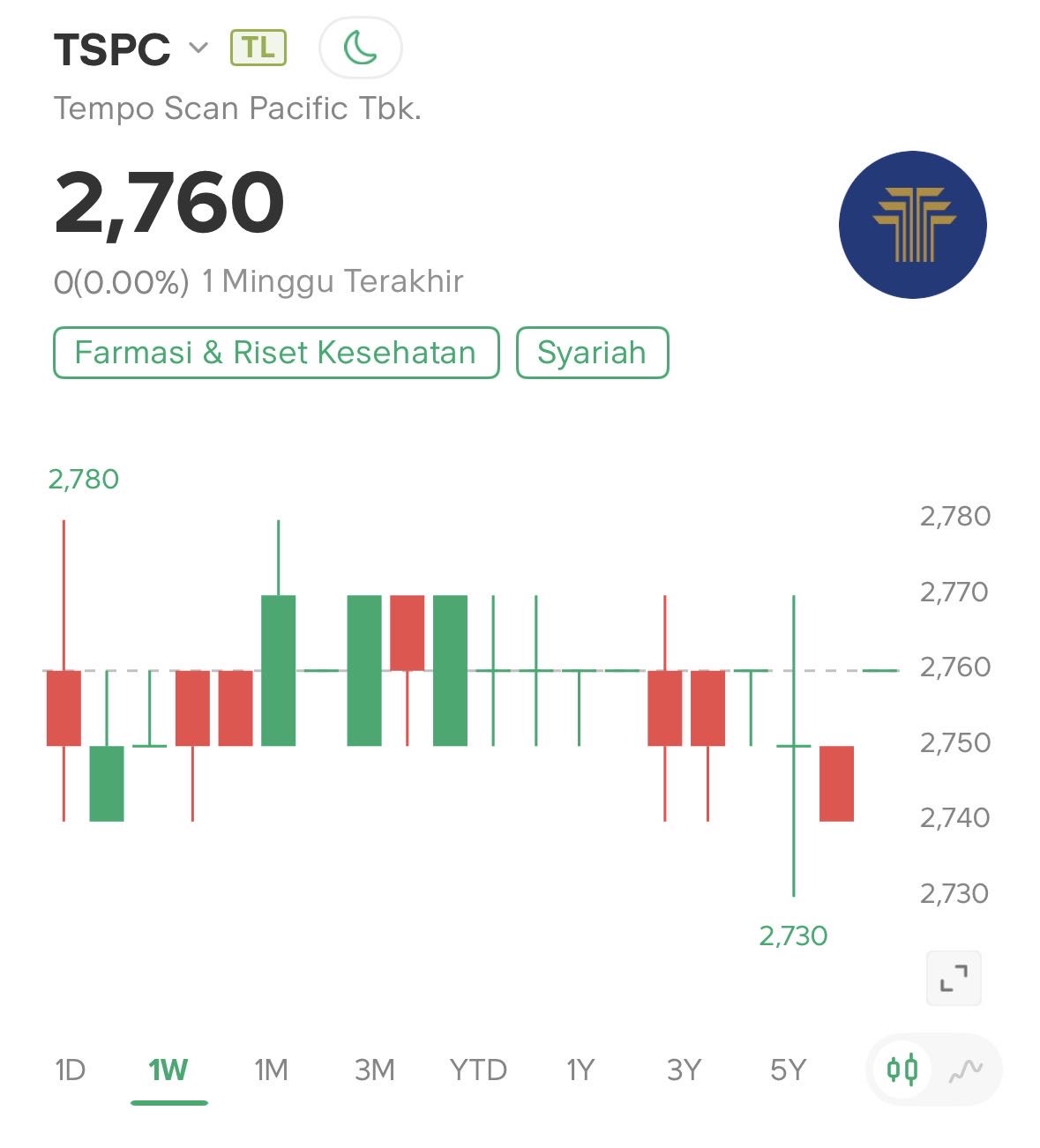

TSPC

Tempo Scan Pacific Tbk.

2,720

-30

(-1.09%)

386,200

Volume

1.21 M

Avg volume

Company Background

PT Tempo Scan Pacific Tbk merupakan perusahaan yang bergerak dalam industri farmasi. Perusahaan memiliki tiga divisi bisnis inti: divisi farmasi, divisi produk konsumen dan kosmetik, dan divisi distribusi. Divisi farmasinya memproduksi dan memasarkan berbagai obat bebas (OTC) dan obat resep serta suplemen. Brand-brand perseroan antara lain Hemaviton, Bodrex, NEO rheumacyl, Revlon, Marina, Vidoran Smart, My Baby, Oskadon, SOS Floor Cleaner, Zevit Grow dan masih banyak lagi brand-brand lainnya. Pabrik produksinya berada di Bekasi, Indonesia. Divisi produk konsumen dan kosmetiknya memproduksi dan memasarkan berbagai produk konsumen... Read More

$TSPC Saham yg too good di lewatkan. , selama belum naik terima deviden dulu.

Kalau dia turun tambah muatan 😄

$TSPC

- cash per share Rp 1000

- Naturaly hedging against USD

- termurah vs Peers consumer

- termurah vs peers farmasi

- owner still in charge

- MOAt brand sangat baik

- hutang hampir tidak ada

- super defensif sector

- tidak ada asimg yg bisa push down harga

- dividen 7% PER TAHUN

- growth 15% per tahun

$INDF $KLBF

Tujuh Prinsip Praktis untuk Berinvestasi dengan Tenang dan Rasional

Dalam investasi jangka panjang, hasil yang baik hampir selalu lahir dari proses yang sederhana, tetapi dijalankan dengan disiplin. Banyak investor sebenarnya sudah memahami teori dasarnya, namun gagal menerapkannya secara konsisten. Masalahnya bukan pada kurangnya informasi, melainkan pada cara kita menata proses berpikir dan pengambilan keputusan. Tujuh prinsip berikut membantu kita membangun pendekatan investasi yang lebih sistematis, rasional, dan tahan uji dalam jangka panjang.

1. Miliki Daftar Perusahaan Berkualitas dan Harga Belinya

Investasi yang tenang selalu dimulai dari persiapan. Kita perlu memiliki daftar perusahaan berkualitas tinggi yang benar-benar kita pahami, jauh sebelum pasar bergejolak. Untuk setiap perusahaan, kita sudah menentukan kisaran harga yang masuk akal untuk membelinya. Dengan pendekatan ini, keputusan investasi tidak diambil secara impulsif saat emosi pasar bergejolak, melainkan berdasarkan rencana yang sudah disusun dengan kepala dingin.

2. Siap Bertindak Saat Peluang Datang

Peluang besar tidak muncul setiap hari. Di sebagian besar waktu, pasar bergerak biasa saja dan bahkan terasa membosankan. Namun sesekali, harga saham perusahaan yang bagus bisa jatuh jauh di bawah nilai wajarnya. Pada saat seperti itu, investor yang sudah siap justru merasa lebih tenang karena tahu apa yang harus dilakukan. Bila persiapan sudah matang, penurunan harga tidak akan terasa menakutkan. Sebaliknya, itu menjadi peluang besar yang dinantikan.

3. Pahami Cara Perusahaan Menghasilkan Uang

Prinsip berikutnya adalah kesederhanaan dalam pemahaman. Jika kita tidak mampu menjelaskan bagaimana sebuah perusahaan menghasilkan uang dengan bahasa yang sangat sederhana, besar kemungkinan kita belum benar-benar memahaminya. Bisnis yang baik tidak harus rumit, tetapi harus jelas sumber pendapatannya, siapa pelanggannya, dan mengapa model tersebut bisa bertahan dalam jangka panjang.

4. Fokus pada Arus Kas Bebas

Pada akhirnya, yang membayar investor bukanlah angka laba di laporan keuangan, melainkan kas nyata yang dihasilkan bisnis. Perusahaan yang secara konsisten menghasilkan arus kas bebas lebih besar daripada yang dibelanjakan memiliki fleksibilitas tinggi. Ia bisa membayar dividen, memperluas usaha, mengurangi utang, dan bertahan saat kondisi ekonomi memburuk. Arus kas bebas adalah fondasi utama dari imbal hasil jangka panjang.

5. Biarkan Pemenang Terus Berlari

Salah satu kesalahan paling umum adalah menjual terlalu cepat saham yang berkinerja baik. Ketika sebuah perusahaan terus bertumbuh, meningkatkan arus kas, dan memperkuat posisinya, kenaikan harga saham bukanlah alasan otomatis untuk menjual. Dalam banyak portofolio yang sukses, sebagian besar keuntungan justru berasal dari segelintir saham yang dibiarkan tumbuh dalam waktu yang sangat panjang.

6. Singkirkan yang Tidak Lagi Bekerja

Disiplin juga berarti berani mengakui kesalahan. Jika sebuah perusahaan kehilangan keunggulan kompetitif, memangkas dividennya karena masalah struktural, atau model bisnisnya tidak lagi relevan, bertahan hanya karena harapan sering kali menjadi keputusan yang mahal. Portofolio yang sehat dibangun dengan menyingkirkan yang tidak lagi bekerja dan memfokuskan modal pada bisnis yang benar-benar berkualitas.

7. Berpikir sebagai Pemilik Bisnis

Pada akhirnya, kita perlu memandang saham sebagai kepemilikan bisnis, bukan sekadar tiket perdagangan. Pemilik bisnis tidak mengecek nilainya setiap jam, melainkan meninjau kinerja secara berkala dan memahami arah jangka panjang. Efek penggandaan (compounding effect) bekerja paling efektif ketika kita memberi waktu dan tidak terus-menerus ikut campur tanpa alasan yang kuat.

Dengan mengikuti tujuh prinsip ini, proses investasi menjadi lebih terstruktur dan menenangkan. Dari ketujuh langkah tersebut, bagian mana yang paling sering Anda abaikan selama ini? Dan perubahan apa yang bisa Anda mulai agar cara berinvestasi Anda semakin mendekati pola pikir seorang pemilik bisnis sejati?

@Blinvestor

Random tags: $KLBF $SIDO $TSPC

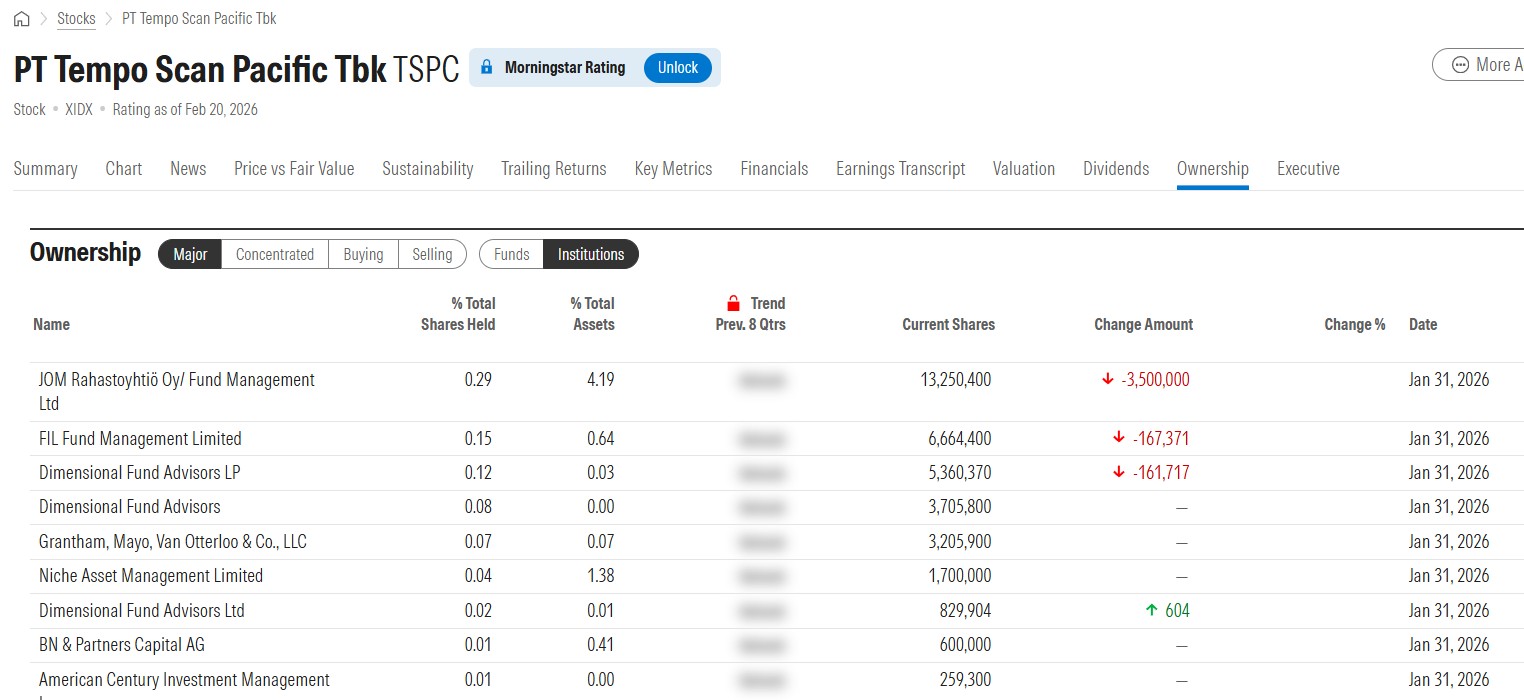

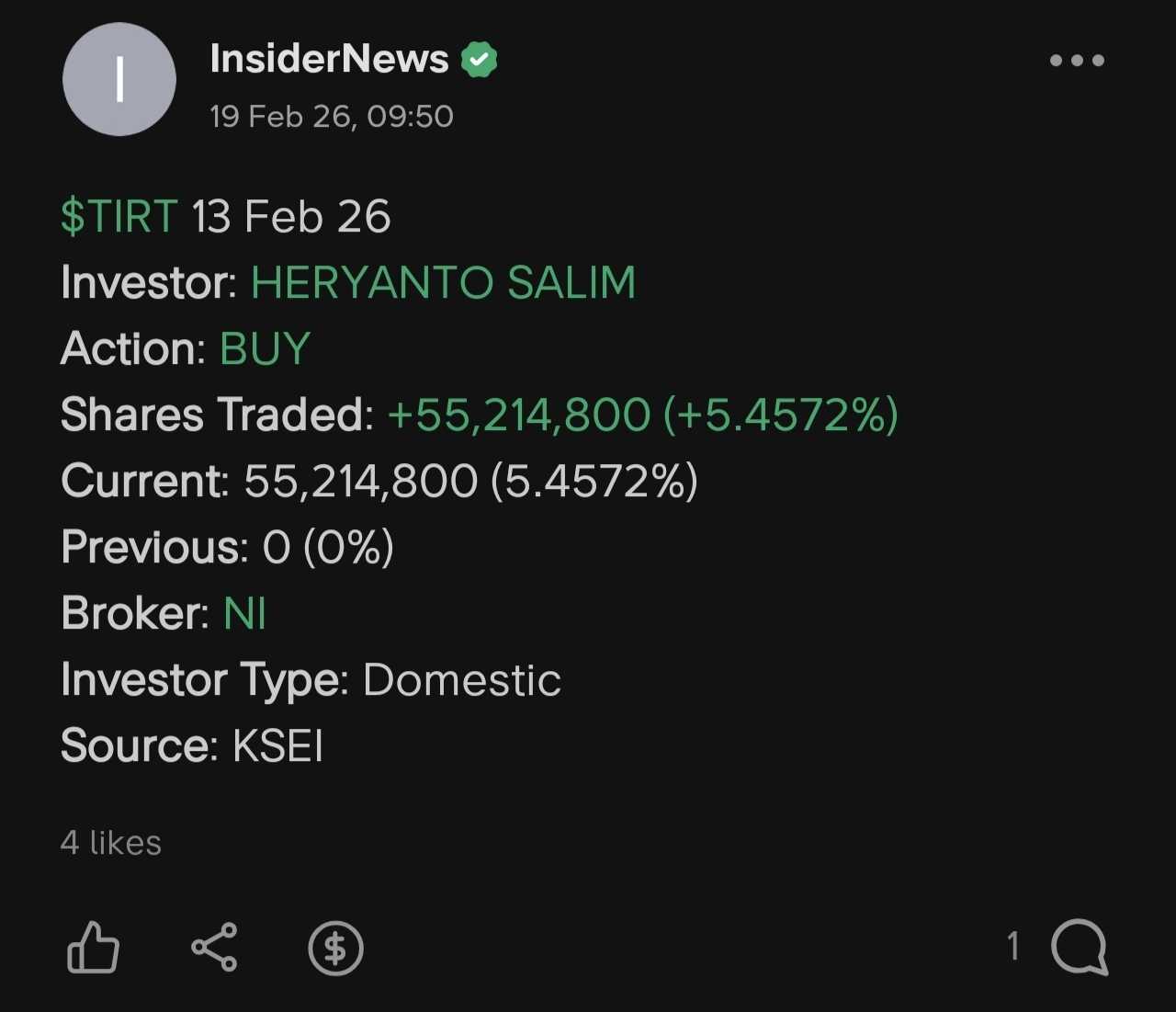

1. Does UBO want to take it all ?

2. Are foreign investors bored of investing in this stock?

Peter Lynch :

Buy only what you understand, believe in, and intend to stick with — even when others are chasing the next miracle.

Stay within your circle of competence

Radar On : $TSPC $BUKA $PALM

Keep the Faith, Don't lose your way.

加油

Jia You

Uraaa

Do Your Own Research

Trust NO Body

Ignore Market Noise

1/2

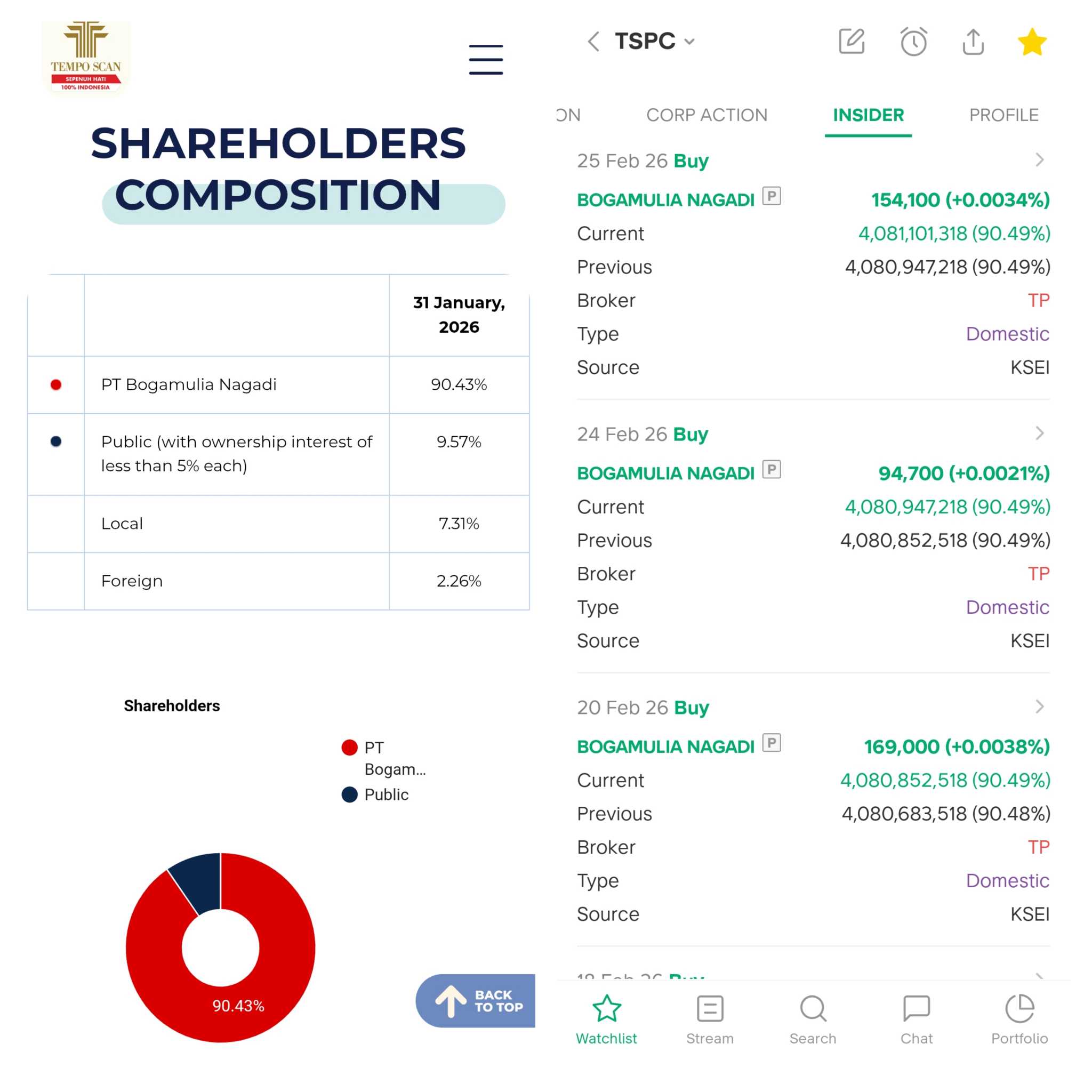

$TSPC 25 Feb 26

Investor: BOGAMULIA NAGADI

Action: BUY

Shares Traded: +154,100 (+0.0034%)

Current: 4,081,101,318 (90.4928%)

Previous: 4,080,947,218 (90.4894%)

Broker: TP

Investor Type: Domestic

Source: KSEI

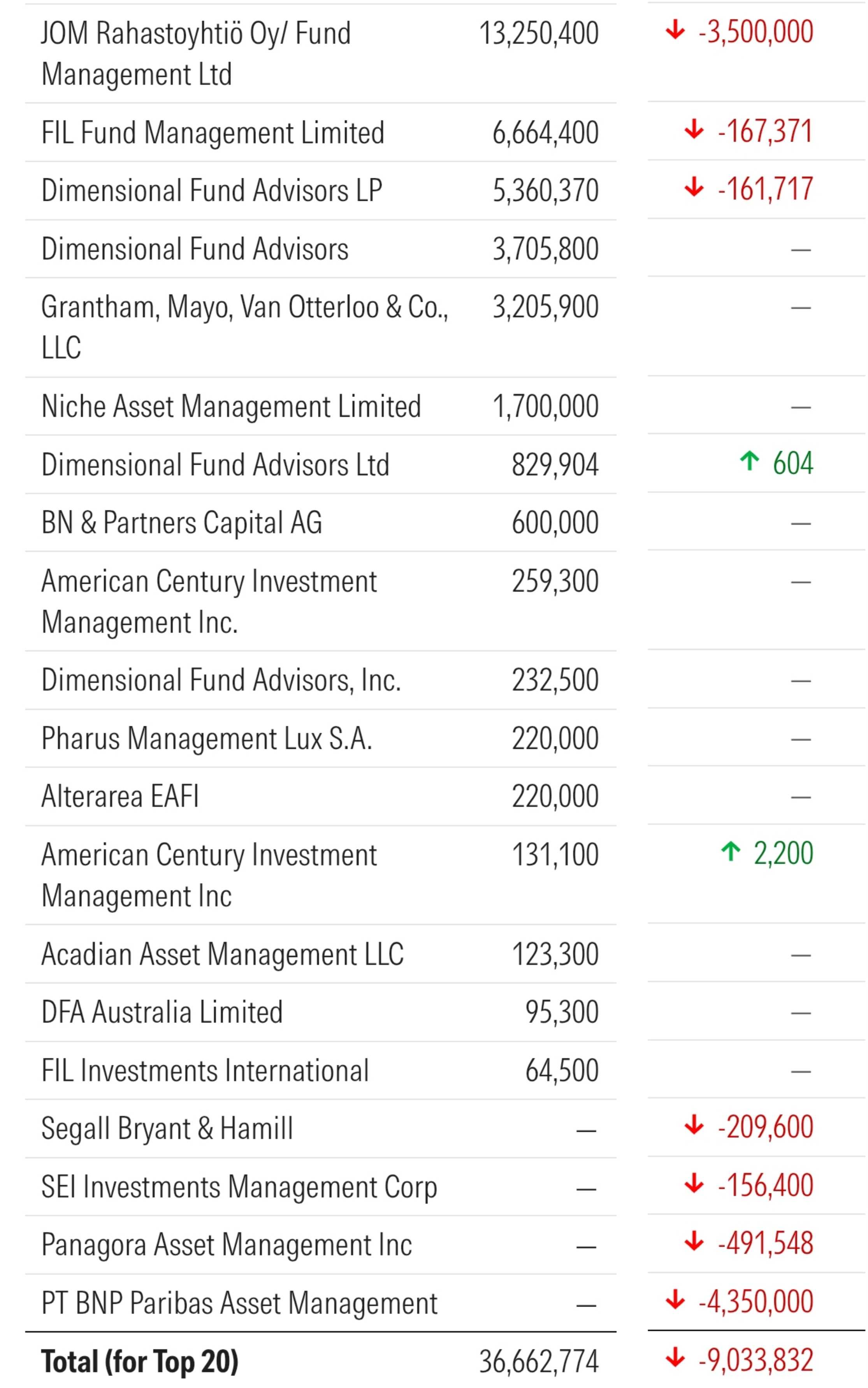

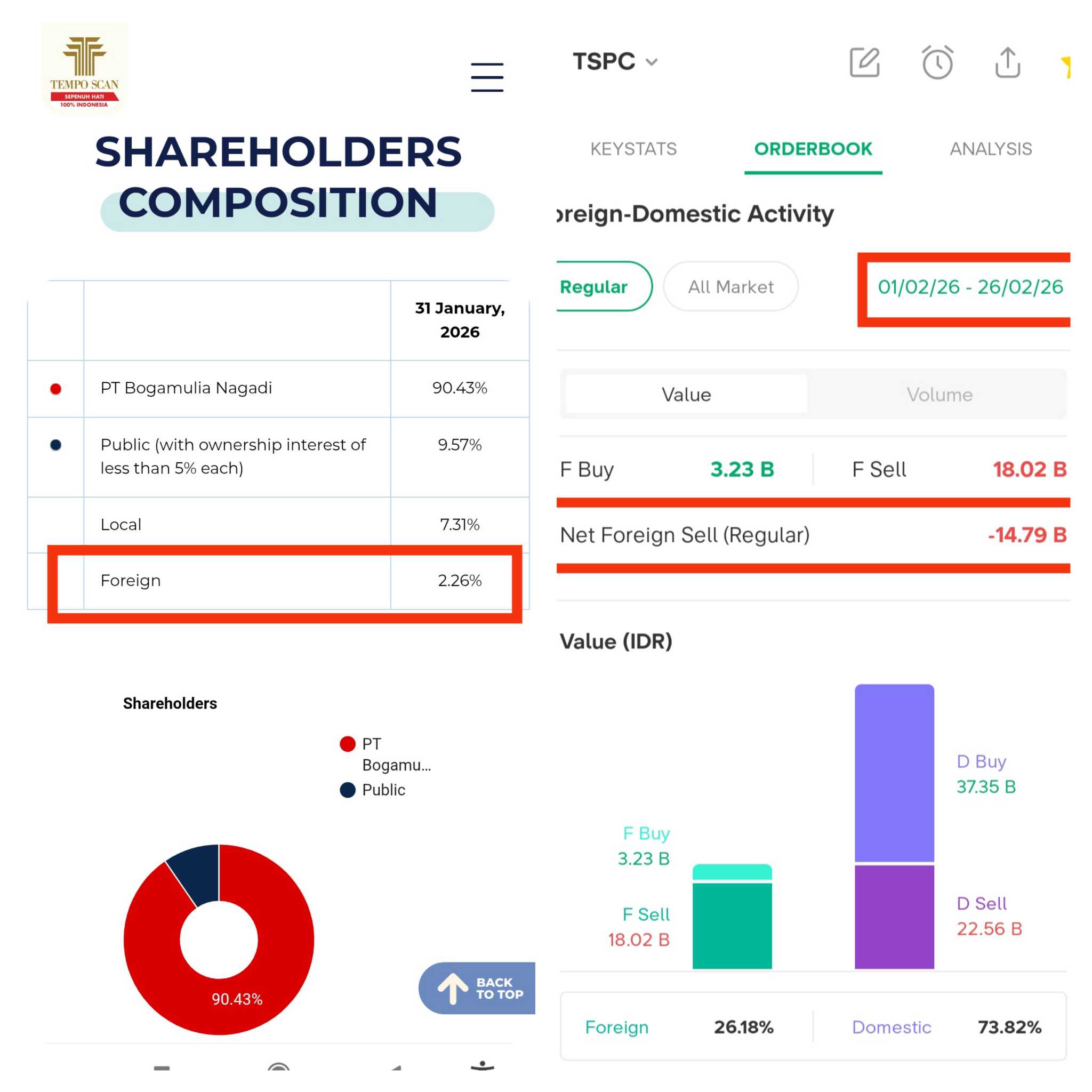

Foreign Stocks has already limited and still reducing.

Peter Lynch :

Buy only what you understand, believe in, and intend to stick with — even when others are chasing the next miracle.

Stay within your circle of competence

Radar On : $TSPC $BUKA $KLAS

Keep the Faith, Don't lose your way.

加油

Jia You

Uraaa

Do Your Own Research

Trust NO Body

Ignore Market Noise

$TSPC 24 Feb 26

Investor: BOGAMULIA NAGADI

Action: BUY

Shares Traded: +94,700 (+0.0021%)

Current: 4,080,947,218 (90.4894%)

Previous: 4,080,852,518 (90.4873%)

Broker: TP

Investor Type: Domestic

Source: KSEI

Atas Ekspektasi yang Harus Dipenuhi

Saya tidak membahas soal market, hanya ingin membahas soal beberapa emiten yang ada di inventory investasi saya.

Dan ini juga bukan hal yang terlalu pelik, ini hanya soal selera dan preferensi saja.

Dan inti tulisan ini untuk saya yang perspektifnya sebagai investor atau trader dengan time frame tahunan, bukan yang saham yang hari ini dibeli besok atau lusa dijual.

Pertama-tama saya ingin membahas soal $ELSA, emiten yg secara performa harga justru meningkat beberapa bulan terakhir. Di tengah kondisi indeks yang cukup sempoyongan.

Buat saya pribadi sebenarnya kenaikan harga yang cukup signifikan membuat sedikit kurang nyaman, saya bukan tidak senang melihat jumlah nominal keuntungan yang terus meningkat dari saham ELSA, saya sendiri tidak pernah menjual 1 lembar-pun saham ELSA sejak saya beli di tahun 2023-an.

Tidak nyamannya muncul karena kenaikan harga terjadi cukup signifikan dan sebelum ada konfirmasi di LK.

sekali lagi betul, ini hanya soal preferensi saja, buat saya lebih nyaman ada data atau informasi, ini bukan saja soal berapa eps atau rasio yang bisa dihitunh dari LK, tapi juga soal informasi mengenai kontrak dan perkiraan kinerja ke depan. Buat saya apa yang ada di LK lebih sahih daripada sekedar informasi non-resmi bahkan seperti informasi (yang terbaca seperti janji) dari BoD emiten misalnya soal laba 1T.

Kalau ditanya "kalau sudah tidak nyaman ya dijual saja?"

Untuk kondisi saya terkait saham ELSA, pertanyaan tersebut seperti mengatakan bahwa kalau kekenyangan kenapa tidak dimuntahkan saja.

Saya termasuk orang yang percaya bahwa ke depan sektor energi termasuk migas dan penunjangnya akan dapat angin segar, karena terkait peningkatan produksi migas dll sepertinya serius dilaksanakan.

Jadi lebih enak kan? sebagai investor dapat data yg lebih pasti karena ada di LK, kalau harga naik bantalannya kuat.

Tapi memang tidak salah juga kalau dibilang namanya investasi ya pasti ada ketidakpastiannya, ada risikonya.

Nah kalau ini saya setuju, mungkin memang saya saja yg agak kolot jadi kurang suka dengan ketidakpastian yang cukup tinggi.

Soal ketidakpastian dan risiko tersebut menurut saya datangnya dari ekspektasi yang sudah terefleksi di harga tetapi belum ada pijakan yang "pasti" berapa sih kira-kira laba dan dividen ke depan. Sekali lagi LK utamanyq memang memperlihatkan kinerja yang telah terjadi tapi di dalamnya kadang ada hint atau informasi mengenai kinerja ke depan seperti kontrak atau aset yg sedang dikerjakan dst.

Kalau ditanya apa yang nyaman hold-nya, buat saya emiten seperti $ADES dan $TSPC saat ini lebih menenangkan hati, sebenarnya utamanya bukan hatinya yang yang tenang lebih ke seberapa besar keberanian untuk avg up hahaha

Ini bukan ajakan untuk beli ades dan tspc yaa, tentu bukan itu. Hanya ingin membagi perspektif saya saja soal ekspektasi yang mungkin sudah terefleksi di harga saja. Saya juga sudah hanya geser-geser emiten saja, iya betul salah satunya untuk realokasi sebagian hasil bumi saya saja.

Buat saya, kalau saya cukup yakin sektornya lagi bagus misal sektor migas dan penunjangnya atau daya beli masyarakat di Q4 2025 maka beli sebagian sebelum ada kepastian (misalnya informasi legit dari LK) lalu beli lagi kalau sudah ada kepastian dan harga masih masuk akal. Kalau harga sudah naik tentu beli sebelum ada kepastian informasi itu agak lebih deg-degan, kurang nyaman.

Beda kalau harga belum naik signifikan tapi sudah ada keyakinan apalagi ada kepastian. meski jarang sekali kondisi tersebut terjadi.

Kalau dibilang harusnya bersyukur punya avg ELSA <350, tentu saya bersyukur tapi jangan lupa holding period saya juga panjang sekali.

Sekian, semoga senantiasa yang terbaik untuk kita semua.

$TSPC 20 Feb 26

Investor: BOGAMULIA NAGADI

Action: BUY

Shares Traded: +169,000 (+0.0038%)

Current: 4,080,852,518 (90.4873%)

Previous: 4,080,683,518 (90.4835%)

Broker: TP

Investor Type: Domestic

Source: KSEI

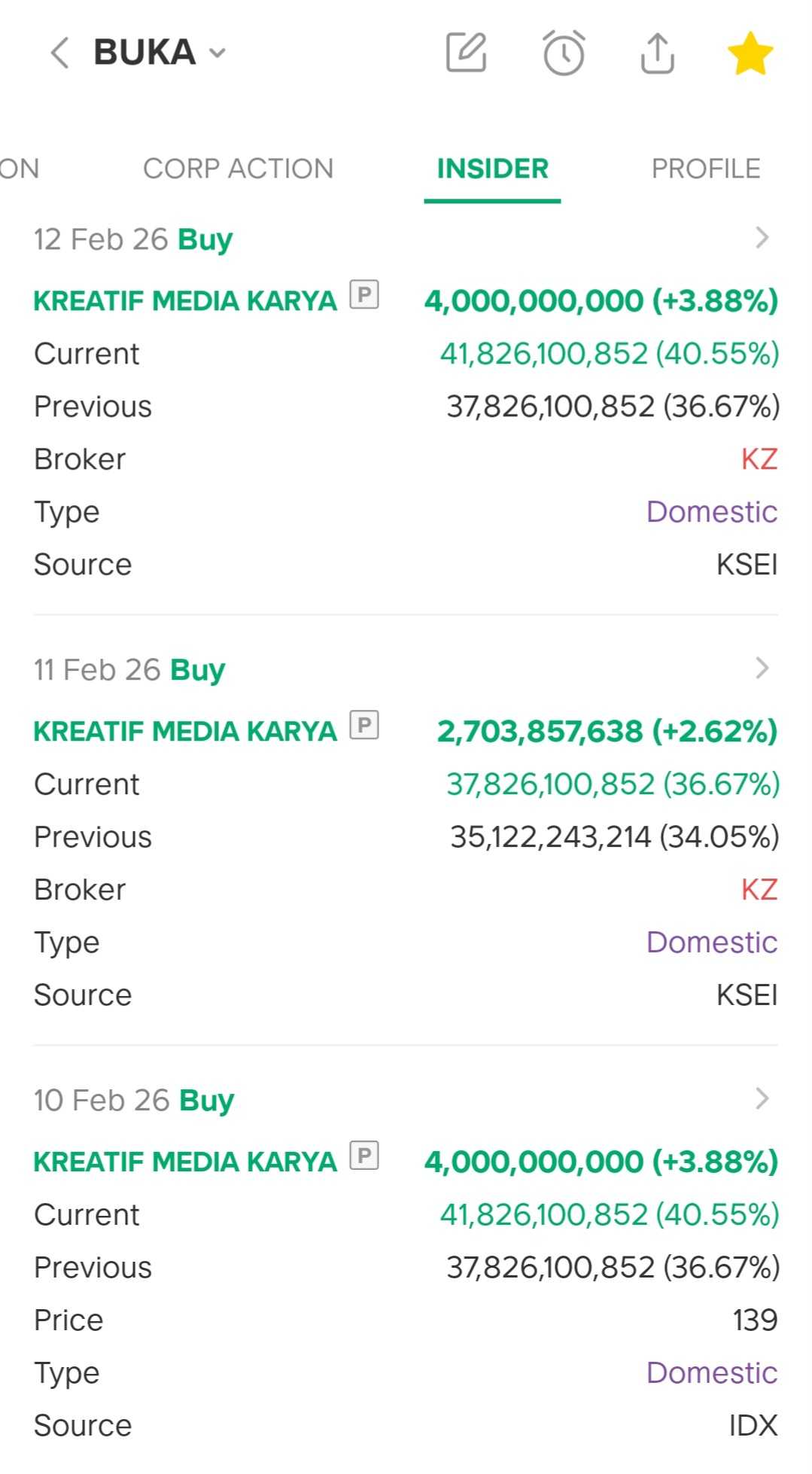

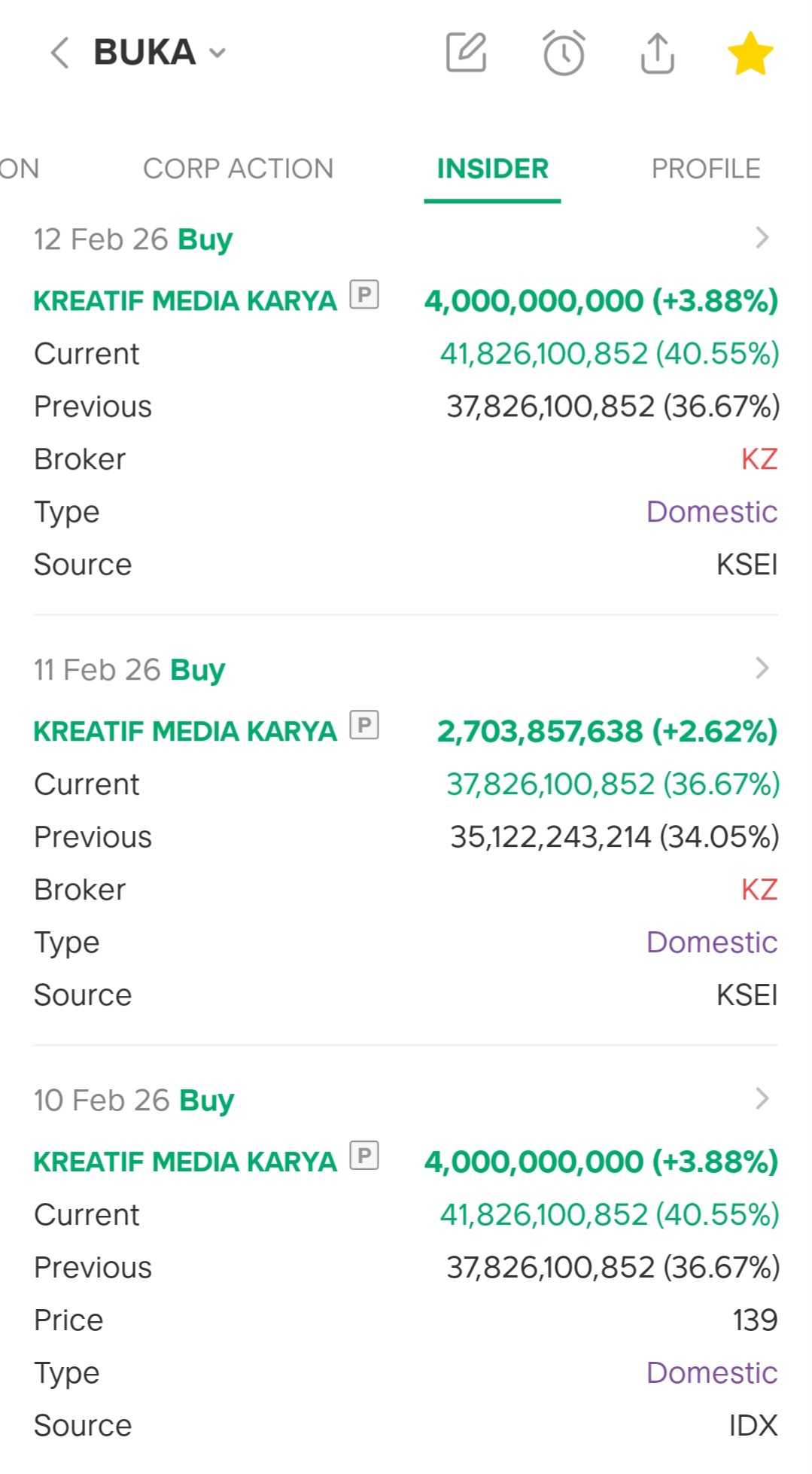

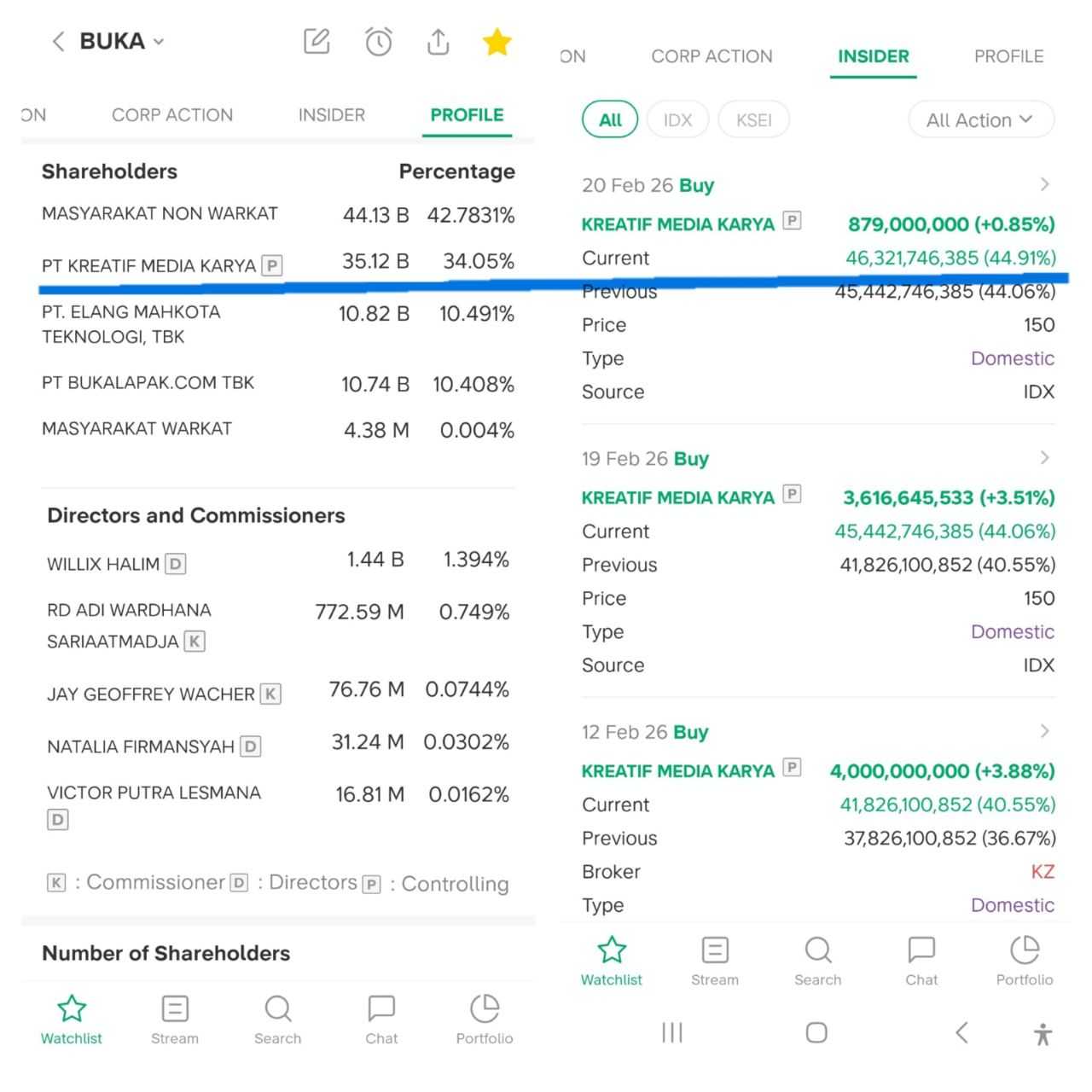

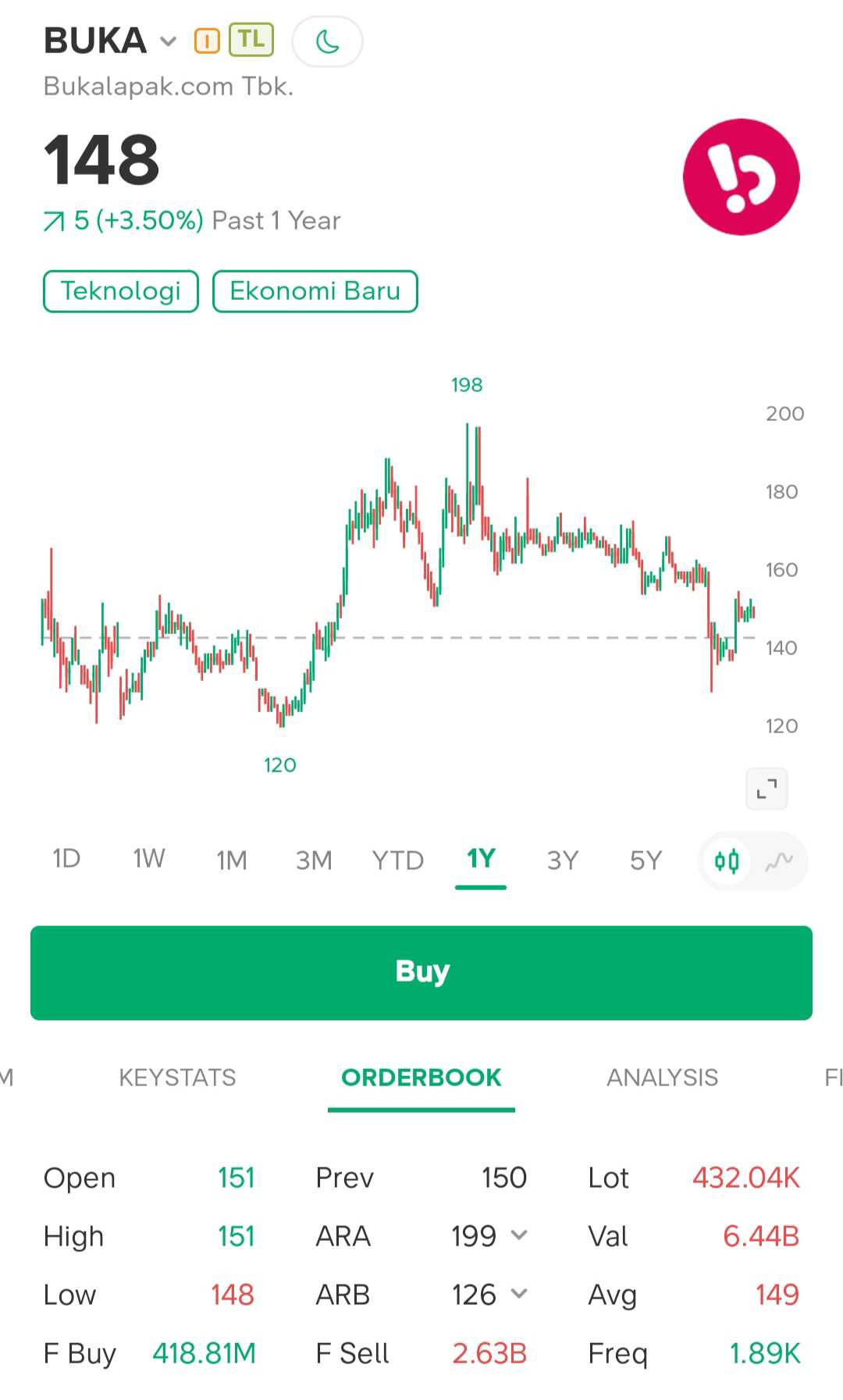

BUKA :

A. Kreatif Media Karya 34.05% =>44.91%

B. EMTK (Ultimate Beneficial Owner) total 55,401% + Treasury Stock 10,408%

C. Free Float around 32%

Booster BUKA :

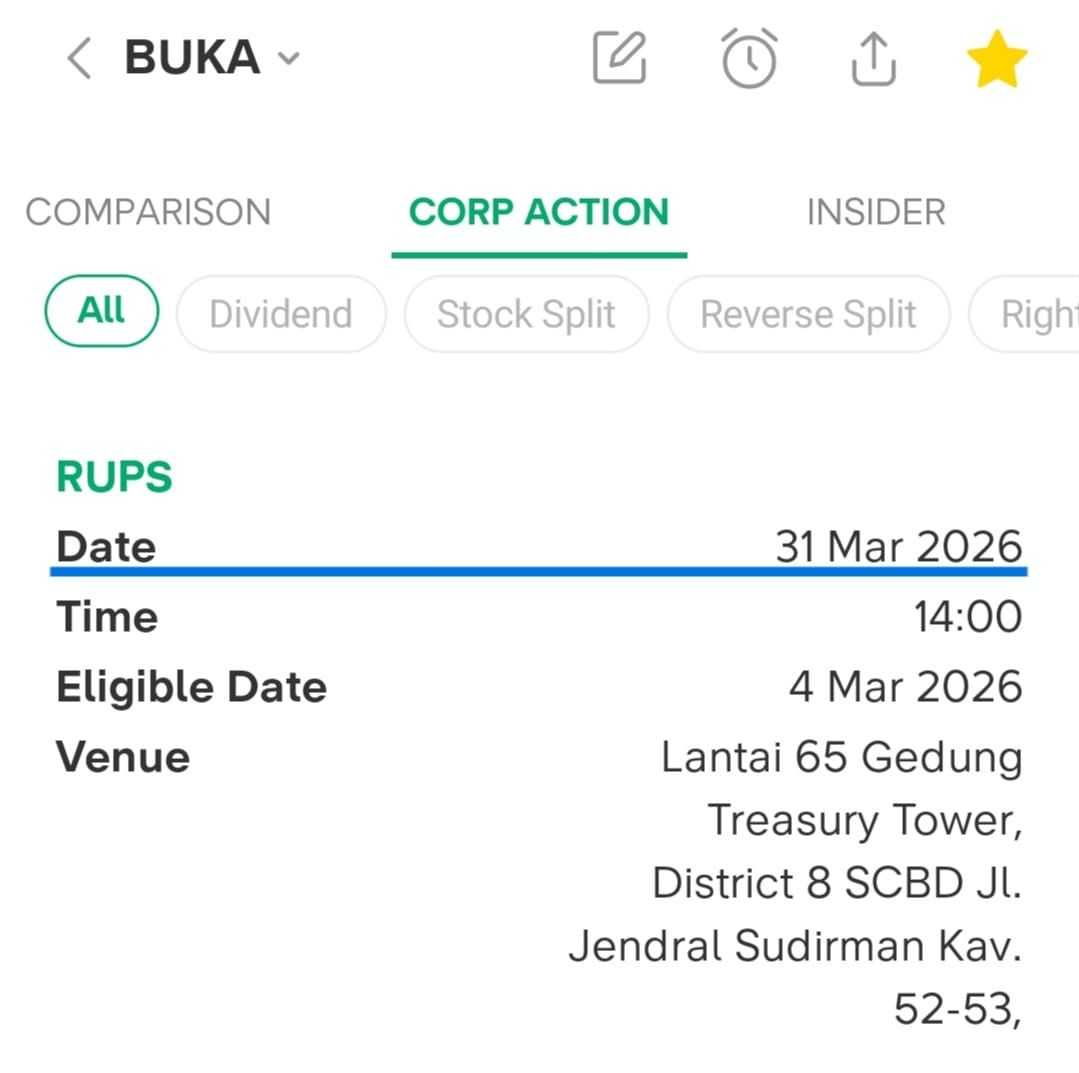

1. Extra Ordinary Shareholders Meeting 31 Mar 2026 :

a. Change Management ? Yes/No

b. Change Business Model => Investment Company ? Yes/No

2. During IPO DANA (Affiliated Company)

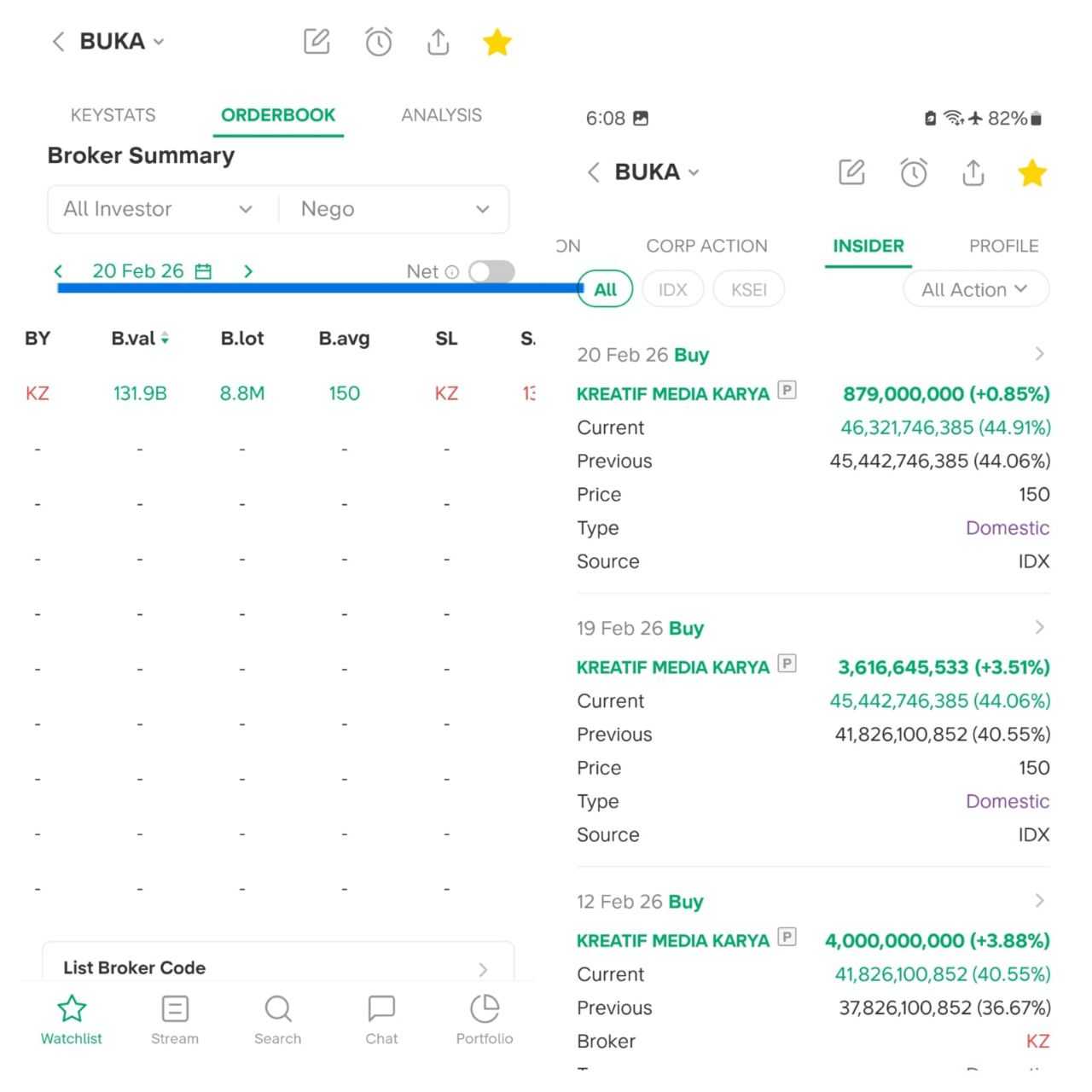

3. Insiders Buying via crossing

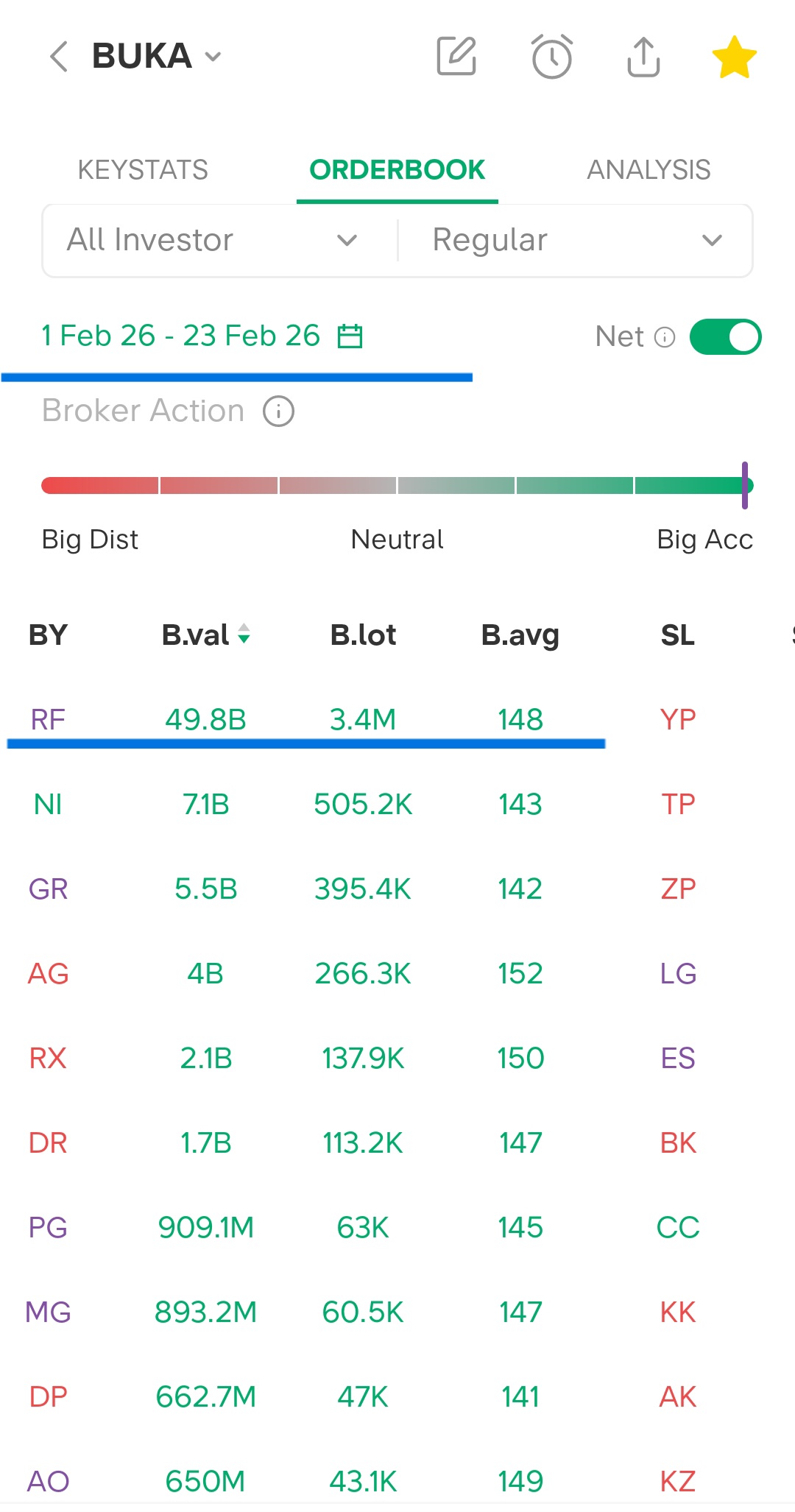

4. RF (underwriter) Top Buy from 01 Feb 2026 - 23 Feb 2026

Peter Lynch :

Buy only what you understand, believe in, and intend to stick with — even when others are chasing the next miracle.

Stay within your circle of competence

Radar On : $BUKA $PALM $TSPC

Keep the Faith, Don't lose your way.

加油

Jia You

Uraaa

Do Your Own Research

Trust NO Body

Ignore Market Noise

1/4

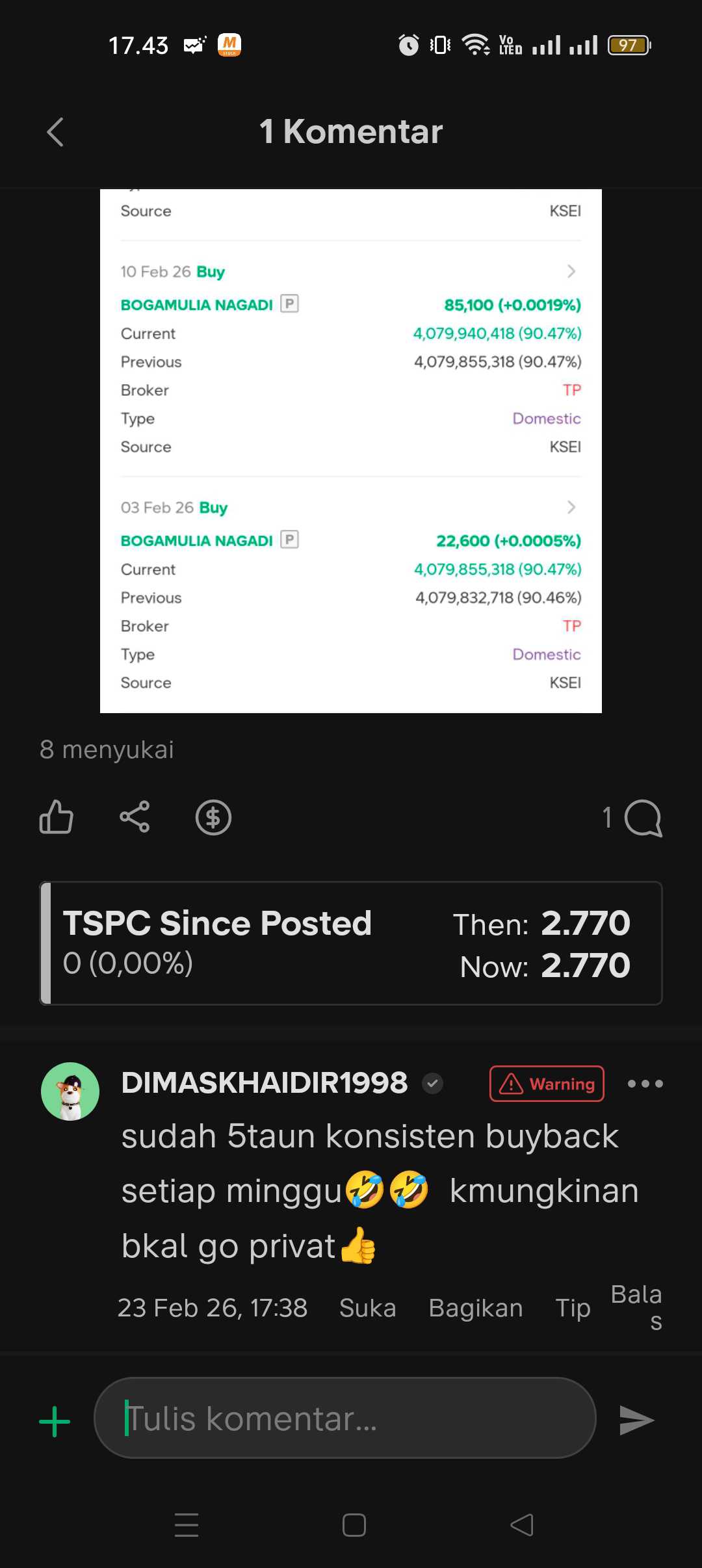

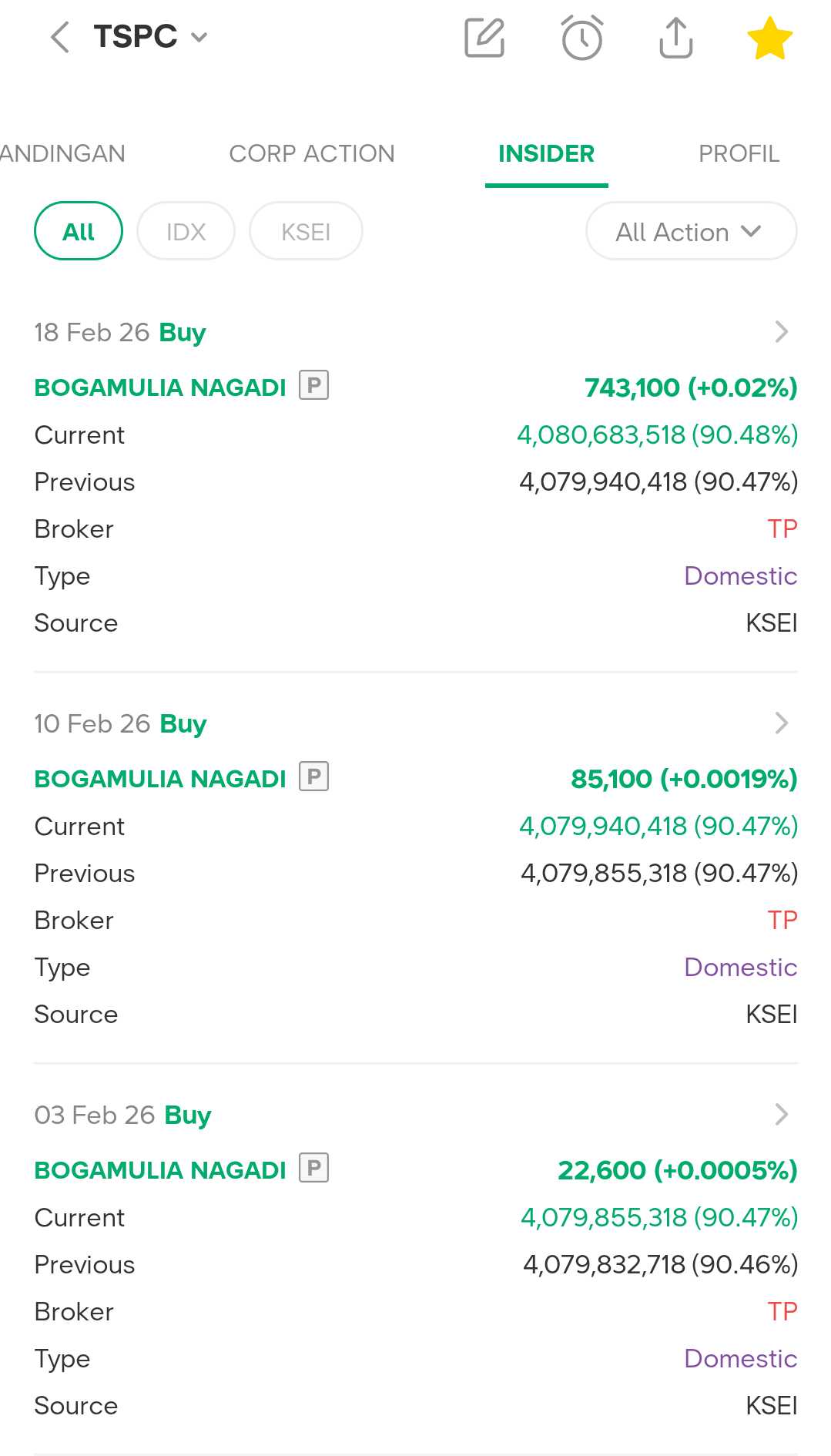

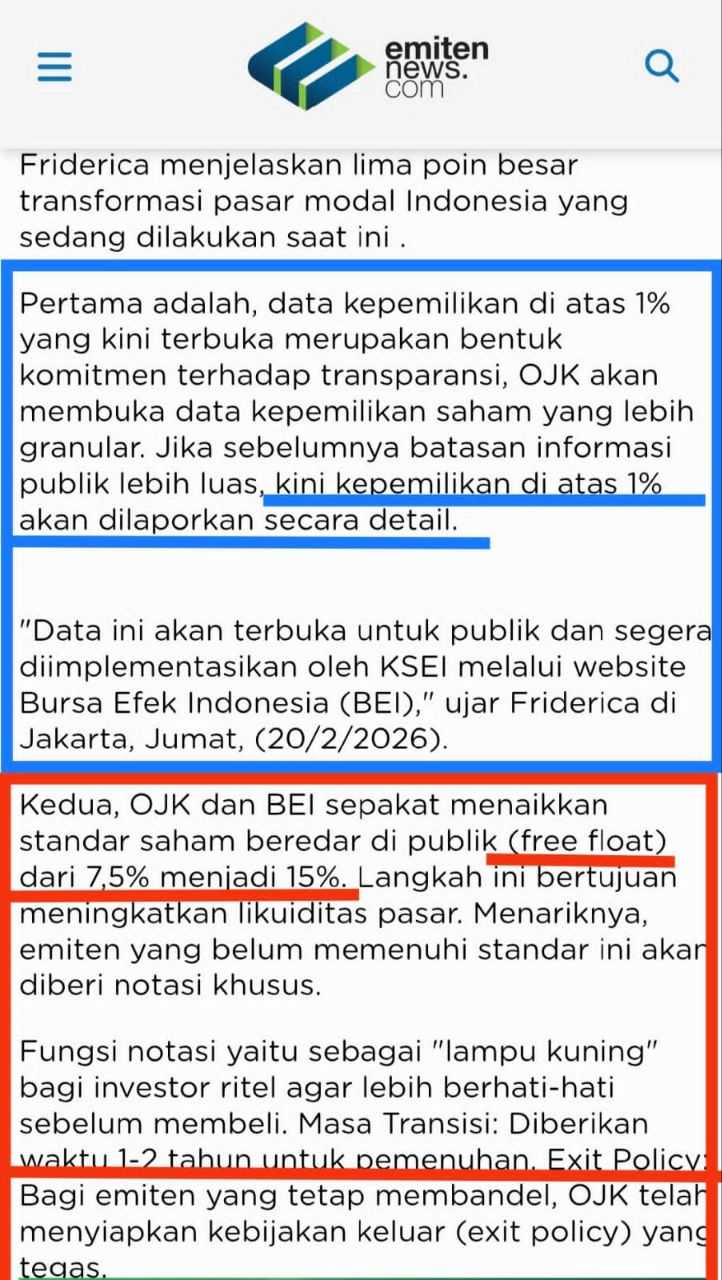

Bukannya Menambah Free Float, Ini PSP $TSPC Maka Sibuk Mengurangi Free Float

Hampir tiap minggu PSP nya nambah posisi terus.

Apakah ndak niat sama Free Float 15% yang akan dipaksakan OJK dalam 3 tahun ke depan?

Apakah itu artinya TSPC nanti memilih go private aja jika enggan refloating 15%?🤔

Ini bukan rekomendasi jual dan beli saham. Keputusan ada di tangan masing-masing investor.

Untuk diskusi lebih lanjut bisa lewat External Community Pintar Nyangkut di Telegram dengan mendaftarkan diri ke External Community menggunakan kode: A38138

Link Panduan https://stockbit.com/post/13223345

Kunjungi Insight Pintar Nyangkut di sini https://cutt.ly/ne0pqmLm

Disclaimer: http://bit.ly/3RznNpU

$TSPC 18 Feb 26

Investor: BOGAMULIA NAGADI

Action: BUY

Shares Traded: +743,100 (+0.0165%)

Current: 4,080,683,518 (90.4835%)

Previous: 4,079,940,418 (90.467%)

Broker: TP

Investor Type: Domestic

Source: KSEI

1. During IPO SUPA Q4/2025 : BUKA 120 => 198

2. How about during IPO DANA : BUKA 148 => 245 ?

Peter Lynch :

Buy only what you understand, believe in, and intend to stick with — even when others are chasing the next miracle.

Stay within your circle of competence

Radar On : $BUKA $PALM $TSPC

Keep the Faith, Don't lose your way.

加油

Jia You

Uraaa

Do Your Own Research

Trust NO Body

Ignore Market Noise

1/2

1. Transparency => disclose shareholder >= 1%

2. Free Float 7.5% => 15% time frame 1 to 2Y + Special Notification (tatto ?) or Exit Strategy.

https://cutt.ly/GtQUkb7r

Peter Lynch :

Buy only what you understand, believe in, and intend to stick with — even when others are chasing the next miracle.

Stay within your circle of competence

Radar On : $PALM $TSPC $HMSP

Keep the Faith, Don't lose your way.

加油

Jia You

Uraaa

Do Your Own Research

Trust NO Body

Ignore Market Noise

$TSPC

long term investment,

dividen 7% setahun

capital gain 25% setahun

hutang hampir NIHIL

Cash melimpah

growth 15%

basic NEEDs consumer & farmasi

value setengah dari PeerS

$BBCA dibandingkan $TSPC ?

jauh bangeettzzz

nikmat apa lagi yg kurang???

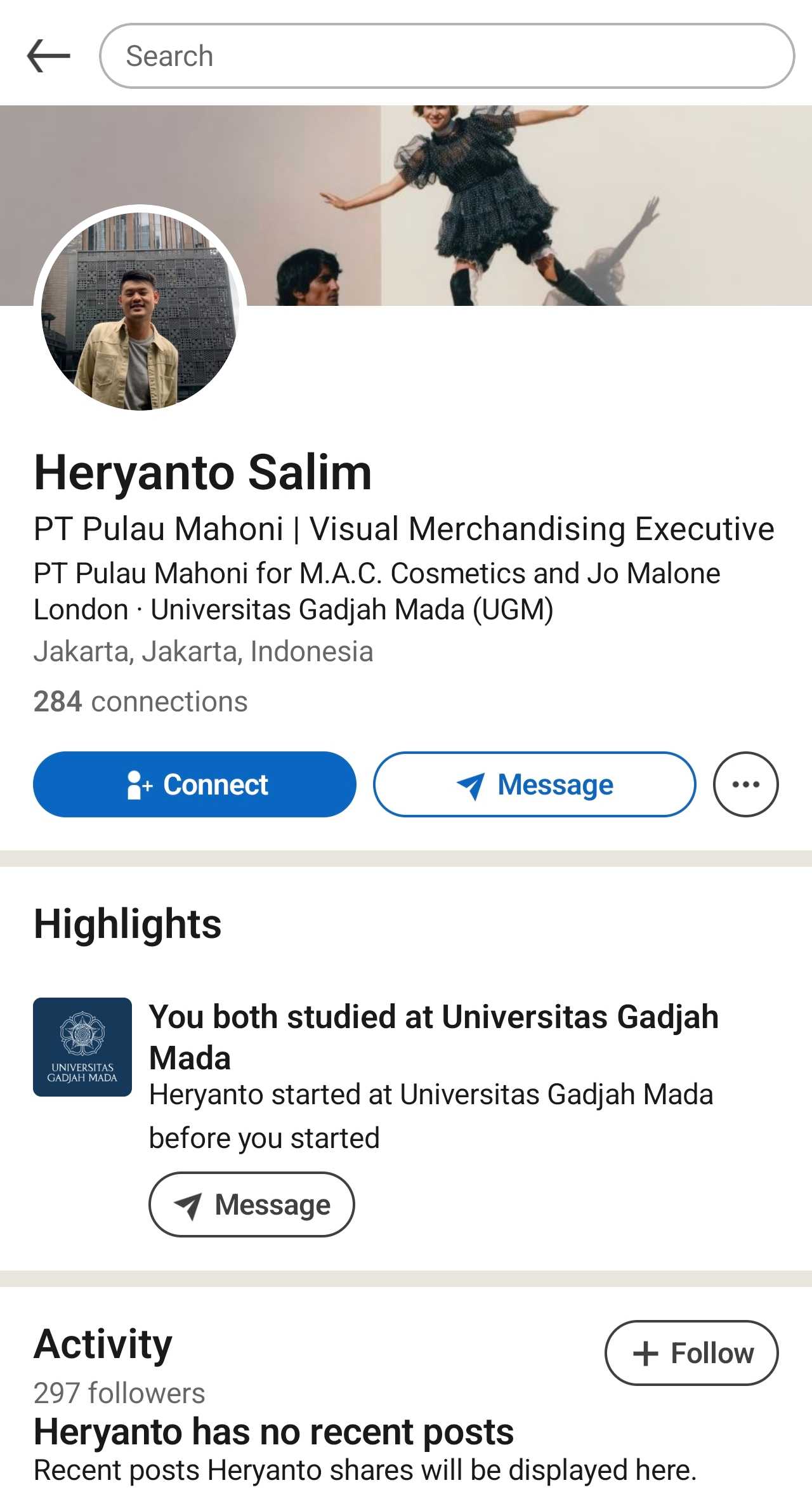

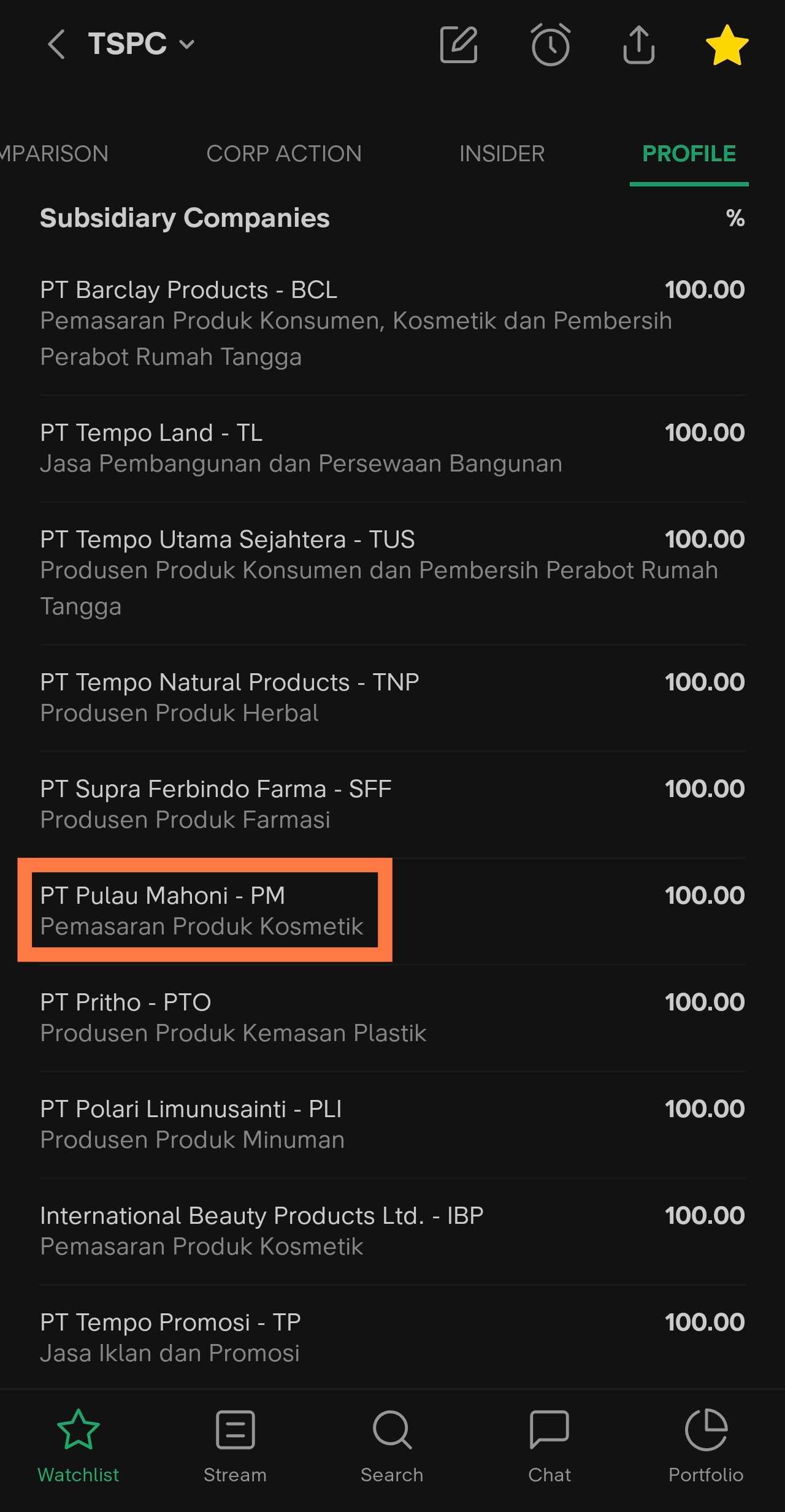

$TIRT Salim yg nggak ada hubungannya sama Anthony ini ternyata terafiliasi dengan anak usaha $TSPC kah? 👀

1/3

Did UBO (Ultimate Beneficial Owner) buy $BUKA via crossing ?

Peter Lynch :

Buy only what you understand, believe in, and intend to stick with — even when others are chasing the next miracle.

Stay within your circle of competence

Radar On : $PALM $TSPC

Keep the Faith, Don't lose your way.

加油

Jia You

Uraaa

Do Your Own Research

Trust NO Body

Ignore Market Noise