Crude Oil

Commodities

Follow

65.64

▴ 1.63 (2.55)

As of Wed 03:02

2.91K

Volume

NA

Avg Volume

Rilis data ekonomi US

➖ API Crude Oil Stocks Change = -0,974M (vs previous -2,4M, vs consensus -1,7M)

❌ EIA Crude Oil Stocks Change = -2,392M (vs previous -6,014M, vs consensus -2M)

➖ EIA Gasoline Stocks Change = -1,236M (vs previous -2,72M, vs consensus -2,5M)

❌ EIA Distillate Stocks Change = -1,786M (vs previous 2,343M, vs consensus 1,1M)

❌ Money Supply Jul = USD 22,12T (vs previous USD 22,02T)

Stok minyak mentah US menurut API dan EIA menurun walaupun masih tidak jauh dari ekspektasi.

Menandakan kondisi supply yang masih cukup ketat, mengerek naik lagi harga $OIL dan berisiko membuat inflasi US sulit turun.

Uang beredar USD juga semakin meningkat, mengindikasikan likuiditas perekonomian yang makin kuat.

Fed kemungkinan tidak akan terlalu agresif melonggarkan kebijakan moneter di tengah inflasi yang masih tinggi dan ekonomi yang masih menunjukkan sisi resilien.

$XAU $ANTM

Rilis data stok minyak mentah US

❌ API Crude Oil Stocks Change = -2,4M (vs previous 1,5M, vs consensus -1,2M)

❌ EIA Crude Oil Stocks Change = -6,014M (vs previous 3,036M, vs consensus -1,3M)

❌ EIA Gasoline Stocks Change = -2,72M (vs previous -0,792M, vs consensus -0,8M)

✅ EIA Distillate Stocks Change = 2,343M (vs previous 0,714M, vs consensus 0,45M)

Stok minyak mentah US menurut API dan EIA kembali menurun signifikan melebihi ekspektasi.

Kondisi supply minyak yang belum sepenuhnya longgar memungkinkan kembali naiknya harga energi yang menjadi faktor inflasi US sulit turun.

$OIL $MEDC $USDIDR

"Ukraine vs Russia: Is It The End?"

Apabila anda sekarang sedang hold saham GOLD dan OIL tapi tidak mengikuti perkembangan negosiasi peace deal antara Ukraina 🇺🇦 dan Russia 🇷🇺, mungkin bisa di bilang anda tidak mengerjakan PR anda sebagai investor yang mengevaluasi perkembangan dari sebuah event yang memiliki impact pada harga komoditas emiten anda

Saya akan menjabarkan apa saja yang baru terjadi belakangan ini dan bagaimana pendapat saya mengenai hasil negosiasi Ukraina-Russia nantinya dan apa dampaknya pada harga emas dan minyak in general

Postingan kali ini akan cukup panjang, grab your popcorn

===========================

"EU, Zelensky & Trump"

Pada tanggal 15 Agustus 2025, akhirnya untuk pertama kalinya Putin kembali menginjakkan kakinya di tanah paman Sam sejak 2015 guna pertemuan dengan presiden Donald Trump membahas mengenai possibility untuk ceasefire maupun peace deal antara Ukraina dan Russia

Setelah pertemuan kedua tokoh tersebut, di nyatakan bahwa Russia open untuk melanjutkan proses "peace deal dengan syarat", salah satu syarat paling utamanya adalah penyerahan wilayah2 di bawah dari Ukraina ke Russia:

1.Crimea

2.Donetsk

3.Luhansk

4.Kherson

5.Zaporizhzhia

Bagi teman2 semua yang mungkin kurang mengikuti geopolitik, pada dasarnya 5 wilayah tersebut sangat penting dan di perebutkan kedua belah pihak. Dari perspective Russia sendiri, wilayah2 tersebut penting karena berbagai macam faktor, yakni:

1.Sejarah

2.Sumber daya alam dan kebutuhan industri

3.Dominasi akan laut hitam dan wilayah sekitarnya

4.Akses ke titik2 penting (khususnya melalui jalur Crimea)

Tidak lama setelah pertemuan Trump dan Putin, pertemuan selanjutnya akhirnya di lakukan antara Trump dan Zelensky pada tanggal 18 Agustus 2025. Perlu di ketahui bahwa pertemuan kali ini cukup berbeda ketimbang pertemuan mereka sebelumnya pada tanggal 28 February 2025 yang dimana cukup fenomenal mengingat pada saat itu Zelensky di "paksa" Trump & Co untuk menyetujui ceasefire. Tidak hanya di paksa, tetapi Zelensky juga di pojoki oleh Trump, Vance dan pembawa berita dengan berbagai cercaan hingga persoalan akan seragam yang di kenakan Zelensky kala itu

Pada pertemuan kali ini, Zelensky tidak menemui Trump sendirian, tetapi kali ini beliau di temani pemimpin2 EU. Kenapa para pemimpin EU kali ini ikut berpartisipasi dalam pertemuan antara Zelensky dan Trump? selain karna EU sendiri berperan penting akan konflik yang sedang terjadi, pemimpin2 EU juga di butuhkan guna ngebalance posisi Trump yang di nilai cenderung "memaksa" Zelensky untuk menyetujui syarat2 ceasefire maupun peace deal yang kurang di setujui Zelensky dan Ukraina itu sendiri (penyerahan wilayah)

Hasil pertemuannya bagaimana? so far belum ada hasil atau persetujuan secara resmi, tetapi mungkin untuk beberapa waktu ke depan kita semua bisa expect pertemuan antara 3 tokoh penting, yakni Zelensky, Trump, Putin guna membahas hasil akhir dan juga setuju atau tidak setujunya untuk ceasefire maupun peace (no date has been arranged yet)

Sekarang possible outcomes dari negosiasinya bakal ada 3, yakni:

-Tidak ada persetujuan, war tetap berjalan

-Ceasefire (dalam arti konflio berhenti sementara tapi bukan berarti inti permasalahan selesai)

-Zelensky (Ukraina) menolak peace deal dengan syarat2 tersebut

-Zelensky (Ukraina) menerima peace deal dan menyetujui syarat2 tersebut

"Bro James, menurut anda outcome paling possible untuk terjadi apa kira2?"

Well...saya bisa saja salah, apapun bisa terjadi secara geopolitik. However, menurut saya outcome paling realistis dan possible dengan kondisi sekarang adalah...

"Zelensky tidak akan menyetujui peace deal agreement bersyarat tersebut"

Ada beberapa faktor utama kenapa saya percaya outcome demikian yang terjadi, yakni:

1.Setiap negosiasi ceasefire maupun peace deal selama konflik Ukraina-Russia, Zelensky berkali2 menegaskan bahwa beliau tidak akan menyetujui bentuk peace deal apapun yang berkaitan dengan penyerahan wilayah milik Ukraina

2.Secara konstitusi di Ukraina sendiri memang dengan tegas tidak memperbolehkan sejengkal tanah pun untuk di serahkan kepada pihak luar

3.Apabila Zelensky menerika syarat2 tersebut untuk meraih peace deal, maka keputusan tersebut akan memposisikan Ukraina sebagai pihak yang "kalah", sedangkan Russia akan keluar sebagai pihak yang "menang" dan tentunya ini juga akan berimbas pada kepercayaan rakyat Ukraina itu sendiri kepada Zelensky

4.Pemerintahan Ukraina dan rakyatnya pada dasarnya mendorong peace deal yang tidak merugikan pihak manapun, khususnya Ukraina

Therefore, I believe these are the primary reasons Zelensky may ultimately reject the deal

Another question:

"Bro James, bukankah kita harus realistis? Apabila Zelensky tidak menyetujui peace deal bersyarat tersebut, terlebih dengan pressure yang di berikan Trump untuk menerima peace deal tersebut, bukankah justru mengingat ini hanyalah masalah waktu bagi Ukraina untuk benar2 di terjang tekanan militer Russia sehingga mau ga mau Zelensky akan menyetujui peace deal bersyarat tersebut?"

True, possibility tersebut tetap ada. However, saya tetap percaya walaupun Ukraina tidak menyetujui peace deal bersyarat tersebut nantinya, EU tetap akan berada di belakang Ukraina untuk benar2 mendukung dan mempertahankan posisi Ukraina. Mau bagaimanapun, posisi Ukraina sama strategisnya untuk EU dan Russia

Mengenai bantuan US selama ini terhadap Ukraina, walaupun adanya tekanan dari Trump dan juga resiko akan kehilangan support dari US, saya rasa realistically US tidak akan benar2 membiarkan Ukraina di terkam Russia begitu saja, kalau memang iya, mqka Ukraina seharusnya di detik ini juga sudah hilang dari map dunia

True, dukungan US terhadap Ukraina sempat tertahan, hanya saja di tahannya bantuan US yang sempat terjadi bersifat sebagai cara US dalam menekan Ukraina untuk menyetujui ceasefire maupun peace deal. At the end of the day, posisi Ukraina tetap sama pentingnya bagi US (Membiarkan Ukraina jatuh di tangan Russia sama saja dengan membiarkan catur Russia maju lebih jauh)

Selain di tolaknya peace deal, menurut saya outcome paling possible kedua ialah ceasefire yang dimana tidak benar2 menyelesailan inti dari permasalahan Ukraina-Russia

==============================

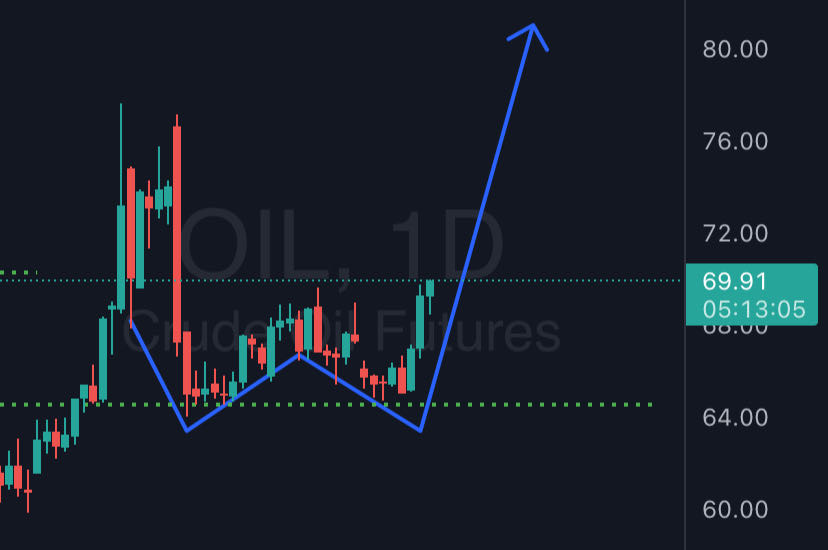

"Harga Gold & Oil"

Walaupun perang Ukraina-Russia bukan satu2nya faktor kenaikan harga emas dan minyak, tetap saja konflik Ukraina-Russia berperan penting dalam naiknya harga komoditas2 tersebut mengingat adanya economic uncertainty bagi investor, sehingga keputusab akhir dari negosiasi nantinya tentu akan memberikan dampak pada harga emas dan juga minyak

>Apabila konflik masih berlanjut, maka harga emas dan minyak most likely bakal lanjut naik atau stay di level atas (terlebih nanti bakal ada cut rate)

>Apabila ceasefire, maka harga most likely stay (mengingat konfliknya akan pause, tapi tidak benar2 menyelesaikan inti masalahnya)

>Apabila benar2 damai yang dimana menurut saya unlikely, tentu economic uncertainty akan menurun dan berimbas ke harga emas (safe haven). Untuk minyak, dengan menurunnya konflik, maka akses akan minyak (supply) harusnya bakal bisa adjust ke level tertentu sesuai dengan demand yang ada

===============================

"Instagram"

Kalau anda suka dengan cara berpikir dan berdiskusi saya, feel free follow Instagram saya di bawah, kebetulan saya sering bahas mengenai ekonomi, saham, finance lewat Insta story saya

Instagram: @James.Jayadi

Link Insta: https://cutt.ly/PrJeUFtS

Random Tags:

$XAU $OIL $ANTM

1/2

Rilis data ekonomi US

✅ NAHB Housing Market Index Aug = 32 (vs previous 33, vs consensus 34)

Indeks perumahan US menurun di bawah ekspektasi, mengindikasikan aktivitas sektor properti yang melambat dan ekonomi lebih luas yang melemah.

$USDIDR $XAU $OIL

$WIRG onto the next one

merdeka 🇮🇩 🫡

form 80's to 200~ it's been a good ride red dragon.

👋 🤗

$IHSG $OIL

Rilis data ekonomi US

➖ Monthly Government Budget Statement Jul = USD -291B (vs previous USD 27B, vs consensus USD -215B)

✅ API Crude Oil Stocks Change = 1,5M (vs previous -4,2M, vs consensus -0,8M)

Anggaran pemerintah US mengalami defisit yang lebih besar dari ekspektasi, membalikkan surplus yang terjadi bulan sebelumnya.

Walaupun kebijakan tarif membantu meningkatkan pendapatan pemerintah US, namun pengeluaran masih lebih tinggi.

Kondisi ini secara tidak langsung meningkatkan desakan bagi Fed untuk segera memangkas suku bunga, dengan harapan beban bunga pemerintah bisa berkurang.

Namun di sisi lain, hal ini memperburuk risiko gagal bayar dan kekhawatiran terhadap kesehatan ekonomi US.

Pemerintah semakin agresif memainkan kebijakan tarif, atau harus meningkatkan efisiensi.

Stok minyak mentah US menurut API meningkat di luar ekspektasi, melonggarkan kondisi supply minyak sehingga menahan kenaikan harga energi

$OIL $XAU $PNLF

Rilis data terkait stok minyak mentah US

❌ API Crude Oil Stocks Change = -4,2M (vs previous 1,539M, vs consensus -1,8M)

❌ EIA Crude Oil Stocks Change = -3,029M (vs previous 7,698M, vs consensus -1,1M)

❌ EIA Gasoline Stocks Change = -1,323M (vs previous -2,724M, vs consensus -1M)

❌ EIA Distillate Stocks Change = -0,565M (vs previous 3,635M, vs consensus 1M)

Stok minyak mentah US menurut API dan EIA turun lebih dalam dari ekspektasi.

Stok gasoline dan distillate juga menurun.

Suplai minyak mulai ketat lagi, bisa berdampak pada kenaikan harga energi dan inflasi US jadi sulit turun.

$USDIDR $OIL $BTC

https://cutt.ly/jrDe5Ruf

$MEDC $OIL $ENRG

$IHSG - Mindset Dulu, Cuan Belakangan

Banyak orang mulai kenal saham bukan dr logika, tapi dr rasa. Ada yg tertarik karena temennya cuan cepat. Ada yg ikut seminar, lihat influencer, lalu tergoda mimpi pensiun dini. Ada juga yg awalnya cuma coba-coba, eh… malah nyangkut dan akhirnya belajar beneran.

Tapi buat Mr. Pi, seorang investor kawakan yg sudah lebih dr 20 tahun di market, titik balik itu bukan soal teknikal, bukan soal tren, apalagi bisikan saham. Titik baliknya justru datang dr satu kesadaran yaitu dibalik saham bukan soal angka saja, tapi ada bisnis yg mendasarinya.

Waktu mulai di 2004, Mr. Pi jg mengalami fase serba campur. Trading, coba bandarmologi, baca indikator, sampai ikut hype. Tapi semua berubah drastis pas krisis 2008. Saat itu market rontok, harga-harga saham anjlok, dan semua terlihat menakutkan. Tapi justru di titik itulah ia melihat peluang.

Perusahaan bagus dijual murah-murah. Ada yg PER-nya tinggal satu digit, ada yg harganya seakan-akan bakal bangkrut, padahal fundamentalnya masih sehat. Dari situ, ia beralih haluan total. Ia sadar bahwa kalau kita bisa membaca perusahaan seperti membaca masa depan bisnisnya, bukan grafiknya, maka kita bisa tetap waras meskipun market jungkir balik.

Buat Mr. Pi investasi itu simpel tp tidak mudah. Simpel karena dasarnya cuma satu, yaitu kita beli bisnis, bukan kertas. Tapi tidak mudah karena dibutuhkan mindset yg kuat utk nahan godaan jangka pendek.

Ia bahkan sering mengandaikan begini: bagaimana kalau bursa cuma bisa utk beli, tp tidak bisa jual? Cuma bisa terima dividen. Kalau kita tetap mau beli saham itu dlm kondisi seperti itu, berarti kita betul-betul percaya pd bisnisnya. Kalau tdk, berarti kita cuma spekulan yg menyamar jd investor.

Makanya, buat dia, mindset itu selalu jadi urutan pertama sebelum bahas valuasi, PER, atau ROE. Mindset bahwa saat kita klik tombol “beli”, kita sebenarnya membeli sepotong perusahaan. Kita jd pemilik, meskipun kecil.

Dan sebagai pemilik, tugas kita bukan cuma berharap harga naik. Tapi mengerti bisnisnya jalan atau tdk. Prospeknya masih masuk akal atau sudah mulai ngaco. Ini beda jauh dgn orang yg beli karena ramai, atau beli karena “katanya bakal naik.”

Menariknya, Mr. Pi juga menyadari bahwa banyak investor pemula, bahkan yg sudah beberapa tahun di market, jatuh ke satu perangkap yg sama, yaitu nyangkut trus jd investasi.

Maksudnya begini. Awalnya beli karena trading, mau swing atau scalping, terus ternyata harganya turun. Tidak rela cut loss, lalu menghibur diri: “udah, jadiin aja investasi.” Ini bahaya. Karena alasan belinya beda dgn alasan menahannya. Dan itu sering membuat kita jd tak objektif lagi. Alih-alih mengevaluasi secara rasional, kita malah terjebak harapan kosong.

Mr. Pi pernah mengalami hal serupa. Ia cerita soal masa awal-awal dulu, portofolionya pernah “berantakan” karena terlalu banyak beli saham yg ternyata tak sejalan dgn filosofi dia sendiri. Akhirnya dia bersihkan semua, cut rugi, dan reset ulang.

Sakit? Iya. Tapi lebih sakit kalau nahan saham yg sudah jelas fundamentalnya memburuk hanya karena gengsi atau harapan palsu. Buat dia, investasi itu soal conviction. Kalau asumsi awalnya berubah, jgn ragu buat ganti arah.

Apa ini berarti semua orang harus langsung jd value investor serius? Tidak juga. Bahkan ia sendiri mengatakan bahwa menemukan gaya yg cocok itu butuh waktu. Mirip seperti olahraga. Ada yg cocoknya lari, ada yg lebih nyaman gowes, ada juga yg hobinya berenang. Yang penting, tahu batasan diri, tahu kekuatan sendiri, dan jangan maksa ikut orang.

Banyak orang yg ngotot jd trader padahal tdk tahan utk memantau market tiap hari. Sebaliknya, ada yg cocoknya investasi jangka panjang tp malah ikut-ikutan swing tiap 3 hari. Hasilnya? Capek sendiri.

Kalau kita kerja kantoran, sibuk, dan tdk bisa full time pantau layar, ya jangan paksa trading. Mr. Pi sendiri dulu kerja kantoran. Dan itu jd salah satu alasan kenapa ia lebih pilih investasi. Karena investing bisa dilakukan tanpa harus mantengin tiap menit. Yang penting tahu bisnisnya, punya ekspektasi yg rasional, dan review berkala.

Jadi kalau sekarang kita baru mulai belajar investasi, saran paling jujur dr Mr. Pi adalah jangan buru-buru cari saham. Cari dulu cara berpikir. Karena masalah terbesar pemula bukan di valuasi, bukan di laporan keuangan, tapi di cara pandang.

Banyak yg bertanya: “PER segini bagus nggak? EV/EBITDA segini murah nggak?” Tapi lupa tanya: “Aku beli saham ini buat apa, dan karena apa?”

Karena kalau alasannya lemah, maka ketika harga turun, biasanya kita bingung harus apa. Tapi kalau kita tahu betul apa yg kita beli, maka kita bisa tetap tenang bahkan saat market merah.

Dan dari sanalah, investasi bukan lagi soal harga naik besok atau minggu depan. Tapi soal membangun aset yg bertumbuh dlm jangka panjang. Seperti Mr. Pi pernah katakan kalau saham itu bisnis, maka kita harus memperlakukannya seperti bisnis. Dan bisnis yg baik, tidak dibangun dalam semalam.

Disclaimer: Catatan ini adalah refleksi pengetahuan penulis tentang Mr. Pi yg diperoleh dr berbagai sumber seperti: https://cutt.ly/5rS3Q8ZQ, dan catatan ini bukan ajakan untuk membeli atau menjual saham. Segala kerugian sebagai akibat penggunaan informasi pada tulisan ini bukan menjadi tanggung jawab penulis. Do your own research.

$COAL-NEWCASTLE

$OIL

$OIL

https://stockbit.com/post/19675818

Update🚀

$RATU $ENRG

Rilis data terkait stok minyak mentah US

✅ API Crude Oil Stocks Change = 1,539M (vs previous -0,577M, vs consensus -2,5M)

✅ EIA Crude Oil Stocks Change = 7,698M (vs previous -3,169M, vs consensus -2M)

❌ EIA Gasoline Stocks Change = -2,725M (vs previous -1,738M, vs consensus -0,5M)

✅ EIA Distillate Stocks Change = 3,635M (vs previous 2,931M, vs consensus -0,3M)

Stok minyak mentah US menurut API dan EIA naik di luar ekspektasi, membalikkan penurunan yang terjadi minggu sebelumnya.

Stok distillate juga meningkat, walaupun stok gasoline menurun lebih dari ekspektasi.

Perkembangan stok ini mengindikasikan supply yang kembali longgar, diharapkan bisa menahan kenaikan harga minyak agar inflasi tetap terjaga.

$OIL $MEDC $USDIDR

Rilis data ekonomi US

✅ JOLTs Job Openings Jun = 7,437M (vs previous 7,712M, vs consensus 7,55M)

❌ JOLTs Job Quits Jun = 3,142M (vs previous 3,270M)

❌ CB Consumer Confidence Jul = 97,2 (vs previous 95,2, vs consensus 95,8)

❌ Dallas Fed Services Index Jul = 2,0 (vs previous -4,4)

❌ Dallas Fed Services Revenues Index Jul = 6,3 (vs previous -4,1)

Pembukaan lapangan kerja baru menurun di bawah ekspektasi, mengindikasikan adanya perlambatan serapan tenaga kerja.

Namun di sisi lain angka job quits menurun, yang menandakan berkurangnya orang yang berhenti kerja.

Pasar tenaga kerja US hanya menunjukkan pelemahan terbatas yang tidak cukup meyakinkan Fed untuk cut rate.

Sementara itu keyakinan konsumen juga naik di atas ekspektasi.

Indeks sektor jasa Dallas juga meningkat ke zona positif.

Resiliensi ekonomi US belum memberikan urgensi untuk Fed memangkas suku bunga segera.

Pertumbuhan ekonomi US nampaknya juga masih baik-baik saja.

$USDIDR $OIL $SP500

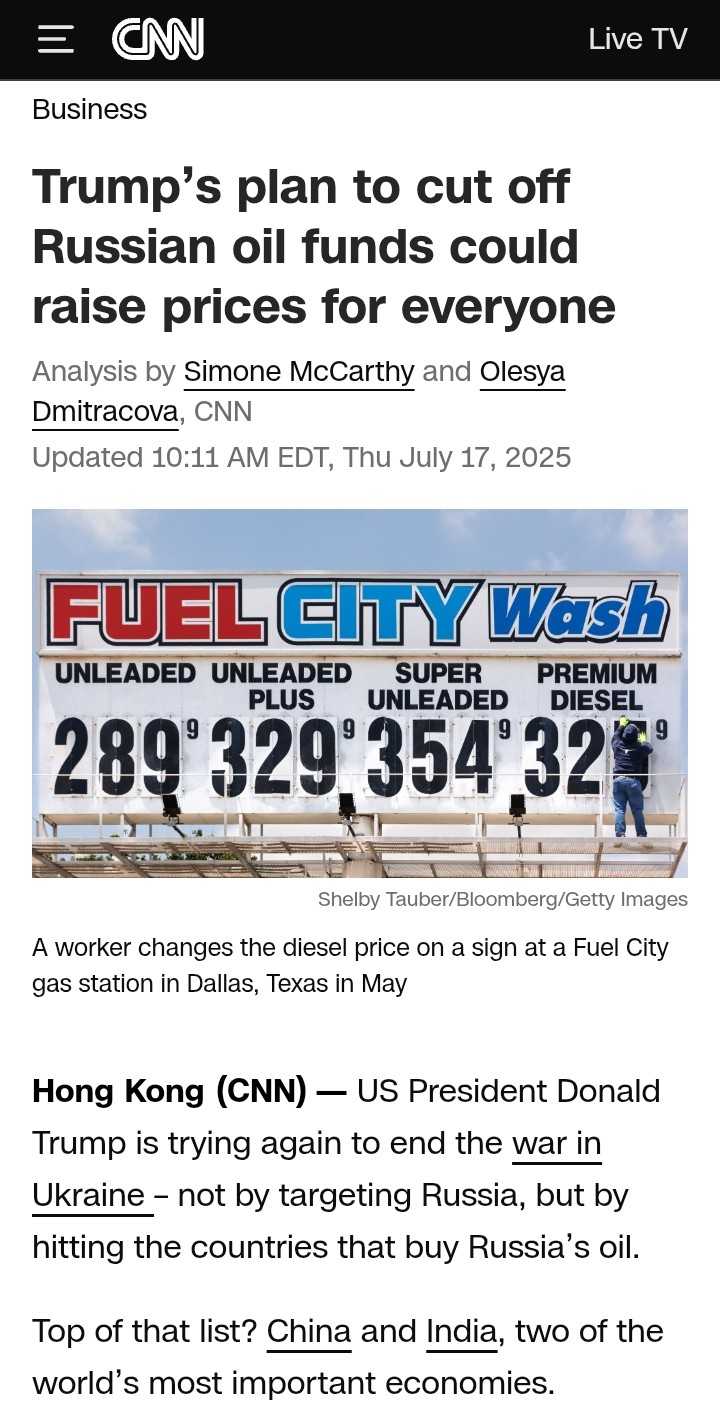

➖ Trump mengancam pemberian sanksi ekonomi bagi negara-negara yang membeli $OIL dari Rusia.

China dan India, 2 importir minyak terbesar, masuk ke dalam target dari sanksi ini.

Ancaman ini dilakukan untuk memaksa Rusia menyetujui gencatan senjata dengan Ukraina dalam kurun waktu 50 hari seperti yang diharapkan oleh Trump.

https://cutt.ly/ArOiLgGE

$IHSG $MEDC

Rilis data terkait stok minyak mentah US

✅ API Crude Oil Stocks Change = -19,1M (vs previous -7,1M, vs consensus -2M)

❌ EIA Crude Oil Stocks Change = -3,859M (vs previous 7,07M, vs consensus -0,9M)

✅ EIA Gasoline Stocks Change = 3,399M (vs previous -2,658M, vs consensus -0,9M)

✅ EIA Distillate Stocks Change = 4,173M (vs previous -0,825M)

Stok minyak mentah US menurut API naik pesat melebihi ekspektasi.

Berkebalikan dengan stok minyak mentah menurut EIA yang turun lebih besar dari ekspektasi.

Namun, stok gasoline dan distillate meningkat cukup signifikan.

Hal ini menunjukkan kondisi supply yang lebih longgar, membatasi kenaikan harga minyak dan potensi inflasi US yang terjadi karena harga energi.

$MEDC $AKRA $OIL

Rilis data ekonomi US

➖ Monthly Budget Statement Jun = USD +27B (vs previous USD -316B, vs consensus USD -11B)

❌ Baker Hughes Oil Rig Count = 424 (vs previous 425)

❌ Baker Hughes Total Rig Count = 537 (vs previous 539)

Anggaran (budget) bulanan pemerintah US mengalami surplus pada Juni, di luar ekspektasi defisit.

Menunjukkan efektivitas kebijakan tarif Trump untuk meningkatkan pendapatan pemerintah US.

Ini bisa mendorong Trump untuk terus bermain dengan tarif, apalagi jika tidak ada penghematan pengeluaran (termasuk Fed yang tidak kunjung cut rate menyebabkan beban bunga tinggi) dan tidak ada tambahan sumber pendapatan pemerintah

lainnya.

Kemudian, jumlah rig oil yang mengindikasikan produksi minyak di US terus menurun, bisa membuat supply ketat dan kembali menaikkan harga energi dan meningkatkan inflasi.

$OIL $SMSM $ERTX

➖ Trump mengumumkan tarif 35% untuk Kanada

https://cutt.ly/mrUKkXQR

$GDST $GDYR $OIL

Rilis data ekonomi US

✅ API Crude Oil Stocks Change = 7,1M (vs previous 0,680M, vs consensus -2,8M)

✅ EIA Crude Oil Stocks Change = 7,07M (vs previous 3,845M, vs consensus -2M)

❌ EIA Gasoline Stocks Change = -2,658M (vs previous 4,188M, vs consensus -1,7M)

➖ EIA Distillate Stocks Change = -0,825M (vs previous -1,71M, vs consensus -0,3M)

✅ Consumer Credit Change May = USD 5,1B (vs previous USD 16,87B, vs consensus USD 11B)

Stok minyak mentah US menurut API dan EIA melonjak signifikan jauh di atas ekspektasi.

Membalikkan serangkaian penurunan yang terjadi minggu-minggu sebelumnya.

Walaupun di sisi lain stok gasoline dan distillate berkurang.

Ini menunjukkan supply yang sudah lebih longgar, bisa menahan kelanjutan kenaikan harga minyak dan menjaga inflasi US tetap bisa turun.

Kredit konsumen juga menurun di bawah ekspektasi, mengindikasikan perlambatan demand.

$OIL $ELSA $SMSM

➖ Trump mengecam Putin yang dianggapnya selalu berbohong mengenai kondisi medan perang Rusia dengan Ukraina.

Rusia terus menggempur Ukraina, membuat janji Trump untuk menghentikan perang segera gagal dipenuhi.

US telah menyetujui lanjutan pengiriman bantuan senjata pertahanan ke Ukraina untuk menghadapi Rusia.

Selain itu, US sedang menyiapkan tambahan sanksi bagi Rusia.

Termasuk ancaman peningkatan tarif sampai 500% bagi negara-negara yang membeli produk ekspor dari Rusia.

https://cutt.ly/4rUcKTOV

$OIL $BRENT $COPPER

➖ Presiden Trump dan Secretary of Commerce Lutnick menjawab pertanyaan dari reporter.

Terkait tarif yang sudah ditentukan besaran persentasenya oleh Trump dan akan dikirim pemberitahuannya via surat.

Penetapan tarif akan dilakukan sebelum 9 Juli, dan mulai efektif berlaku 1 Agustus.

https://cutt.ly/2rYKa16W

Trump juga menyampaikan update mengenai deal gencatan senjata dan pelepasan tawanan Hamas-Israel.

Perkembangan Rusia-Ukraina, bencana banjir di Texas, dan berbagai isu dalam negeri US lainnya.

$BTC $XAU $OIL

➖ Trump kecewa atas diskusinya dengan Putin, tidak ada progres yang diperoleh.

Rusia menegaskan tidak akan berhenti menggempur Ukraina sampai tujuan perangnya tercapai.

https://cutt.ly/XrYaQtl1

Sebelumnya, US sudah menghentikan suplai misil ke Ukraina.

$OIL $GAS $XAU

Rilis data terkait stok minyak mentah US

✅ API Crude Oil Stocks Change = 0,680M (vs previous -4,277M, vs consensus -2,26M)

✅ EIA Crude Oil Stocks Change = 3,845M (vs previous -5,836M, vs consensus -2M)

✅ EIA Gasoline Stocks Change = 4,188M (vs previous -2,075M, vs consensus -0,94M)

➖ EIA Distillate Stocks Change = -1,71M (vs previous -4,066M, vs consensus -1,25M)

Stok minyak mentah US menurut API dan EIA akhirnya meningkat lagi di atas ekspektasi, setelah beberapa minggu terakhir terus mencatatkan penurunan.

Stok gasoline pun meningkat signifikan, walaupun distillate masih menurun.

Diharapkan ini bisa menjaga harga energi tetap rendah.

$OIL $USDIDR $AKRA

❌ Eskalasi serangan udara Rusia ke Ukraina semakin meningkat, tertinggi dalam 3 tahun terakhir.

https://cutt.ly/PrTthPtY

Serangan ini dilakukan ketika Presiden Rusia Putin justru menyatakan akan melanjutkan ronde baru negosiasi dengan Ukraina di Istanbul, Turki.

Dua ronde negosiasi sebelumnya tidak membuahkan deal.

Mungkin serangan ini dilakukan untuk memberi tekanan ke Ukraina di meja negosiasi.

$ANTM $UNTR $OIL

❌ Baker Hughes Oil Rig Count = 432 (vs previous 438, vs consensus 436)

❌ Baker Hughes Total Rig Count = 547 (vs previous 554)

Jumlah rig produksi minyak di US masih tetap dalam tren penurunan, kali ini angkanya pun di bawah ekspektasi.

Turunnya produksi akan memicu terus berkurangnya stok, supply $OIL semakin ketat, harga minyak sulit untuk kembali melanjutkan penurunan.

$BRENT $MEDC

➖ Pernyataan Pemimpin Tertinggi Iran soal gencatan senjata yang dianggap sebagai kemenangan Iran.

Sambil terus menyerukan kemarahan dan kebencian terhadap US.

Ini membuat Trump enggan untuk melanjutkan upaya pencabutan sanksi yang bisa memulihkan ekonomi Iran.

Walaupun Trump secara persuasif masih punya harapan terhadap Iran untuk kembali menyepakati hal yang diinginkan US.

Namun ini juga menjadi sinyal gencatan senjata yang rapuh.

Tinggi kemungkinan terjadi konflik yang lebih besar antara Israel-Iran dengan keterlibatan US, jika Iran masih terus mempertahankan sikap kerasnya.

$IHSG $OIL $XAU

Rilis data terkait stok minyak mentah US

❌ API Crude Oil Stocks Change = -4,277M (vs previous -10,133M, vs consensus -0,6M)

❌ EIA Crude Oil Stocks Change = -5,836M (vs previous -11,473M, vs consensus -0,75M)

❌ EIA Gasoline Stocks Change = -2,075M (vs previous 0,209M, vs consensus 0,25M)

❌ EIA Distillate Stocks Change = -4,066M (vs previous 0,514M, vs consensus 0,4M)

Stok minyak mentah US menurut API dan EIA kembali melanjutkan penurunan signifikan melebihi ekspektasi.

Stok gasoline dan distillate juga menurun.

Menunjukkan kondisi supply minyak yang ketat, mendorong harga $OIL naik, inflasi US berisiko naik lagi.

$MEDC $NISP