CASS

Cahaya Aero Services Tbk.

2,390

+10

(0.42%)

4,600

Volume

266,096

Avg volume

Company Background

PT Cahaya Aero Services Tbk, yang dikenal dengan sebutan CAS dalah entitas induk dengan standar operasi dan mutu yang telah diakui dunia di bidang jasa penunjang transportasi udara, solusi boga dan pengelolaan fasilitas. Perseroan menjalankan usahanya di banyak lokasi, yakni bandar udara, daerah terpencil, kawasan industri maupun wilayah perkotaan. Pada tahun 2018 Perseroan menangani lebih dari 27,6 juta penumpang dan lebih dari 88.000 penerbangan, serta menyediakan 10 juta porsi makanan dan mengelola lebih dari 320.000 ton kargo.

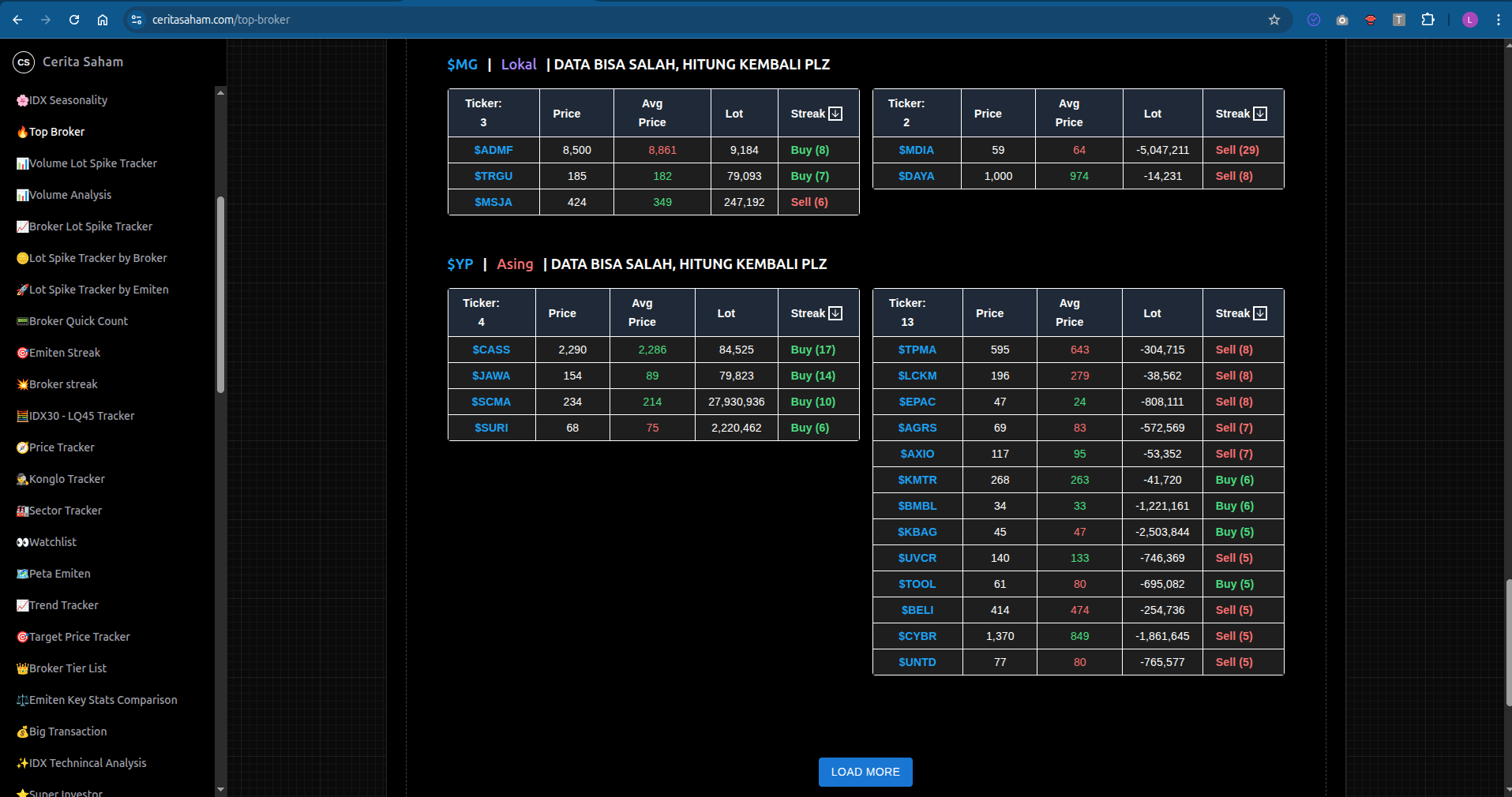

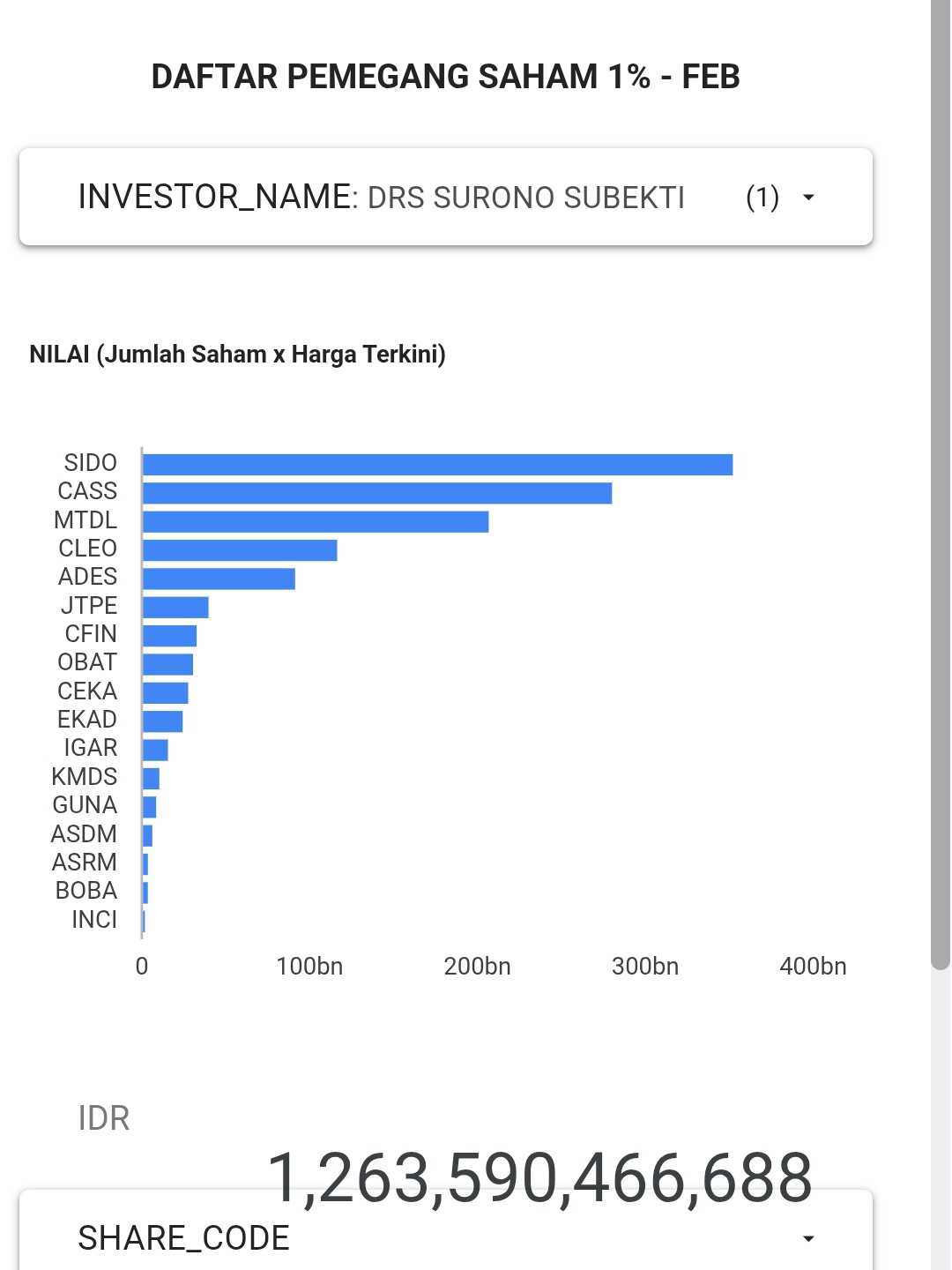

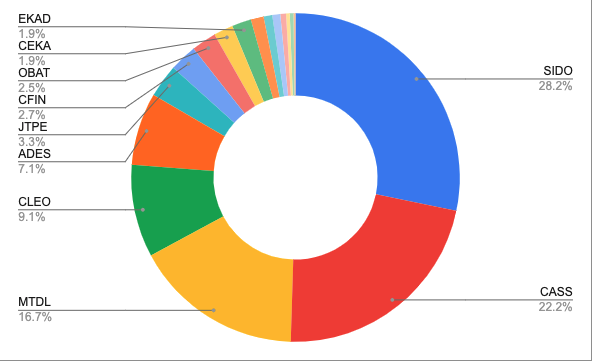

Investor Individu Dengan Paling Banyak Pegang Saham di Atas 1%

Surono Subekti adalah investor individu yang pegang paling banyak saham di atas 1%. Itu artinya tajir banget ini Pak Surono.

Tapi pasti banyak yang tidak kenal sama Surono Subekti karena dia memang ndak flexing McLaren Ijo dan ndak pernah ajak followernya makan besar 35 mangkok Ikan Nila Dari Senegal tapi endingnya digorok itu follower.

Surono Subekti ini cenderung low profile. Tapi diam - diam begini, dia sampai pegang 17 biji saham dengan kepemilikan di atas 1%.

Paling gede di $OBAT $CASS itu sampai di atas 5%. Dia juga ada SIDO 2,26%.

Aplikasi ini adalah Whale Tracker buatan salah satu member Pintar Nyangkut @Maxlong. Aplikasi ini menurut saya sangat bagus dalam memvisualisasikan data kepemilikan saham dari data KSEI.

Ini bukan rekomendasi jual dan beli saham. Keputusan ada di tangan masing-masing investor.

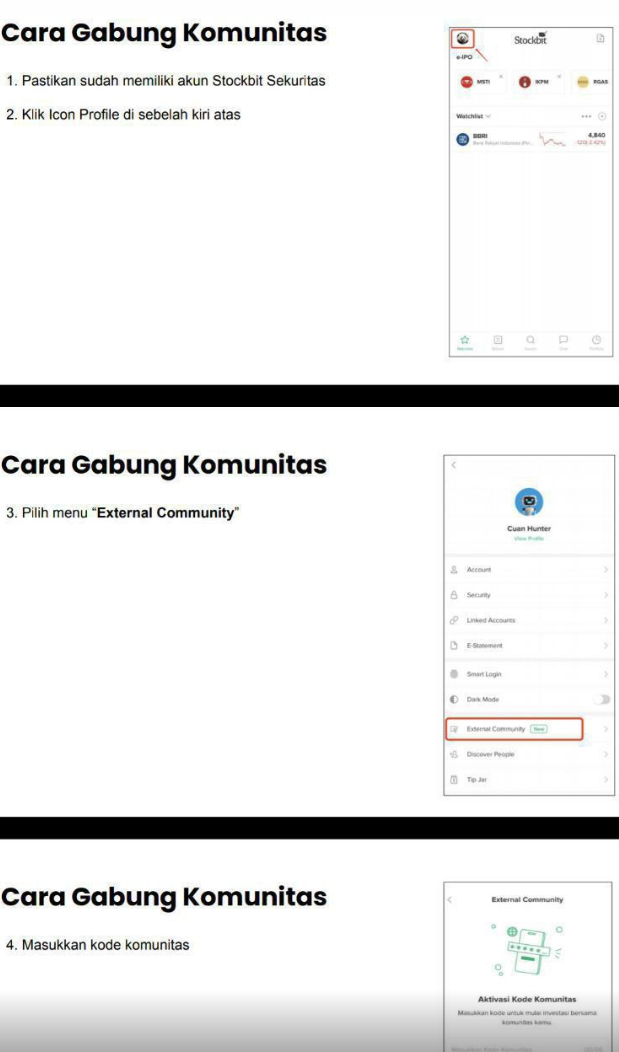

Untuk diskusi lebih lanjut bisa lewat External Community Pintar Nyangkut di Telegram dengan mendaftarkan diri ke External Community menggunakan kode: A38138

Link Panduan https://stockbit.com/post/13223345

Kunjungi Insight Pintar Nyangkut di sini https://cutt.ly/ne0pqmLm

Sedangkan untuk rekomendasi belajar saham bisa cek di sini https://cutt.ly/Ve3nZHZf

https://cutt.ly/ge3LaGFx

Toko Kaos Pintar Nyangkut https://cutt.ly/XruoaWRW

Disclaimer: http://bit.ly/3RznNpU

1/7

update : tyt beliau orang bijak, ane pernah baca bukunya, tapi ga ngeuh sedang merujuk orang yg sama..

$SIDO $CASS $MTDL

SURONO SUBEKTI.

Dari gelar, beliau agaknya sudah berumur.

tiga porto terbuka yg terbesarnya lumayan terkonsentrasi.

Nilai porto terbukanya 1.3T.

Nice

Value Investor detected. Ada yg punya info lebih lanjut ttg beliau?

Pendekar2 kek gini harusnya dapat tempat di podcast2 yg mencerahkan. atau memang beliau lebih senang tertutup.

$SIDO $CASS $MTDL

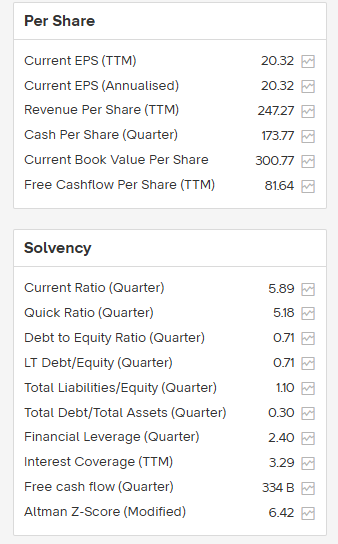

cash per share nya lebih besar dari harga 1 lembar sahamnya!!!

penjualan nya meningkat

laba nya pun menarik

kedekatan indonesia dgn china jelas menjadi story menarik dari perussahaan ini

$KIJA $CASS $DOSS

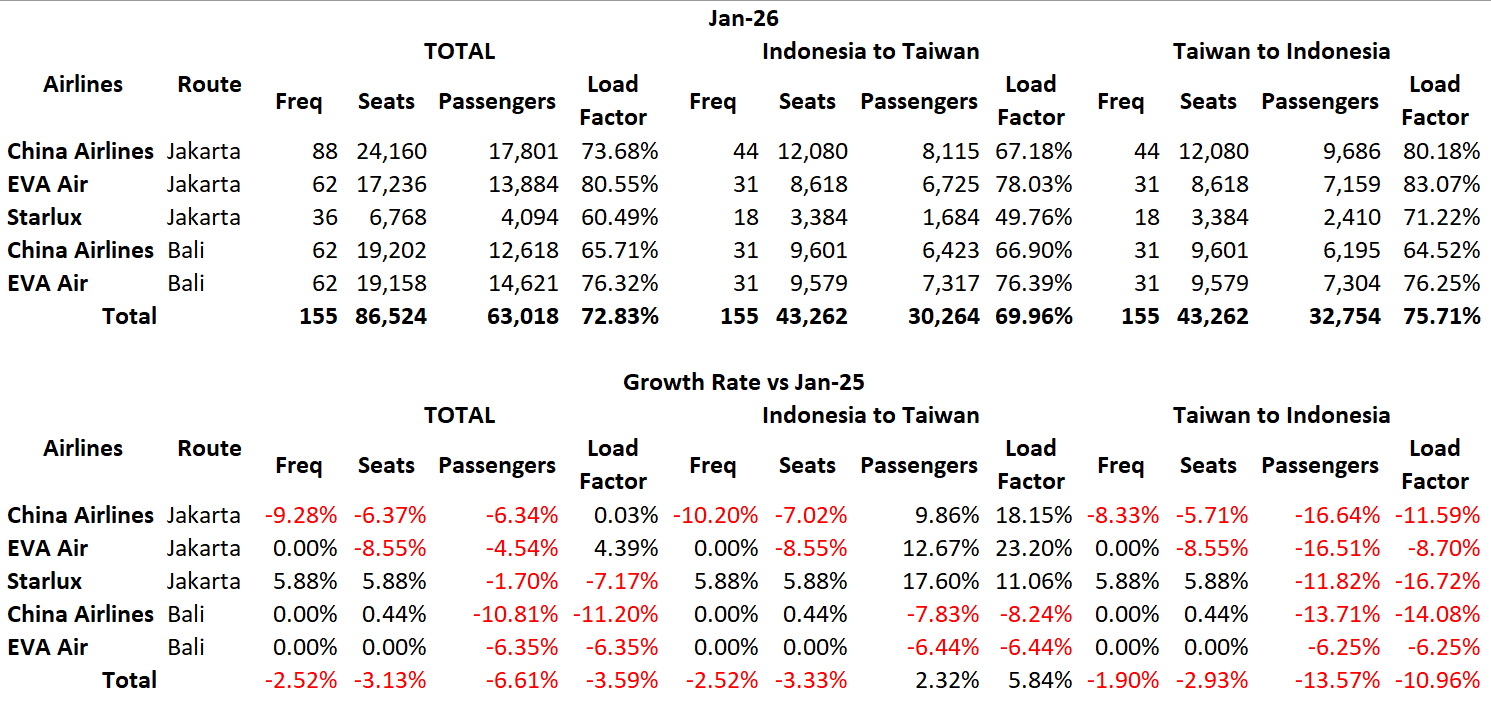

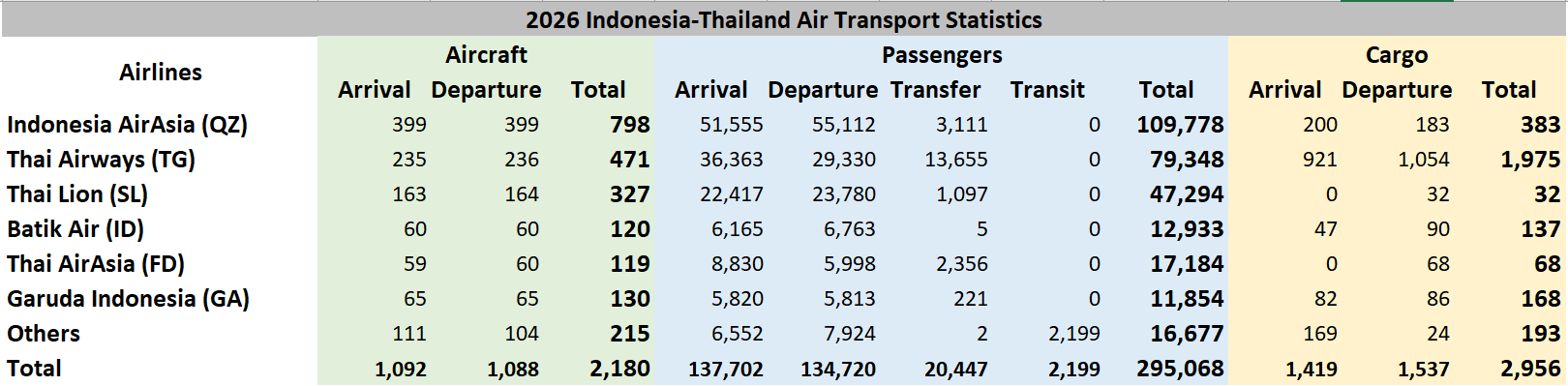

Data Penerbangan Indonesia dari dan ke Thailand tahun 2026 hingga bulan Februari

*Traffik mengalami peningkatan sebesar 5,67% dibandingkan dengan periode yang sama di tahun 2025.

*Jumlah penumpang menurun sebesar 0,49% dibandingkan dengan periode yang sama di tahun 2025.

*Volume kargo meningkat signifikan sebesar 19,25% dibandingkan dengan periode yang sama di tahun 2025.

$CASS $GIAA $GMFI

kalo dia kaya $CASS auto cuan. Tapi klo research yang gua lakuin, $GMFI nanti punya + di bidang bengkel pesawat militer 😗

Anda beli angsa yang beraknya emas di harga X.

Sekian tahun berlalu, angsa ini selalu menghasilkan emas buat Anda. Ukurannya juga tambah besar dari awal pas beli.

Suatu waktu, angsa Anda tiba-tiba sembelit. Anda baca-baca dan pelajari dari sejarah, ternyata sudah sering kejadian begitu. Nanti angsanya juga akan sembuh dan berak emas lagi.

Meanwhile, angsa tetangga Anda punya kondisi yang sama dengan angsa Anda. Tetangga Anda si B yang dulu belinya bareng Anda panik, tidak belajar dan cari tahu. Dia ketuk pintu tetangga C, menawarkan untuk menjual angsa itu di harga X - Y%.

Apakah Anda akan ikutan dia untuk ke tetangga C dan menawarkan angsa Anda seharga X - Z%?

Atau Anda malah panggil si B dan beli saja angsa miliknya sebelum diambil si C karena mumpung murah?

$CASS $BRIS $MSTI

The HIDDEN version of Lo Keng Hong,

his name is Surono Subekti.

Berikut saham beliau beserta AUM kepemilikan:

$ADES 90 milyar

ASDM 7 milyar

ASRM 4.5 milyar

BOBA 4.5 milyar

$CASS 280 milyar

CEKA 24 milyar

CFIN 34 milyar

CLEO 115 milyar

EKAD 24 milyar

GUNA 9.9 milyar

IGAR 16 milyar

INCI 2.5 milyar

JTPE 41 milyar

KMDS 11 milyar

MTDL 210 milyar

OBAT 31 milyar

$SIDO 356 milyar

Total saham: 17

Total AUM: 1,26 Triliun (belum termasuk saham lain dengan kepemilikan di bawah 1%)

Rute penerbangan Indonesia-Saudi masih terpantau relatif aman. Ini karena pintu masuknya biasanya lewat bandara Jeddah dan Madinah, yang jaraknya lebih dekat ke Mekkah.

Posisi ini agak jauh dari wilayah konflik sebagaimana terlihat di peta, dibandingkan dengan bandara Riyadh. Kalau sampai kena dampak juga penerbangannya, bakal serius juga efeknya buat emiten-emiten terkait.

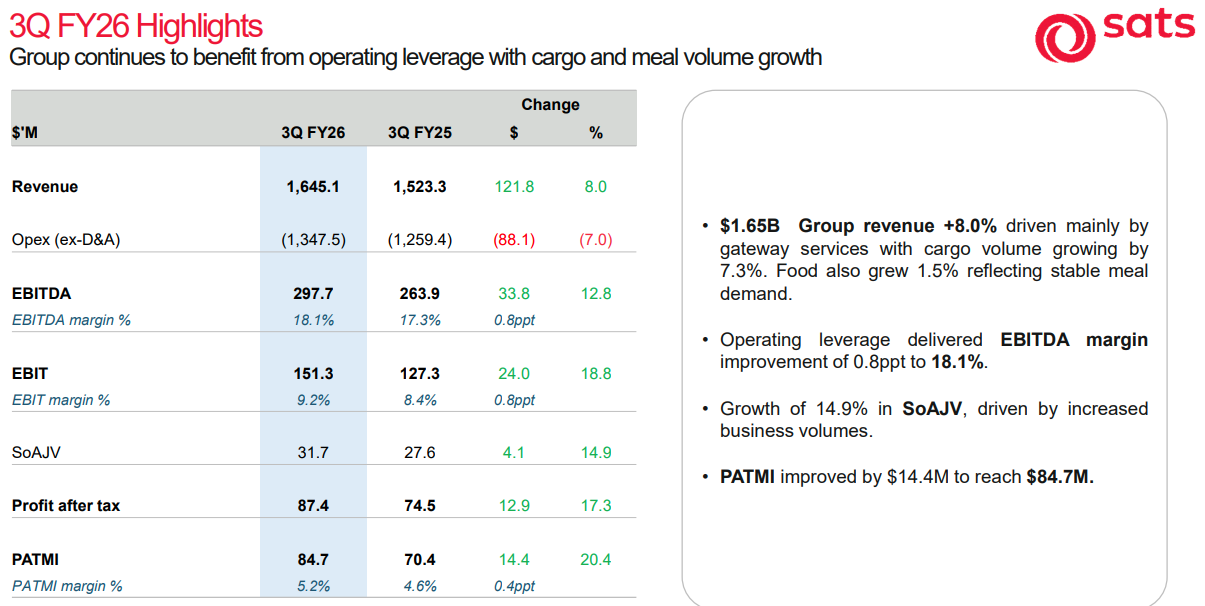

Terlepas dari kondisi perang, sebenarnya prospek $CASS masih bagus. Bahkan dari laporan keuangan SATS Ltd terakhir, terdapat indikasi berdasarkan hitung-hitungan bodoh saya bahwa laba bersih CASS akan berkisar antara 470M sd 500M.

$HAJJ $GIAA

1/3

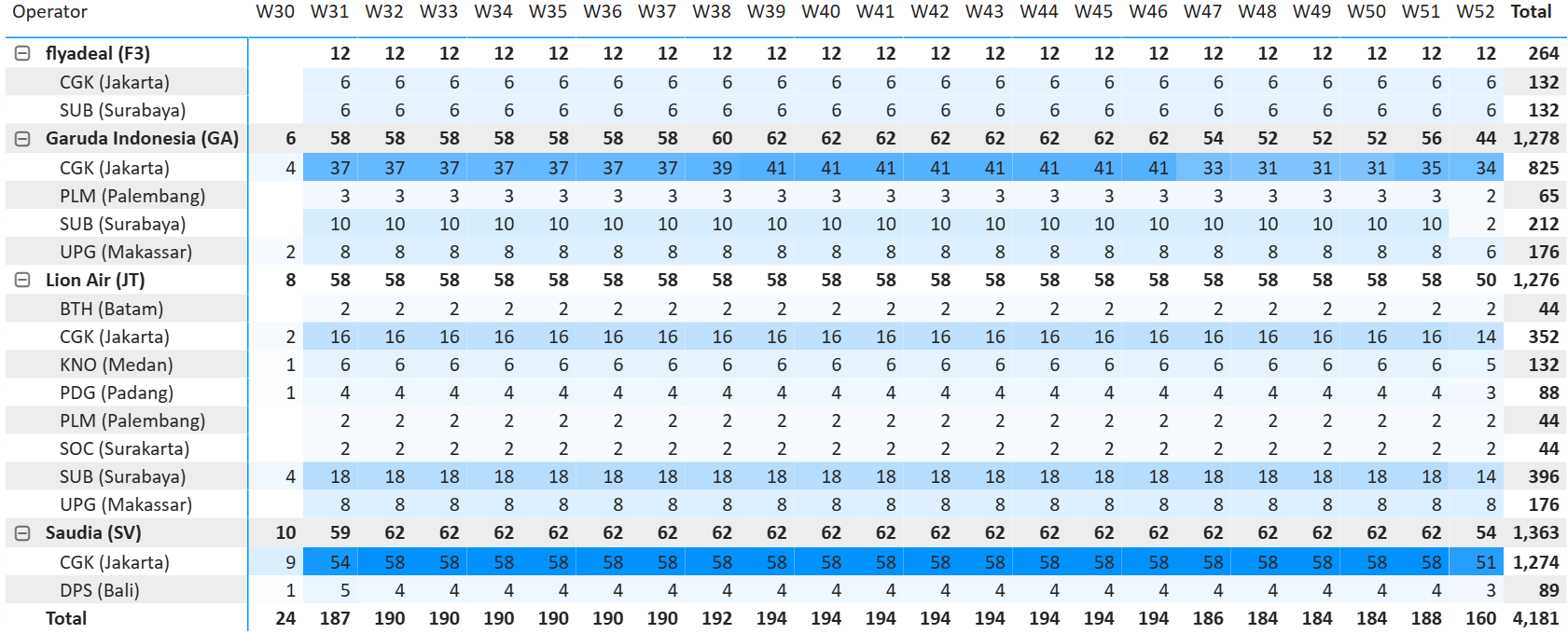

Seberapa buruk bagi $CASS jika perang Iran benar-benar berlangsung selama 4 pekan?

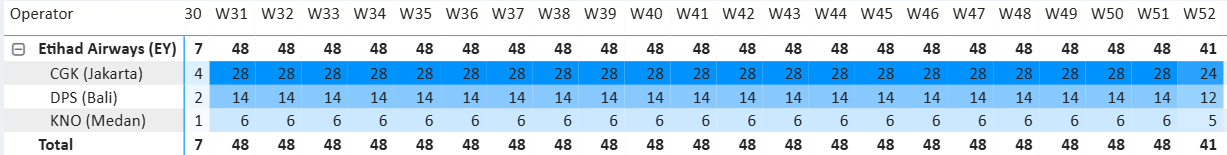

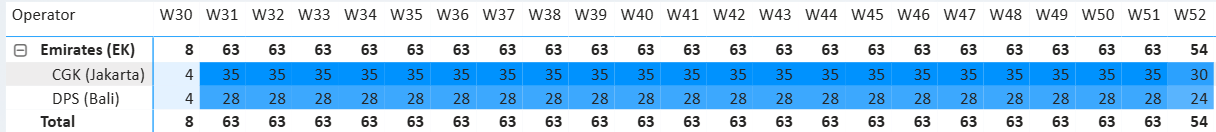

Rute Etihad ke Indonesia (PP) per pekan ada 48 flight. (gambar 1)

Rute Emirates ke Indonesia (PP) per pekan ada 63 flight. (gambar 2)

Rute Qatar ke Indonesia (PP) per pekan ada sekitar 42 sd 56 flight.

Tinggal dikalikan 4, total ada sekitar 660-an flight yang terdampak. Ini masih belum memperhitungkan kemungkinan rute Turki dan Oman.

Kalau berlangsung lebih lama, lebih banyak lagi yang terdampak, apalagi jika meluas hingga ke wilayah udara Saudi.

Trus kita harus exitkah? Saya tempatkan diri saya di pihak pemilik, apakah mereka keluar dari bisnis puluhan tahun ini hanya gara-gara ada perang beberapa pekan? You know the answer..

$IHSG $GIAA

1/2

Beberapa rute penerbangan yang kemungkinan bisa terdampak oleh perang Iran adalah rute Indonesia dari dan menuju Qatar, UAE, Turki, dan Oman.

Apa kabar holder $CASS ? 🥲

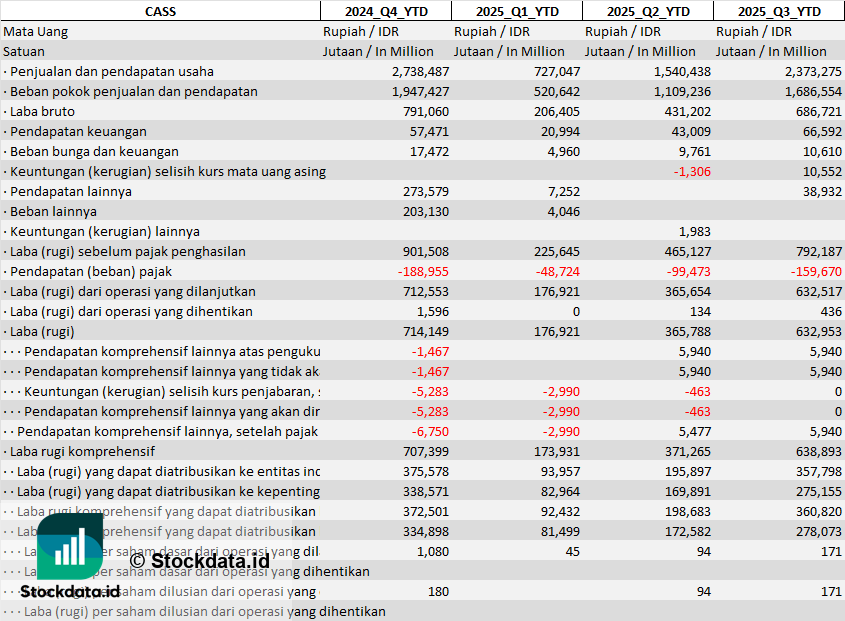

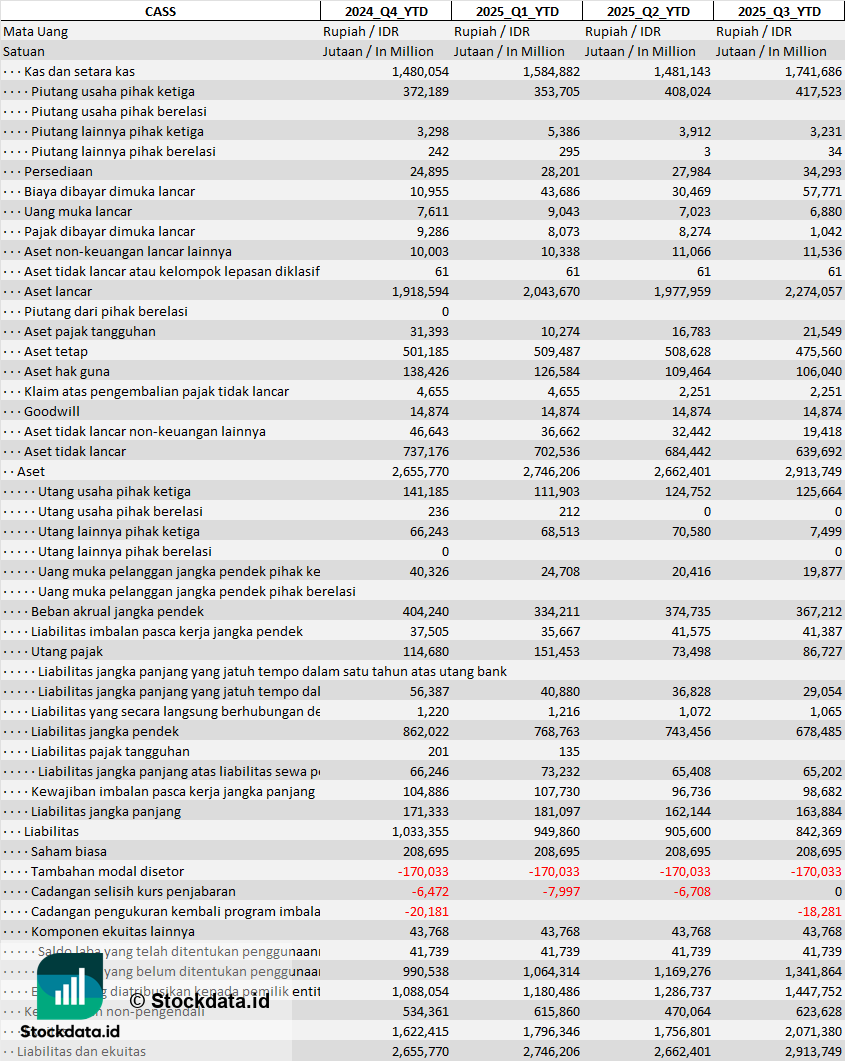

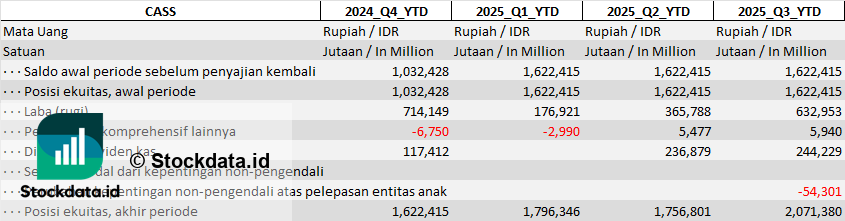

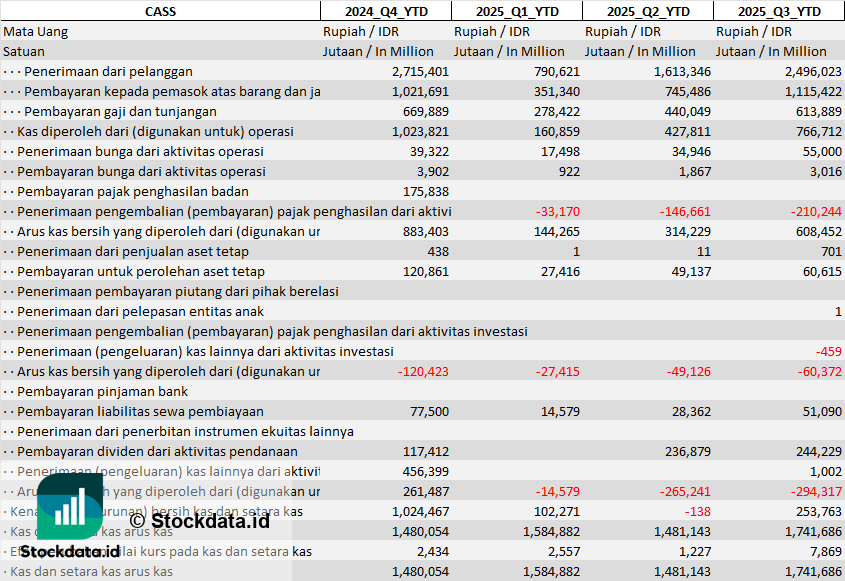

Cahaya Aero Services Tbk - CASS

Laporan Keuangan

- Neraca Keuangan

- Laporan Laba Rugi

- Laporan Arus Kas

- Laporan Perubahan Ekuitas

Follow kami untuk laporan fundamental emiten!

$CASS

1/4

#47 Menghormati Risiko Sejak Awal

Semakin lama saya berinvestasi, semakin saya memahami bahwa risiko bukan sesuatu yang muncul di tengah jalan. Ia sudah ada sejak keputusan pertama diambil. Dulu saya lebih fokus pada potensi hasil, sementara risiko saya anggap sebagai kemungkinan yang bisa dihindari dengan cukup hati-hati. Sekarang saya melihatnya berbeda. Risiko bukan gangguan, melainkan pasangan tetap dari setiap peluang. Menghormatinya sejak awal membuat saya lebih realistis dalam menilai apa yang mungkin terjadi.

Saya mulai menyadari bahwa sistem yang saya bangun tidak bertujuan menghilangkan risiko, melainkan mengelolanya. Sistem memberi batas, memberi struktur, dan mengingatkan saya bahwa tidak semua hasil akan sesuai ekspektasi. Ketika hasil kurang baik muncul, emosi mungkin ingin menyalahkan keadaan atau keputusan tertentu. Namun sistem mengajarkan untuk tetap melihat konteks yang lebih luas. Selama kerangka berpikir masih konsisten, saya tidak perlu membongkar semuanya hanya karena satu fase tidak berjalan mulus.

Perubahan terbesar dalam diri saya terjadi ketika saya berhenti berharap pada hasil yang selalu ideal. Saya menerima bahwa drawdown adalah bagian dari perjalanan, bukan penyimpangan dari rencana. Saya tidak lagi melihat penurunan sebagai bukti bahwa saya tidak cukup baik. Sebaliknya, saya melihatnya sebagai pengingat bahwa risiko memang bekerja sebagaimana mestinya. Dengan cara pandang itu, respon saya menjadi lebih terukur dan tidak tergesa.

Pada akhirnya, menghormati risiko sejak awal membuat saya lebih tenang saat hasil tidak sesuai harapan. Saya tidak lagi merasa terkejut ketika fase sulit datang, karena saya sudah mengakuinya sebagai bagian dari sistem. Ketahanan tidak dibangun saat semuanya berjalan lancar, tetapi saat saya tetap disiplin di tengah ketidaknyamanan. Di situlah kedewasaan tumbuh—bukan dari menghindari risiko, melainkan dari menerima dan mengelolanya dengan sadar.

$IHSG $IPCC $CASS

Korean carrier T’way Air from March to July 2026 schedules service reductions on Cheongju – Denpasar route. From 03MAR26 to 15JUL26, the airline schedules 2 weekly flights with 737 MAX 8, instead of 3 weekly.

TW157 CJJ1725 – 2315DPS 7M8 47

TW158 DPS0015 – 0835CJJ 7M8 15

Korean carrier T’way Air during Northern summer 2026 season plans to launch new route to Indonesia, as the carrier opened reservations for Seoul Incheon – Jakarta route. From 29APR26, Airbus A330-300 aircraft to serve this route 5 times weekly.

TW155 ICN1510 – 2010CGK 333 x24

TW156 CGK2150 – 0705+1ICN 333 x24

Rute Jakarta pakai $CASS ga nih?

Bacaan panjang, cocok buat mengalihkan anda dari hiruk-pikuk pasar. Semoga bermanfaat!

𝐁𝐚𝐬𝐞 𝐑𝐚𝐭𝐞 𝐈𝐧𝐯𝐞𝐬𝐭𝐢𝐧𝐠

Base rate investing is an approach to making investment decisions that rely on statistical data to assess the probability of an investment's success.

This method is based on the concept of the base rate fallacy, which is a tendency in decision-making to ignore base rate information (general information) and focus on specific information (information only about the case at hand).

In investing, this fallacy can lead people to overestimate the significance of recent events or specific news about a company, while underestimating the importance of long-term, general trends. By focusing on base rates, investors aim to correct this bias. They look at how similar investments have performed under similar conditions.

For example, if considering investing in a tech startup, an investor might look at the historical success rate of similar startups in the same industry, at the same stage of development, and possibly in the same geographical area. This base rate then serves as a benchmark to evaluate the expected success of the current investment opportunity.

Base rate investing encourages a more disciplined, data-driven approach, reducing the impact of emotional reactions to market news or events. It aligns with principles found in behavioral finance, which studies how psychological influences and biases affect the financial behaviors of investors.

By considering the base rates, investors can make better decisions, taking into account the broader statistical realities of investment outcomes. This doesn't mean ignoring specific information about the investment opportunity; rather, it means integrating this specific information with the base rates to form a more balanced and comprehensive view of potential risks and returns.

𝐈𝐧𝐬𝐢𝐝𝐞 𝐕𝐢𝐞𝐰 𝐯𝐬. 𝐎𝐮𝐭𝐬𝐢𝐝𝐞 𝐕𝐢𝐞𝐰

Imagine you're trying to guess how many candies are in a big jar. There are two ways you could make your guess:

*𝐓𝐡𝐞 𝐈𝐧𝐬𝐢𝐝𝐞 𝐕𝐢𝐞𝐰: This is like looking at the jar and thinking only about what you see right before you. For example, you might think, "This jar is huge, and candies are small, so there must be many candies in there!" This view focuses on the specific situation and details you're directly observing or know about.

*𝐓𝐡𝐞 𝐎𝐮𝐭𝐬𝐢𝐝𝐞 𝐕𝐢𝐞𝐰: This is like stepping back and thinking about how many candies were in other jars you've seen before that were about the same size. Instead of just thinking about this one jar, you remember, "Last time I saw a jar this big, it had about 100 candies." This view doesn't focus on the jar's details in front of you but on what happened in similar situations in the past.

𝐈𝐧 𝐬𝐜𝐞𝐧𝐚𝐫𝐢𝐨𝐬 𝐰𝐡𝐞𝐫𝐞 𝐥𝐮𝐜𝐤 𝐡𝐚𝐬 𝐦𝐢𝐧𝐢𝐦𝐚𝐥 𝐢𝐧𝐟𝐥𝐮𝐞𝐧𝐜𝐞 𝐚𝐧𝐝 𝐲𝐨𝐮'𝐫𝐞 𝐩𝐫𝐢𝐯𝐲 𝐭𝐨 𝐚𝐥𝐥 𝐜𝐫𝐢𝐭𝐢𝐜𝐚𝐥 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧, 𝐭𝐡𝐞 𝐢𝐧𝐬𝐢𝐝𝐞 𝐯𝐢𝐞𝐰 𝐛𝐞𝐜𝐨𝐦𝐞𝐬 𝐦𝐨𝐫𝐞 𝐬𝐢𝐠𝐧𝐢𝐟𝐢𝐜𝐚𝐧𝐭. 𝐓𝐡𝐢𝐬 𝐢𝐬 𝐬𝐢𝐦𝐢𝐥𝐚𝐫 𝐭𝐨 𝐚 𝐬𝐢𝐭𝐮𝐚𝐭𝐢𝐨𝐧 𝐰𝐡𝐞𝐫𝐞 𝐚 𝐜𝐨𝐧𝐠𝐫𝐞𝐬𝐬 𝐦𝐞𝐦𝐛𝐞𝐫 𝐦𝐚𝐤𝐞𝐬 𝐬𝐭𝐨𝐜𝐤 𝐭𝐫𝐚𝐝𝐞𝐬 𝐛𝐞𝐟𝐨𝐫𝐞 𝐩𝐚𝐬𝐬𝐢𝐧𝐠 𝐥𝐚𝐰𝐬 𝐭𝐡𝐚𝐭 𝐰𝐢𝐥𝐥 𝐚𝐟𝐟𝐞𝐜𝐭 𝐭𝐡𝐨𝐬𝐞 𝐬𝐭𝐨𝐜𝐤𝐬.

𝐂𝐨𝐧𝐯𝐞𝐫𝐬𝐞𝐥𝐲, 𝐢𝐧 𝐬𝐜𝐞𝐧𝐚𝐫𝐢𝐨𝐬 𝐰𝐡𝐞𝐫𝐞 𝐥𝐮𝐜𝐤 𝐡𝐚𝐬 𝐚 𝐠𝐫𝐞𝐚𝐭𝐞𝐫 𝐢𝐦𝐩𝐚𝐜𝐭, 𝐞𝐬𝐩𝐞𝐜𝐢𝐚𝐥𝐥𝐲 𝐰𝐡𝐞𝐧 𝐲𝐨𝐮 𝐥𝐚𝐜𝐤 𝐢𝐧𝐬𝐢𝐝𝐞𝐫 𝐤𝐧𝐨𝐰𝐥𝐞𝐝𝐠𝐞, 𝐢𝐧𝐜𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐢𝐧𝐠 𝐭𝐡𝐞 𝐨𝐮𝐭𝐬𝐢𝐝𝐞 𝐯𝐢𝐞𝐰 𝐢𝐬 𝐜𝐫𝐮𝐜𝐢𝐚𝐥 𝐭𝐨 𝐠𝐚𝐢𝐧𝐢𝐧𝐠 𝐚 𝐦𝐨𝐫𝐞 𝐜𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐮𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠.

How does this framework work in practice when analyzing stocks? Well, it’s quite simple. You can apply this framework to almost every metric/ratio when forecasting a company’s future.

*You've discovered a young company with a net profit margin of 30%, while the average for its industry hovers around 10%. It's reasonable to anticipate that, over time, this company's net profit margin will move closer to the industry average, unless the company proves to be an exceptional outlier.

*A company is currently trading at 50x Sales. Historically, how frequently have stocks maintained such high trading multiples? And how often did their valuation reverse to the mean?

*A CEO declares an ambitious target to increase sales by 30% annually over the next decade. A standard approach by a Wall Street analyst would involve a detailed bottom-up analysis, examining the company's product lineup, potential market size, and achievable market share. However, a reader of this writing would take a different approach, questioning the feasibility of such growth by comparing it with similar cases in an appropriate reference class, considering factors like the company's current market capitalization, its industry, and the distinctiveness of its product.

*A company is experiencing consistent growth in Free Cash Flow (FCF) year over year, yet its stock price remains stagnant. Typically, since a stock price often aligns with FCF trends, this scenario could present an attractive buying opportunity.

*A company sells exciting software and Wall Street is in love with it and sends the stock higher and higher, but the debt is getting out of control? Guess how this will end? The same way it has ended for all companies that were Wall Street darlings but couldn’t produce any internal fuel (Free Cash Flow) to keep the business running.

Not only can you apply the base rate to an external reference class, but you can also use it within the company itself. This method has been a part of my toolkit, especially when a company announces initiatives like a "restructuring plan" or a "5-year innovation plan."

We can evaluate their history with similar strategic plans, and check their execution success and forecast accuracy. This approach helps me form a clearer expectation for their current plans. Here, the reference class is the company's management and their track record in similar past situations.

Investing requires a holistic approach. Unfortunately, many investors concentrate too much on the detailed, inside view and overlook the broader, outside view. Blending these perspectives yields the most effective insights because it offers a comprehensive view of a company. This underscores the importance of understanding stock market history for investment success.

New investors often seek quick results, not recognizing that building knowledge and experience takes time. It's after several years that you'll become adept at forecasting a stock's movement, thanks to your accumulated experiences (your reference group).

$TOTL $CASS $SMSM

“𝐀 𝐭𝐫𝐞𝐞 𝐭𝐡𝐚𝐭 𝐫𝐞𝐚𝐜𝐡𝐞𝐬 𝐭𝐡𝐞 𝐬𝐤𝐲 𝐦𝐮𝐬𝐭 𝐟𝐢𝐫𝐬𝐭 𝐠𝐫𝐨𝐰 𝐝𝐞𝐞𝐩 𝐫𝐨𝐨𝐭𝐬. 𝐓𝐡𝐞 𝐡𝐢𝐠𝐡𝐞𝐫 𝐲𝐨𝐮 𝐰𝐚𝐧𝐭 𝐭𝐨 𝐫𝐢𝐬𝐞, 𝐭𝐡𝐞 𝐦𝐨𝐫𝐞 𝐠𝐫𝐨𝐮𝐧𝐝𝐞𝐝 𝐲𝐨𝐮 𝐧𝐞𝐞𝐝 𝐭𝐨 𝐛𝐞.”

The philosophy that investors can extract from the sentences is that long-term, sustainable, and high-level success requires a foundation of patience, discipline, and strong fundamentals. For an investor, this means that rapid, speculative gains are unsustainable if not supported by solid research and a resilient strategy.

𝐃𝐞𝐞𝐩 𝐑𝐨𝐨𝐭𝐬

*Fundamental Analysis: Just as roots provide nutrients, you must deeply understand what you are investing in before expecting growth. A solid foundation is built on analyzing balance sheets, competitive advantages (moats), and management quality, rather than chasing hype.

*Patience and Time: Strong roots do not grow overnight. Similarly, compound interest requires a long-term perspective (time in the market) rather than quick trading.

*Intrinsic Value: Investing in companies with real value allows the portfolio to "grow" rather than just jump in price.

𝐆𝐫𝐨𝐮𝐧𝐝𝐞𝐝

*Managing Volatility: Being "grounded" means remaining steady when the market "winds" blow. It implies having a risk management strategy (diversification) that prevents a market downturn from destroying your portfolio.

*Emotional Discipline: It refers to staying humble and not letting greed or ego dictate investments. A grounded investor does not chase the latest, overvalued trend but stays within their circle of competence.

𝐑𝐞𝐚𝐜𝐡𝐢𝐧𝐠 𝐭𝐡𝐞 𝐒𝐤𝐲

*Sustainable Wealth: The goal is not just a quick profit, but a portfolio that can grow high and withstand storms (recessions or crashes).

*Compounding: The ultimate "rise" in investment is the compounding of returns over decades, which is only possible if the initial "roots" (capital) are not destroyed by reckless risk.

𝐓𝐡𝐞 𝐭𝐫𝐞𝐞𝐬 𝐭𝐡𝐚𝐭 𝐢𝐦𝐩𝐫𝐞𝐬𝐬 𝐮𝐬 𝐰𝐢𝐭𝐡 𝐢𝐧𝐬𝐭𝐚𝐧𝐭 𝐡𝐞𝐢𝐠𝐡𝐭 𝐟𝐚𝐥𝐥 𝐢𝐧 𝐭𝐡𝐞 𝐟𝐢𝐫𝐬𝐭 𝐬𝐭𝐨𝐫𝐦. 𝐓𝐡𝐞 𝐨𝐧𝐞𝐬 𝐭𝐡𝐚𝐭 𝐭𝐚𝐤𝐞 𝐝𝐞𝐜𝐚𝐝𝐞𝐬 𝐭𝐨 𝐚𝐧𝐜𝐡𝐨𝐫 𝐭𝐡𝐞𝐦𝐬𝐞𝐥𝐯𝐞𝐬 𝐬𝐭𝐚𝐧𝐝 𝐟𝐨𝐫 𝐜𝐞𝐧𝐭𝐮𝐫𝐢𝐞𝐬.

$TOTL $SMSM $CASS

Bacaan teman ngopi Anda sore ini. Semoga bermanfaat!

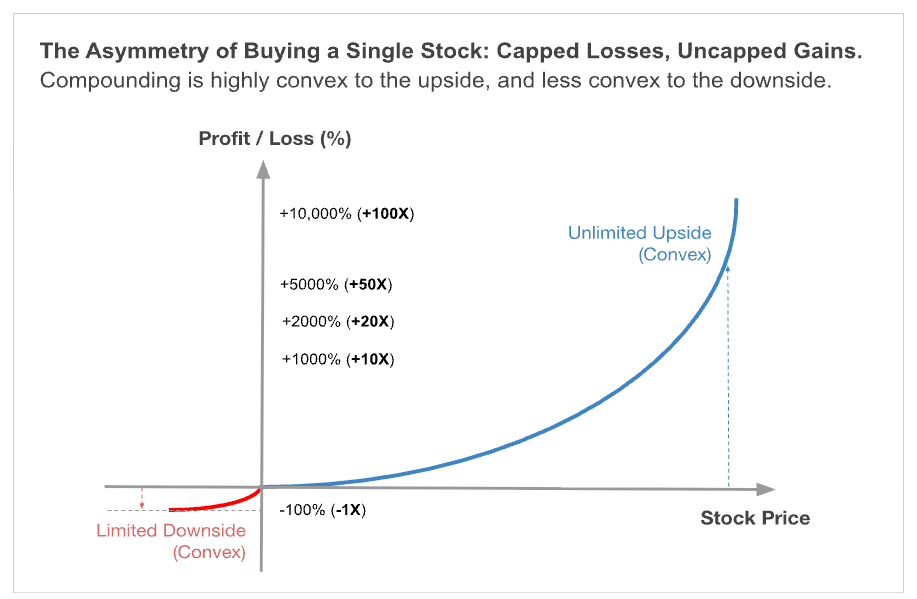

Asymmetry is the holy grail in finance. The initial return profile of buying a stock is symmetrical. If a stock goes up 25%, you make 25%, and vice versa, if a stock goes down 25%, you lose 25%.

Yet over the long term, it is certainly not symmetrical. The risk-reward asymmetry becomes compelling. When buying a stock, the downside is capped at 100%, but the upside is theoretically unlimited, with potential returns of 10x, 20x, or 50x. Each long stock position functions like a long call option, and a portfolio of stocks effectively resembles a giant long call option payoff.

Asymmetry is the holy grail in investing, where over a long time, in heads, you don’t lose a lot, and in tails, you win increasingly more.

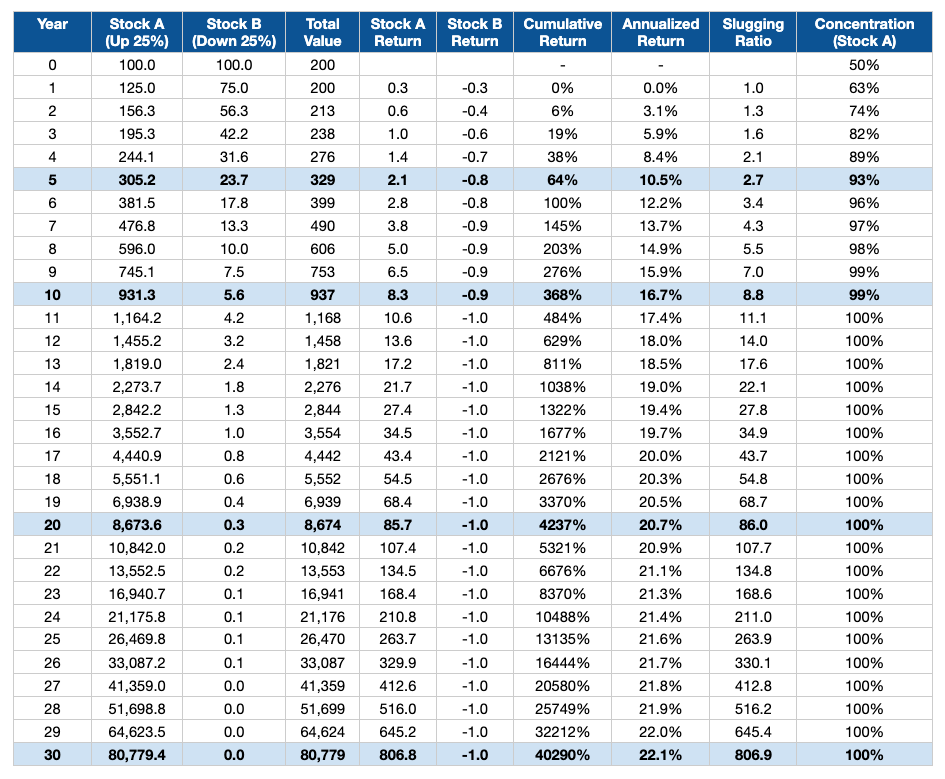

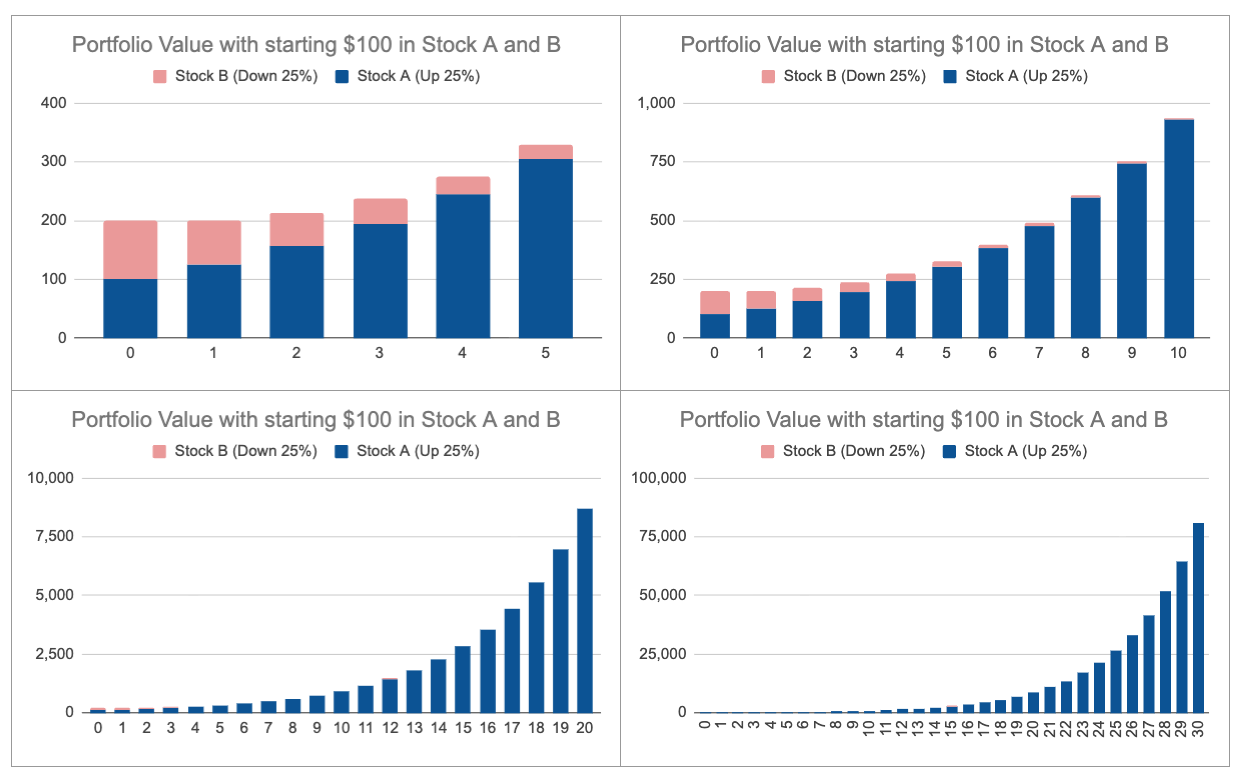

Let’s start with 100 equally invested in Stock A and B. The price of Stock A keeps rising 25% every year, and Stock B keeps declining 25% every year. (shown in picture 1 below)

In the first year, the value of Stock A rises 25% to 125, and Stock B declines 25% to 75. The portfolio value remains unchanged at 200 with 0% returns (not good).

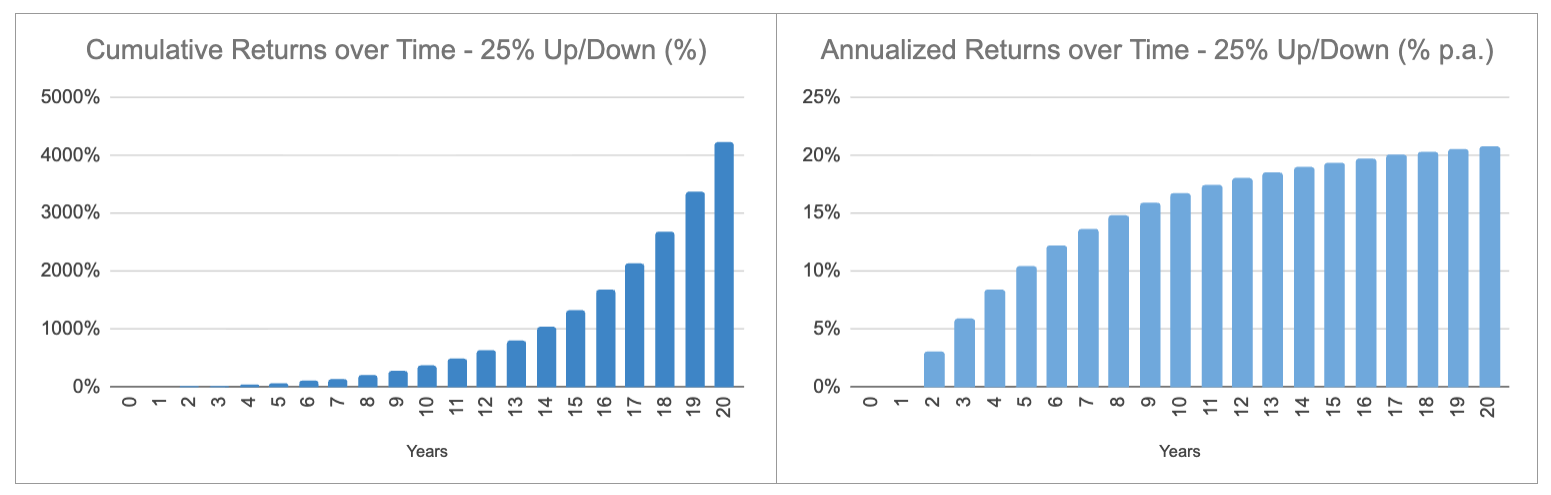

At the end of year 5, Stock A rose ~3X to 305, and Stock B has declined by 76% to 24. The portfolio value is 329, with a cumulative return of 64% and an annualized return of 10.5% p.a. (good).

At the end of year 10, Stock A rose ~9.3X to 931, and Stock B has declined 94% to 6. The portfolio value is 937, with a cumulative return of 368% and an annualized return of 16.7% p.a. (strong).

At the end of year 20, Stock A is an 86-bagger to 8674, and Stock B has declined 99.7% to 0.30. The portfolio value is 8,674, with a cumulative return of 4237% and an annualized return of 20.7% p.a. (very strong).

While we acknowledge that the assumptions are highly simplistic:

(1) a constant 50% batting average

(2) an equal-weighted two-stock portfolio

(3) both stocks rising and declining at the same rate,

the following lessons are instructive.

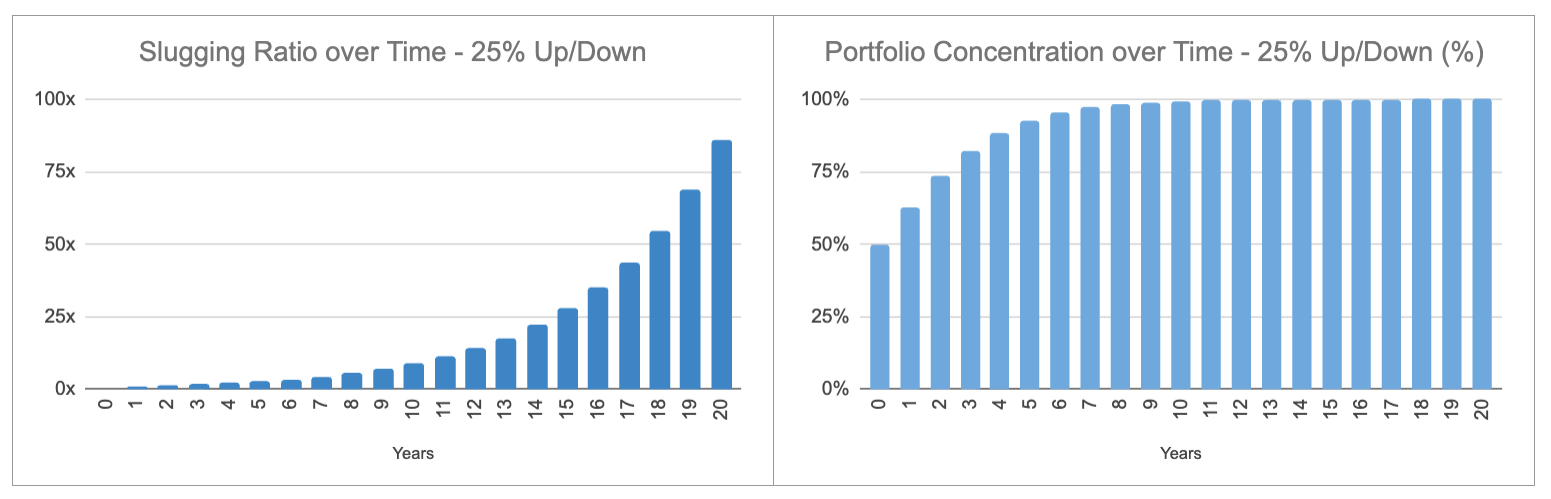

*𝐖𝐢𝐧𝐧𝐞𝐫𝐬 𝐢𝐧𝐜𝐫𝐞𝐚𝐬𝐢𝐧𝐠𝐥𝐲 𝐦𝐚𝐭𝐭𝐞𝐫, 𝐥𝐨𝐬𝐞𝐫𝐬 𝐢𝐧𝐜𝐫𝐞𝐚𝐬𝐢𝐧𝐠𝐥𝐲 𝐝𝐨𝐧’𝐭. If you have a winner, a little is all you need, and even if you do have a loser, it doesn’t matter. Asymmetry does not exist in discrete time periods, but shows up over time. (as illustrated in picture 2)

*𝐂𝐨𝐦𝐩𝐨𝐮𝐧𝐝𝐢𝐧𝐠 𝐬𝐭𝐚𝐫𝐭𝐬 𝐬𝐥𝐨𝐰 𝐛𝐮𝐭 𝐚𝐜𝐜𝐞𝐥𝐞𝐫𝐚𝐭𝐞𝐬 𝐨𝐯𝐞𝐫 𝐭𝐢𝐦𝐞. Returns take time to show up, only if the winners are held. Being able to hold on to winners and not trim them allows one to keep growing cumulative returns exponentially and annualized returns towards steady-state rates of 20%-22%+ p.a. after 10-20 years. (as illustrated in picture 3)

*𝐖𝐢𝐧𝐧𝐞𝐫𝐬 𝐛𝐞𝐜𝐨𝐦𝐞 𝐢𝐧𝐜𝐫𝐞𝐚𝐬𝐢𝐧𝐠𝐥𝐲 𝐬𝐢𝐠𝐧𝐢𝐟𝐢𝐜𝐚𝐧𝐭 𝐚𝐬 𝐲𝐨𝐮 𝐡𝐢𝐭 𝐢𝐭 𝐨𝐮𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐩𝐚𝐫𝐤, 𝐚𝐬 𝐩𝐨𝐫𝐭𝐟𝐨𝐥𝐢𝐨 𝐜𝐨𝐧𝐜𝐞𝐧𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐠𝐫𝐨𝐰𝐬 𝐨𝐯𝐞𝐫 𝐭𝐢𝐦𝐞. The gains from the multi bagger winners will keep growing, increasingly offsetting the losers’ combined losses many times over. The losers don’t matter. The winners do. (as illustrated in picture 4)

*𝐒𝐮𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐝𝐢𝐯𝐞𝐫𝐬𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐢𝐬 𝐧𝐞𝐜𝐞𝐬𝐬𝐚𝐫𝐲 𝐭𝐨 𝐚𝐥𝐥𝐨𝐰 𝐟𝐨𝐫 𝐭𝐡𝐢𝐬 𝐭𝐨 𝐛𝐞 𝐚𝐜𝐡𝐢𝐞𝐯𝐞𝐝, 𝐧𝐨𝐭 𝐛𝐞𝐢𝐧𝐠 𝐨𝐯𝐞𝐫𝐥𝐲 𝐜𝐨𝐧𝐜𝐞𝐧𝐭𝐫𝐚𝐭𝐞𝐝 (<𝟏𝟎 𝐬𝐭𝐨𝐜𝐤𝐬) 𝐨𝐫 𝐛𝐞𝐢𝐧𝐠 𝐨𝐯𝐞𝐫𝐥𝐲 𝐝𝐢𝐯𝐞𝐫𝐬𝐢𝐟𝐢𝐞𝐝 (>𝟑𝟎 𝐬𝐭𝐨𝐜𝐤𝐬). If one is overly concentrated, and if a winner becomes overly large or runs into single-position limits, one eventually has to trim the winner. Constantly trimming your flowers, not allowing your winners to run, and watering your weeds are among the worst things one can do. Sufficient diversification by owning more stocks allows one to have a better risk appetite and more patience to hold on to winners, especially when they experience inevitable large price declines along the way.

Compounding increases at an increasing rate on the upside and decreases at a decreasing rate on the downside. That makes it the eighth wonder of the world. Gains grow faster, and losses shrink slower. Those who understand this asymmetry earn it. Those who don’t, pay it. Find winners, hold them, and let time bend the curve in your favor.

$CASS $ADES $TOTL

1/5