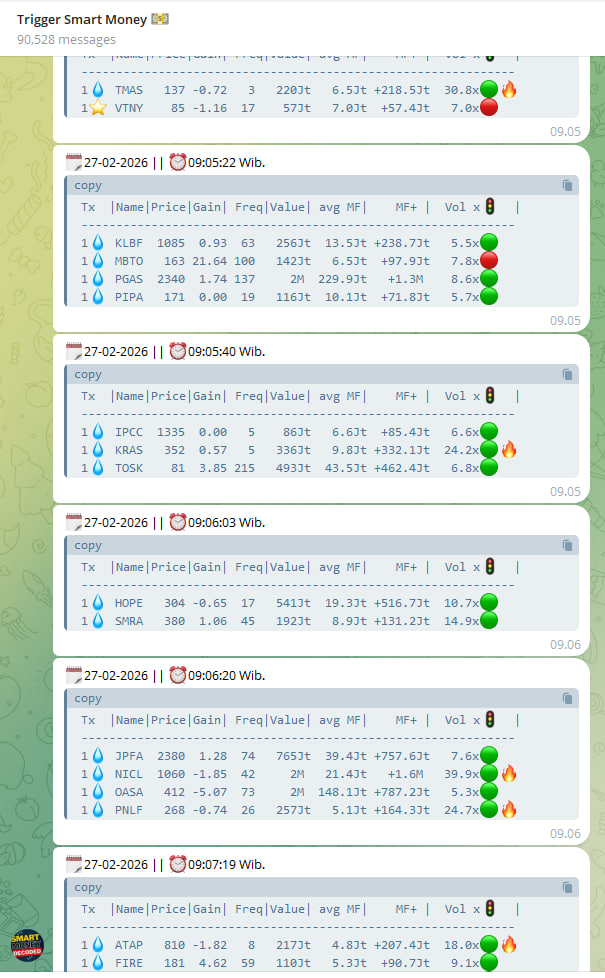

✅ Validitas Sinyal: Hanya Sinyal Akumulasi yang Terverifikasi Ganda

Dalam trading, validitas sinyal adalah segalanya. Sinyal yang tidak valid menyebabkan kerugian. Untuk mencapai validitas yang tinggi, sinyal akumulasi harus melalui verifikasi ganda: pertama, volume harus abnormal, dan kedua, volume tersebut harus didominasi oleh pembelian yang kuat dari Smart Money.

Trigger Smart Money adalah alat yang menerapkan sistem verifikasi ganda yang ketat untuk menjamin validitas sinyal akumulasi di pasar saham Indonesia. Kami mengubah volume tinggi yang ambigu menjadi sinyal beli yang teruji.

Verifikasi Ganda kami dimulai dengan Deteksi Anomali Volume Intraday yang Ekstrem. Kami mencari lonjakan volume yang sangat cepat dan signifikan (misalnya, 6x hingga 9x lipat dari rata-rata intraday). Ini adalah filter volume yang ketat. Verifikasi kedua adalah Uji Dominasi Money Flow. Kami memastikan bahwa volume ekstrem tersebut didominasi oleh arus dana masuk bersih (net buying). Jika dominasi net buying lemah atau negatif, sinyal tersebut dianggap tidak valid dan diabaikan. Dengan verifikasi ganda ini, Trigger Smart Money menjamin Anda hanya mendapatkan sinyal akumulasi yang memiliki validitas tertinggi, meminimalkan risiko Anda mengikuti sinyal yang menyesatkan.

$IPCC $KRAS $TOSK

1/3

#47 Menghormati Risiko Sejak Awal

Semakin lama saya berinvestasi, semakin saya memahami bahwa risiko bukan sesuatu yang muncul di tengah jalan. Ia sudah ada sejak keputusan pertama diambil. Dulu saya lebih fokus pada potensi hasil, sementara risiko saya anggap sebagai kemungkinan yang bisa dihindari dengan cukup hati-hati. Sekarang saya melihatnya berbeda. Risiko bukan gangguan, melainkan pasangan tetap dari setiap peluang. Menghormatinya sejak awal membuat saya lebih realistis dalam menilai apa yang mungkin terjadi.

Saya mulai menyadari bahwa sistem yang saya bangun tidak bertujuan menghilangkan risiko, melainkan mengelolanya. Sistem memberi batas, memberi struktur, dan mengingatkan saya bahwa tidak semua hasil akan sesuai ekspektasi. Ketika hasil kurang baik muncul, emosi mungkin ingin menyalahkan keadaan atau keputusan tertentu. Namun sistem mengajarkan untuk tetap melihat konteks yang lebih luas. Selama kerangka berpikir masih konsisten, saya tidak perlu membongkar semuanya hanya karena satu fase tidak berjalan mulus.

Perubahan terbesar dalam diri saya terjadi ketika saya berhenti berharap pada hasil yang selalu ideal. Saya menerima bahwa drawdown adalah bagian dari perjalanan, bukan penyimpangan dari rencana. Saya tidak lagi melihat penurunan sebagai bukti bahwa saya tidak cukup baik. Sebaliknya, saya melihatnya sebagai pengingat bahwa risiko memang bekerja sebagaimana mestinya. Dengan cara pandang itu, respon saya menjadi lebih terukur dan tidak tergesa.

Pada akhirnya, menghormati risiko sejak awal membuat saya lebih tenang saat hasil tidak sesuai harapan. Saya tidak lagi merasa terkejut ketika fase sulit datang, karena saya sudah mengakuinya sebagai bagian dari sistem. Ketahanan tidak dibangun saat semuanya berjalan lancar, tetapi saat saya tetap disiplin di tengah ketidaknyamanan. Di situlah kedewasaan tumbuh—bukan dari menghindari risiko, melainkan dari menerima dan mengelolanya dengan sadar.

$IHSG $IPCC $CASS

$IPCC saham "tidur" yang "nggak ke mana-mana" karena holders-nya cuma beli habis itu nggak berpindah-pindah dari saham ke saham, melainkan nggak ke mana-mana, fokus value investing meningkatkan value diri sendiri di dunia nyata, dari mulai dalam karier hingga bisnis, dan saham "tidur" nya hanya mereka tinggal tidur, karena prinsip investasi utamanya adalah yang bisa membuat mereka tetap tidur nyenyak untuk beberapa dekade ke depan

Tapi ternyata kita dibangunkan oleh danantoro/danabandar melalui programnya agrinas

Tapi ingat, ada perbedaan kontras yang mendasar antara momentum chaser dengan investor yang conviction-nya terus bertambah seiring berjalannya waktu. Yang satu terombang-ambing, harus selalu waspada supaya tidak telat untuk melompat keluar saat momentum itu berubah, yang satu membangun kastil, mercusuar, pelabuhan, dan infrastruktur lainnya yang membuat mereka tetap kokoh di tengah terjangan badai dan ombak manapun, supaya mereka bisa hidup nyaman, mapan, sejahtera, makmur, dan tidur nyenyak di dalamnya

$IPCM $IHSG

Portfolio/Trading saham Jumat, 27 Feb 2026

--Day Trading (1-3 day)

1. SHIP

2. ATAP

3. TRIN

4. $IPCC

5. $TOBA

6. ASLI

7. BAPA

--Swing Trading (3-10 hari)

1. AMAN

2. ITMA

3. MEDC

4. DEWA

5. NSSS

6. BNII

7. $AVIA

--Positional Trading (1 week-6 months)

1. ARCI / MDKA / EMAS / AMMN

2. JECC

3. ADMR

4. EMTK / SCMA

5. ANTM

6. JPFA

Watchlist: AHAP, TKIM, ULTJ

Done eksekusi hari ini:

TP partial done: ANTM, ASLI

TP Full: DPUM, SLIS, LAJU, BSML, HEXA

Tambah muatan: EMAS, JPFA

Out of list: MSIN, INOV, HOPE

Kalau saham-saham yang "nggak ke mana-mana" jadi penggendong porto, artinya market lagi flight to quality

$SIDO $UNTR $IPCC

Mana ada nilai truk 700 jutaan per unit? Itu ada daftar harganya.

Totalnya cuma 24T sekian, bukan 70T++

$IPCC

Tadi pagi average up $IPCC

105.000 pickup India tetap ngegas masuk Tanjung Priok. Sebagian udah tiba katanya.

Dengar2, ternyata EBIT Margin untuk impor lebih besar daripada ekspor. Ada yang bisa klarifikasi?

Target terdekat saya untuk $SOCI, cek postingan ini ⤵️

https://stockbit.com/post/21165242

Random Tags : $BULL $IPCC

SAHAM : $IPCC

HARGA SAAT INI : 1335

1️⃣ TREN & STRUKTUR HARGA (Swing View)

- Tren Utama : Rebound menuju uptrend

- Timeframe Acuan : Daily (Swing Trader)

- Catatan : Harga mulai membentuk higher low setelah fase turun sebelumnya. Struktur sedang uji resistance area atas dan berpotensi lanjut jika volume mendukung. Namun masih rawan pullback teknikal jangka pendek.

2️⃣ SUPPORT & RESISTANCE

- Support Minor : 1280

- Support Kunci : 1200

- Resistance 1 : 1400

- Resistance 2 : 1500

3️⃣ KONDISI VOLUME & BANDAR

- Analisa volume : Meningkat saat kenaikan

- Indikasi : Akumulasi bertahap

- Selama harga di atas 1200 → masih dijaga

4️⃣ RISK / REWARD (WAJIB)

- Entry Acuan : 1335

- Stop Loss : 1150

- Target Swing : 1480

- Risk : Reward : ±1 : 0,8 (CUKUP)

5️⃣ FUNDAMENTAL SINGKAT

- Emiten jasa kepelabuhanan kendaraan, sensitif terhadap volume ekspor–impor otomotif

- Cocok untuk swing hingga mid-term dengan volatilitas moderat

📌 KESIMPULAN SWING TRADER

- IPCC menarik untuk swing lanjutan selama bertahan di atas support kunci 1200

- Target area 1400–1500, risiko meningkat jika breakdown 1200

Analisa ini panduan ya Boss, eksekusi tetap kembali ke gaya trading Boss.

$AMRT $BATR

Teori konstipasi: ini akal-akalannya danantoro/danabandar supaya $IPCC $CUAN, setelah gagal mendapatkan tambang $EMAS miliknya ASII & UNTR 🤣

Anyway kalau ASII dibuki gara-gara kena sentimen negatif dari sini, you already know what I'm gonna do 😉

Mobil Impor India Sudah Sampai di Tanjung Priok

Sumber dari Detik https://cutt.ly/9tWz81zR

Padahal katanya tadi pagi mau ditunda.

https://cutt.ly/BtWz8Mui

Ternyata ya gitu lah.

$IPCC cuan karena dapat proyek di Priok untuk penanganan kendaraan impor yang masuk.

$ASII dan $IMAS dapat ucapan terimakasih aja karena sudah bangun pabrik di Indonesia tapi produknya tidak dipakai pemerintah untuk proyek Koperasi Merah Putih.

Tinggal sama-sama aja itu ASII dan IMAS main dipojokan bareng Alfamart dan Indomaret yang dilarang ekspansi ke Desa sama Menteri Koperasi.

Ini bukan rekomendasi jual dan beli saham. Keputusan ada di tangan masing-masing investor.

Untuk diskusi lebih lanjut bisa lewat External Community Pintar Nyangkut di Telegram dengan mendaftarkan diri ke External Community menggunakan kode: A38138

Link Panduan https://stockbit.com/post/13223345

Kunjungi Insight Pintar Nyangkut di sini https://cutt.ly/ne0pqmLm

Sedangkan untuk rekomendasi belajar saham bisa cek di sini https://cutt.ly/Ve3nZHZf

https://cutt.ly/ge3LaGFx

Toko Kaos Pintar Nyangkut https://cutt.ly/XruoaWRW

Disclaimer: http://bit.ly/3RznNpU

1/2