Gold

Commodities

Follow

5,357.51

▴ 109.61 (2.09)

As of Tue 03:42

2.17K

Volume

NA

Avg Volume

$XAU ath, geoplitik gak aman, $IHSG crash, udah paling benar masuk saham emas atau emas fisik $ARCI salah satu yang paling aman 😁

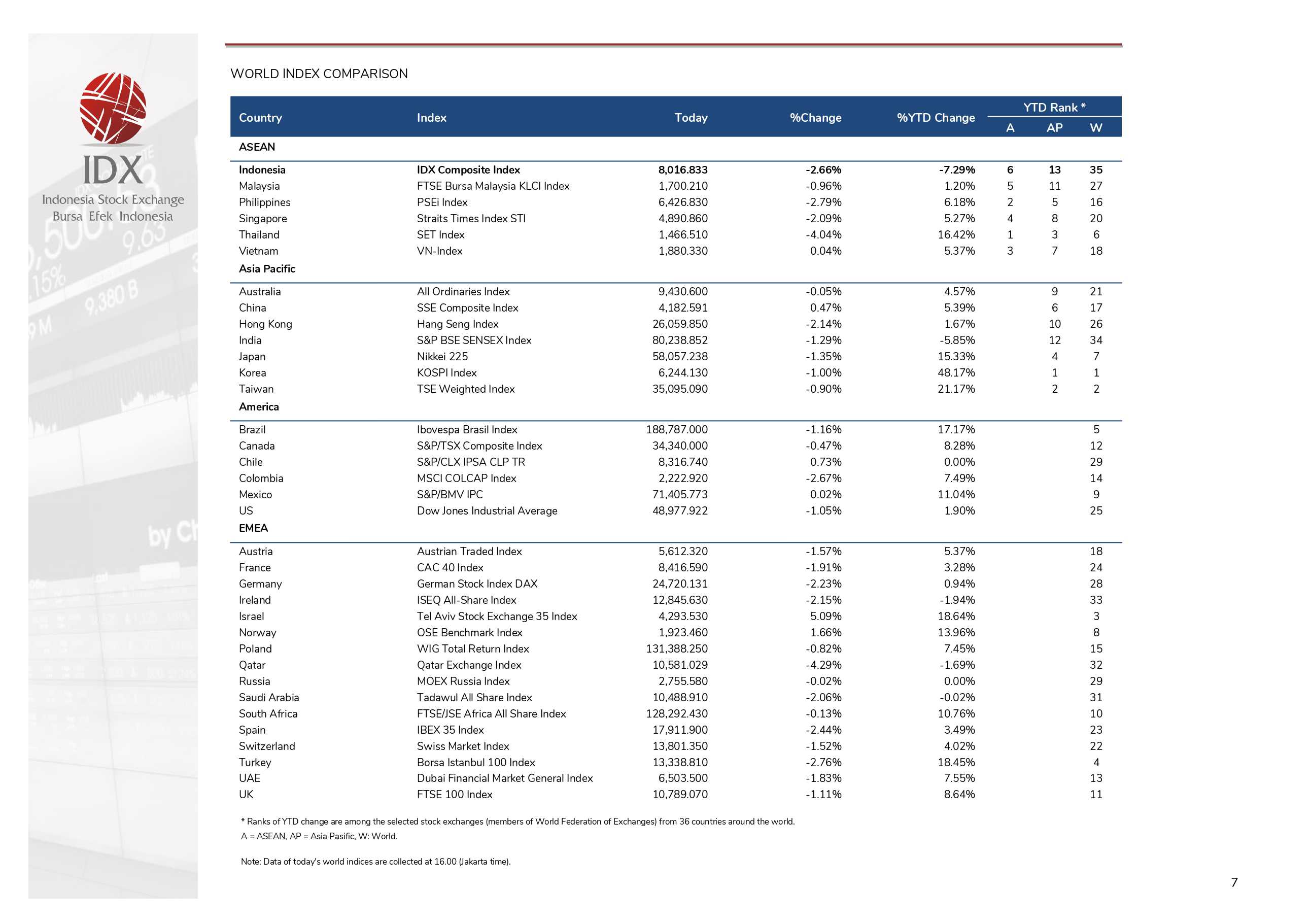

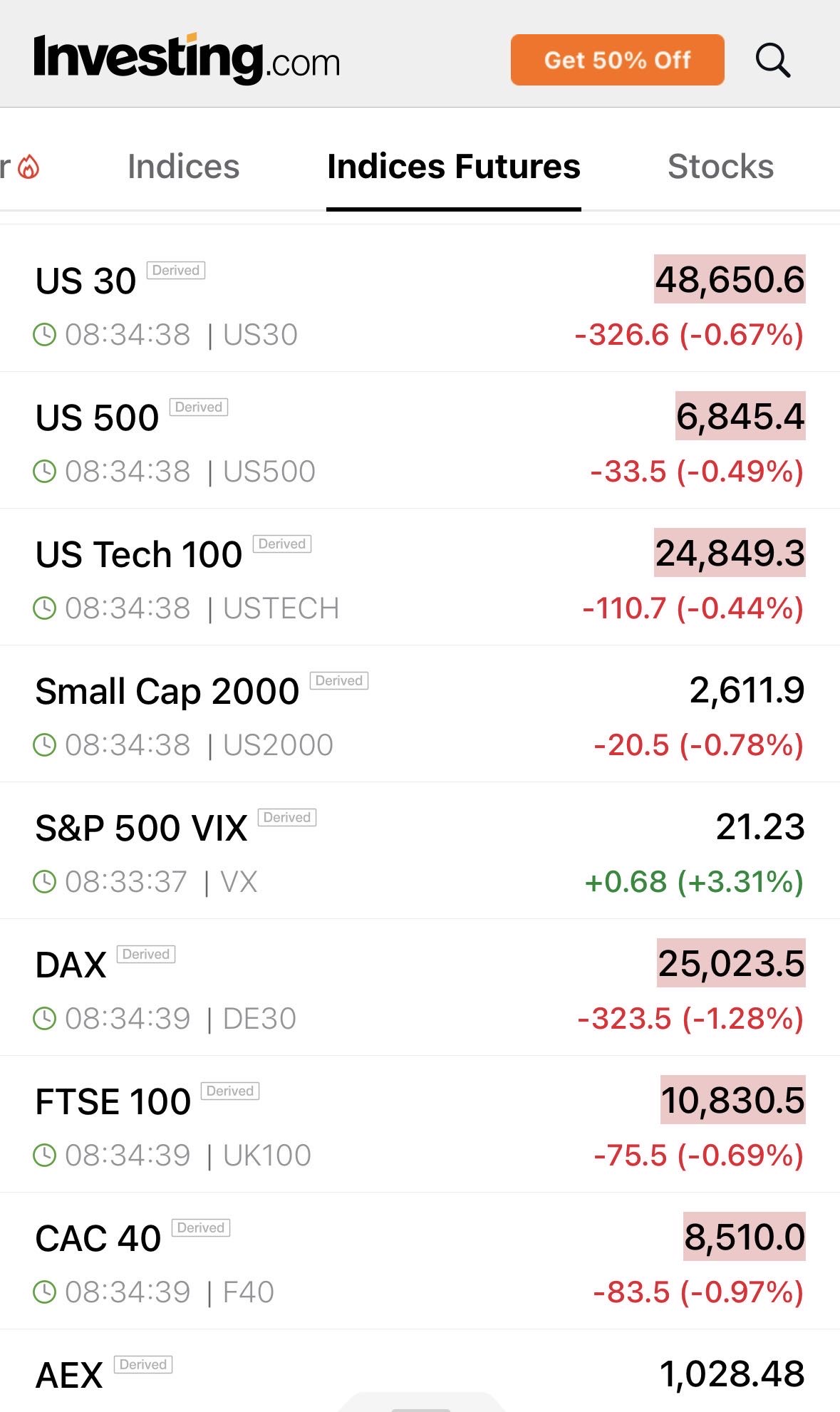

$IHSG YTD return -7,29% rank 35.

Anomali dari negara yang berperang (Israel) indeksnya naik 5,09%.

$XAU $NASDAQ

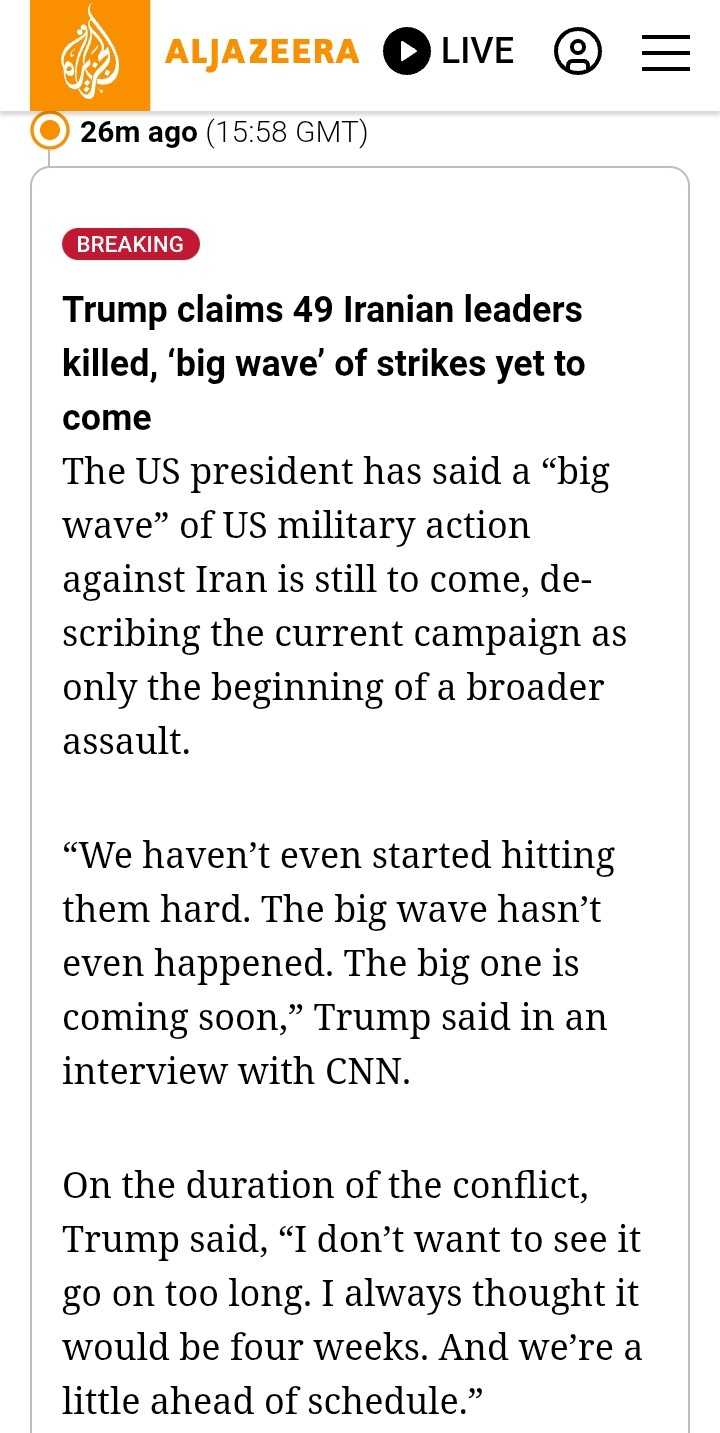

❌ Trump mengklaim serangan US telah menewaskan 49 pejabat Iran.

Serangan sebelumnya bukanlah yang terbesar, dan hanyalah awal dari gelombang serangan yang lebih besar.

$USDIDR $SP500 $XAU

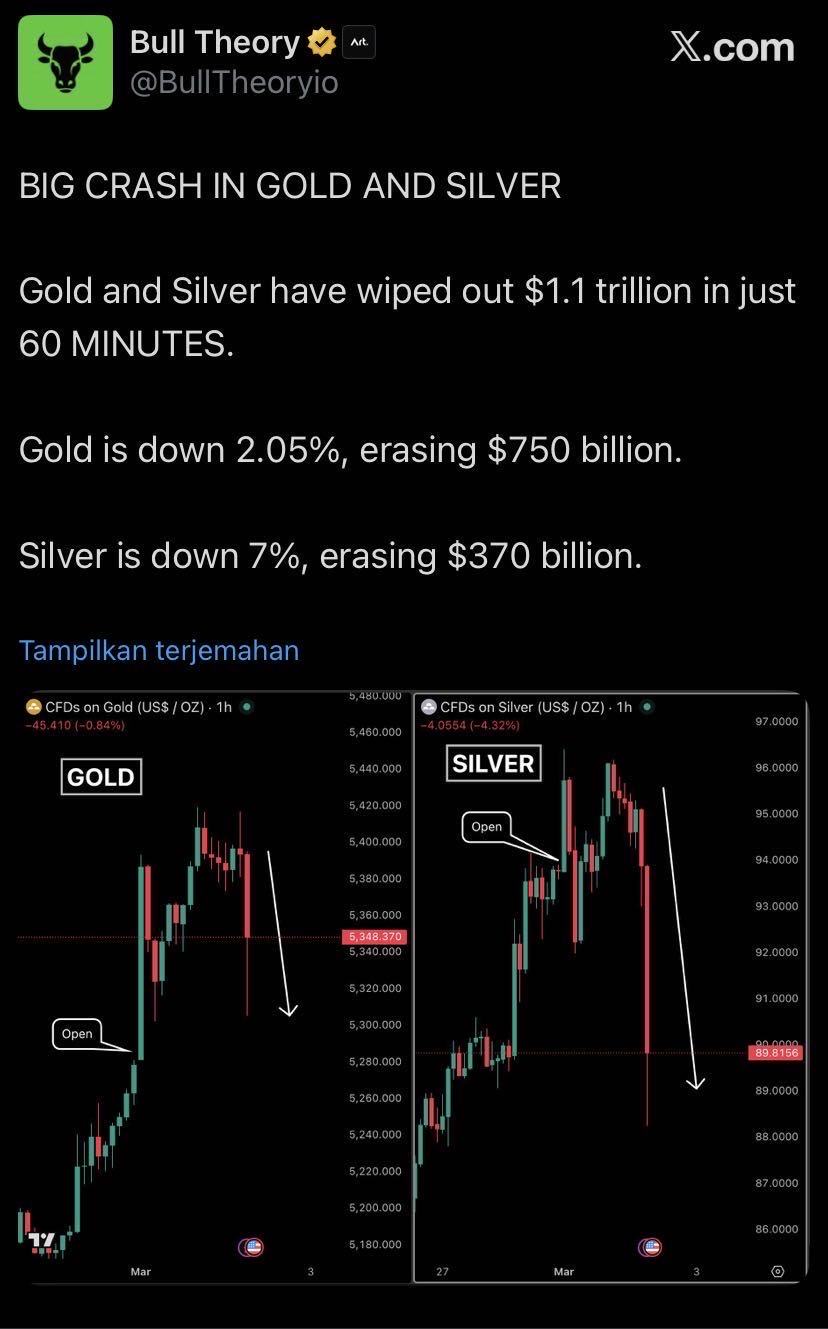

⚠️ BUAT GOLD SAMA PERAK INI HATI”. ⚠️

$ARCI :INI PALING BAHAYA KALOK EMAS TURUN. BUAT YG MASUK DI #ARCI 1,800 LEBIH PIKIR LAGI MAU DI TP/KEJEMPUT.

DAN BUAT YANG BARU MASUK DI PUCUK TADI MUNGKIN SIAP” AJA.

KARENA #ARCI PURE GOLD.

$XAU

$ANTM

DISCLAIMER ON BUKAN AJAKAN JUAL BELIK.

Rilis data ekonomi US

➖ ISM Manufacturing PMI Feb = 52,4 (vs previous 52,6, vs consensus 51,8)

➖ ISM Manufacturing Employment Feb = 48,8 (vs previous 48,1)

➖ ISM Manufacturing New Orders Feb = 55,8 (vs previous 57,1)

❌ ISM Manufacturing Prices Feb = 70,5 (vs previous 59,0, vs consensus 59,5)

➖ S&P Global Manufacturing PMI Final Feb = 51,6 (vs previous 52,4, vs preliminary 51,2)

PMI manufaktur US masih bertahan kuat di atas ekspektasi, walaupun ekspansi sedikit melambat dibandingkan bulan lalu.

Kondisi demikian masih belum mendukung Fed untuk menurunkan suku bunga dalam waktu dekat.

$USDIDR $IHSG $XAU

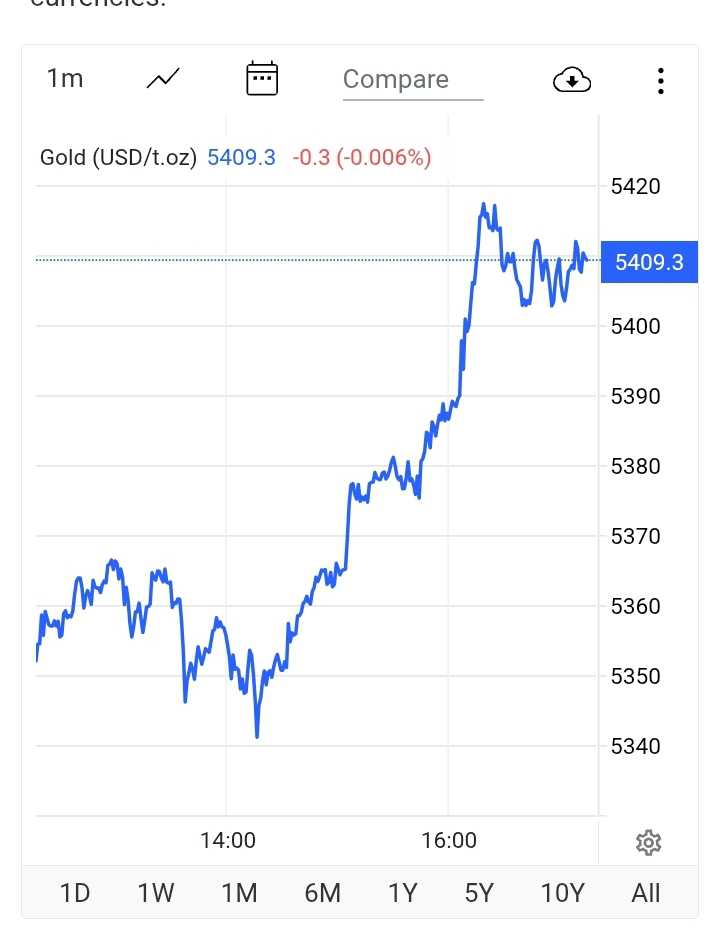

$XAU

Emas

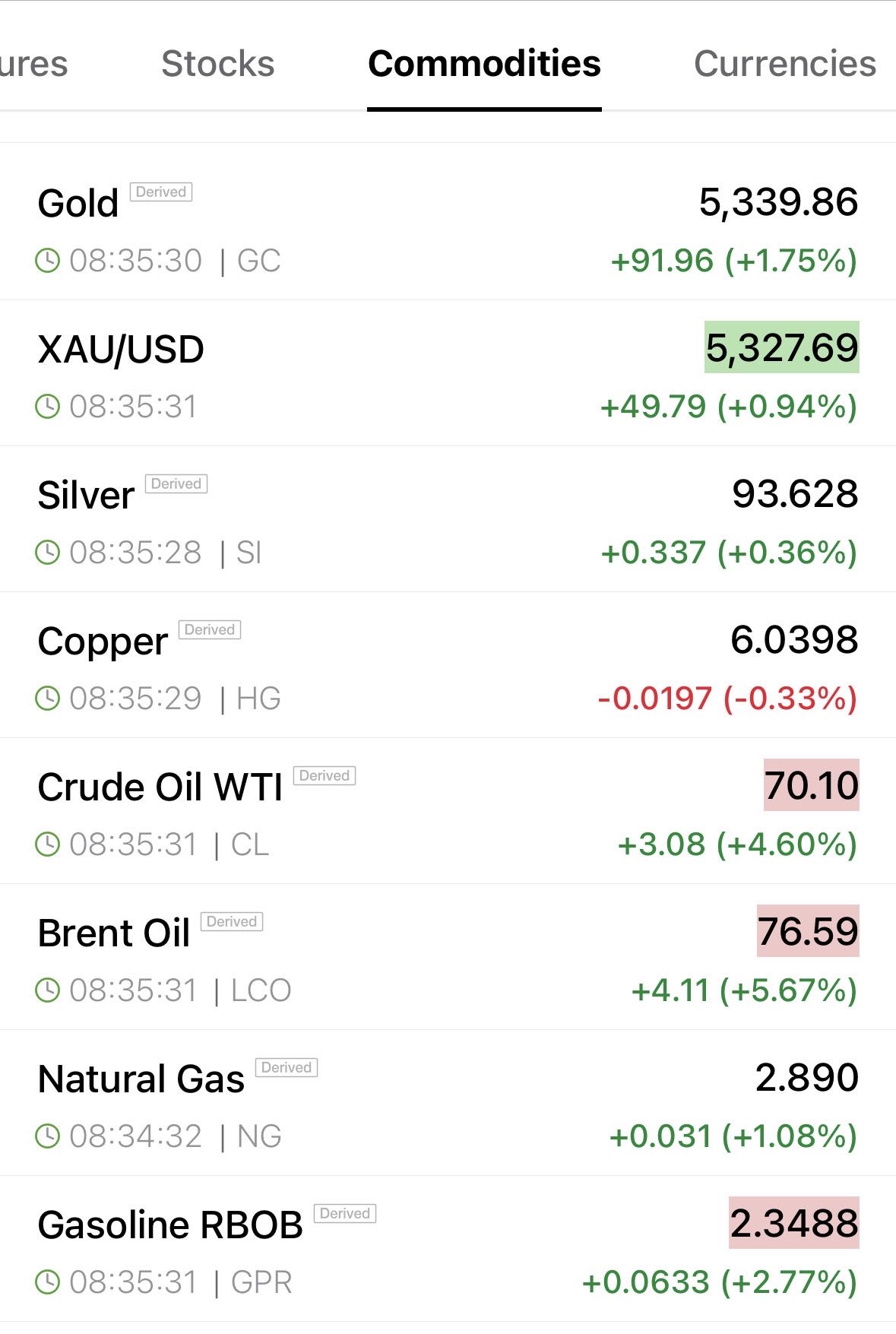

Ketegangan geopolitik biasanya mendorong arus dana ke aset safe–haven seperti emas. Emas spot sempat melonjak +2,7% pada Senin (2/3) ke level US$5.419/oz, sebelum melandai ke level US$5.398/oz (+2,25%) per Senin sore.

Saham terkait: 💲BRMS, $ARCI, $EMAS

https://snips.stockbit.com/snips-terbaru/-eskalasi-konflik-asiran-dampak-ke-ihsg?source=research

$IHSG $XAU $ENRG Mengapa IRAN akan sulit untuk berperang melawan USA dan Israel? Salah satunya adalah karena China sebagai sekutu Iran sangat membutuhkan Energi / Minyak. Dan Iran membutuhkan Negara" lain untuk membeli minyak dari mereka. Perang keberlanjutan akan membunuh ekonomi Iran dan mengurangi dukungan diplomatis dari negara" sekutu Iran

1/3

Awal bulan maret $IHSG langsung dihajar minus 2% lebih 🤣 thanks to duo mamarika and isriwil yang akhir pekan bukannya jalan2 ke dufan malah maen petasan .. 🤣

Sepaham sama beberapa influencer account di @stockbit harusnya kalo timteng panas harga minyak ikut mendidih.. biasanya kalo lagi begitu komoditas mineral dan metal juga bisa keangkat.. energi lain kayak gas dan amonia juga bisa ikutan naik..

Selain itu yang perlu jadi watchlist juga adalah saham2 yang punya potensi kasih laporan keuangan full year 2025 yang ciamik dan tentunya kasih dividen yang cakep ..

Perang persia kali ini sepertinya bakal lama bisa berminggu2, semoga aja sih ga lama2 ya harapan ane nanti malem si trumpet kasih statement yang memberikan kesejukan kayak misalnya akan ada perundingan lanjutan sama iran bahkan kalo bisa ada gencatan senjata..

$XAU $USDIDR

❌ Eskalasi konflik Timur Tengah kembali meluas dan intensitasnya meningkat.

Semua negara di kawasan kini menghadapi ancaman serangan nyata di antara konflik Iran dengan US dan Israel.

https://cutt.ly/ktEF6ZlZ

$IHSG $OIL $XAU

https://cutt.ly/ftEFEGw6

France, England, German join the club. 🤯

$IHSG $OIL $XAU

Low base effect, mau puasa-lebaran, efek MBG.. $IHSG .. BI Rate tahun ini paling banyak turun 1x,.. external perang iran bbm naik.. rupiah $USDIDR makin keok.. dampaknya demand $XAU masih akan terjaga ..

Lambat laun saya mulai mengerti kenapa sekelas Investor papan atas seperti Warren Buffet dan Lo Kheng Hong tidak mau investasi di Emas. Saya mulai pelajari faktor apa saja dan ingredients apa saja yang dibutuhkan agar harga Emas naik. Saya melihat data historis dan menemukan bahwa emas selalu naik jika terjadi hal-hal buruk. Contoh sederhana yaitu saat pandemi Covid, perang Ukraina-Russia, perang Israel-Palestina dan sekarang kombo perang Iran-USA combo Pakistan-Afganistan maka harga emas NAIK secara signifikan. Kemudian saya menarik kesimpulan bahwa kenaikan harga emas memerlukan 1 Ingredient penting yaitu "NYAWA MANUSIA". Setiap ada nyawa yang dikorbankan maka HARGA EMAS NAIK. Apakah ini yang menyebabkan seorang Warren Buffett atau Lo Kheng Hong tidak mau membeli emas? Karena secara tidak langsung pikiran alam bawah sadar selalu berharap keburukan terjadi di dunia agar Harga Emas yang kita miliki naik dan memperoleh keuntungan. Pikiran adalah Doa. Apa yang kita pikirkan itulah yang akan terjadi. Well.. ini semua kembali kemasing-masing pribadi.. Tapi saya salut kepada Warren Buffet dan Bapak Lo Kheng Hong yang kokoh dalam pendirian untuk tidak investasi di Emas. Mungkin mereka tidak mau menodai Investasi mereka dengan "Nyawa Manusia".

Semoga bermanfaat

Random Tags

$IHSG $XAU $ARCI *B** *B**

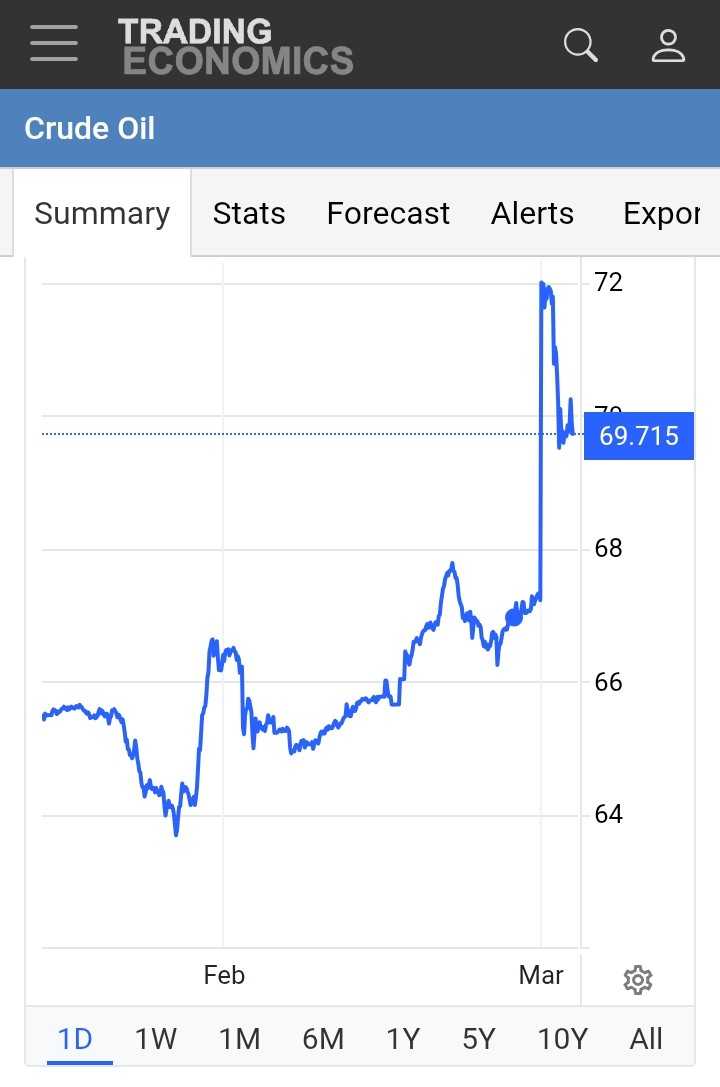

➖ Harga $OIL balik ke bawah 70

Market menilai disrupsi supply minyak belum akan terjadi terlalu parah.

Walaupun ada ancaman dan serangan dari Iran, namun Selat Hormuz belum secara resmi ditutup.

$IHSG $XAU

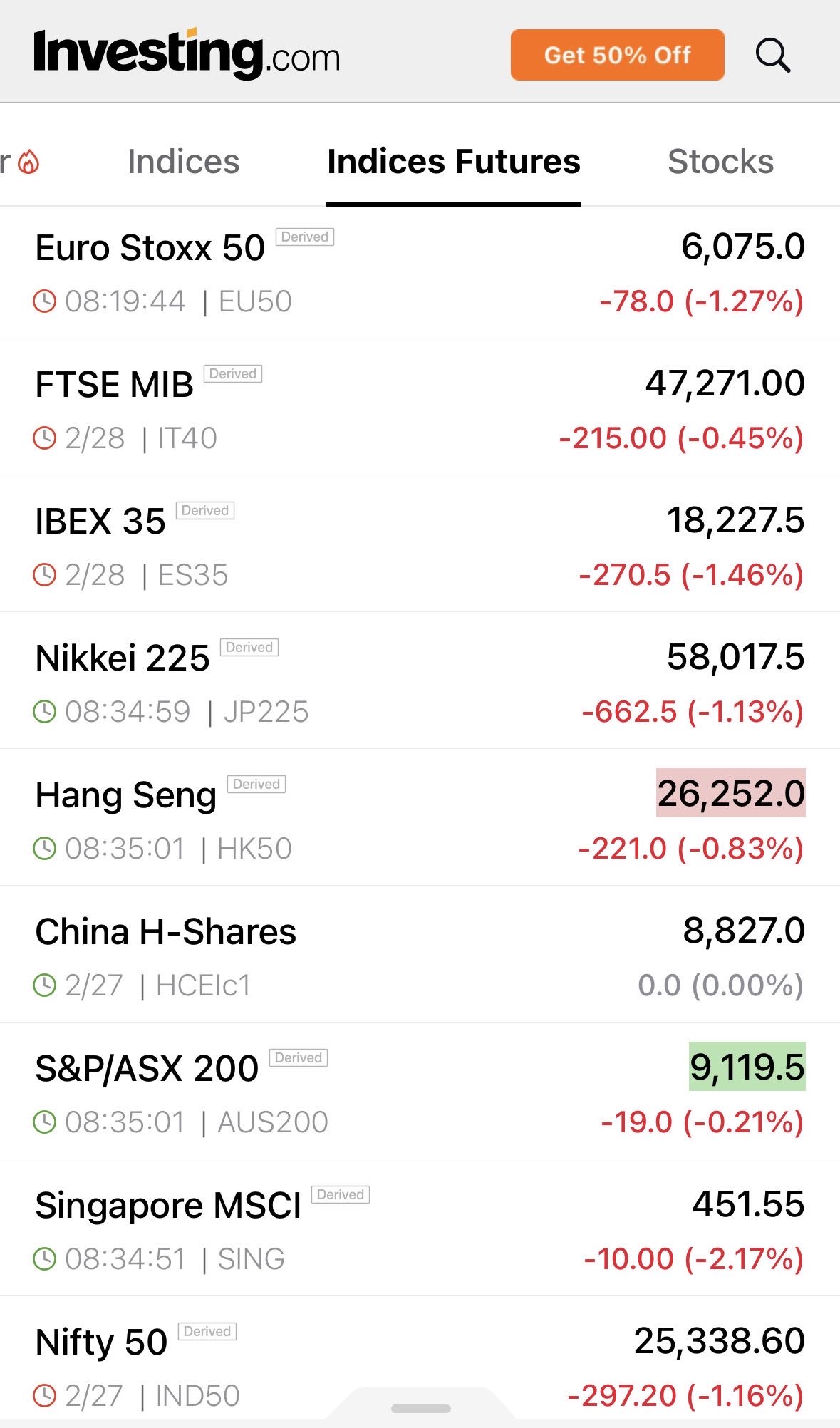

Update market future

-> index global terkoreksi cenderung netral

-> $OIL (wti) dibuka gap up +8% dan kemudian per pagi ini sudah koreksi dan ada di +4% dari harga minggu lalu

-> $XAU 5,339 +1.7%

-> $IHSG we'll ses

OPEC akan menambah supply, dan menyampaikan Iran tidak akan menutup selat Hormuz

Read from OPEC:

- Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman adjust production and reaffirm commitment to market stability

Tips:

- Jangan FOMO

- Tidak perlu ikut tebar fear seperti influencer2

- Market selalu benar, ikuti price action

(honesty, lama kelamaan herding act dari genk2 ini meresahkan -too much lebaynya) *opini, bukan fact

Credit: Investing, Reuters, https://cutt.ly/stESBfyY

1/4

$XAU biasanya kl di game2 platinum lebih tinggi dr gold, di perbankan kartu platinum lebh tinggi nilainya dr gold, jd skrg gold yg overvalue apa platinum yg undervalue ya? 🤔