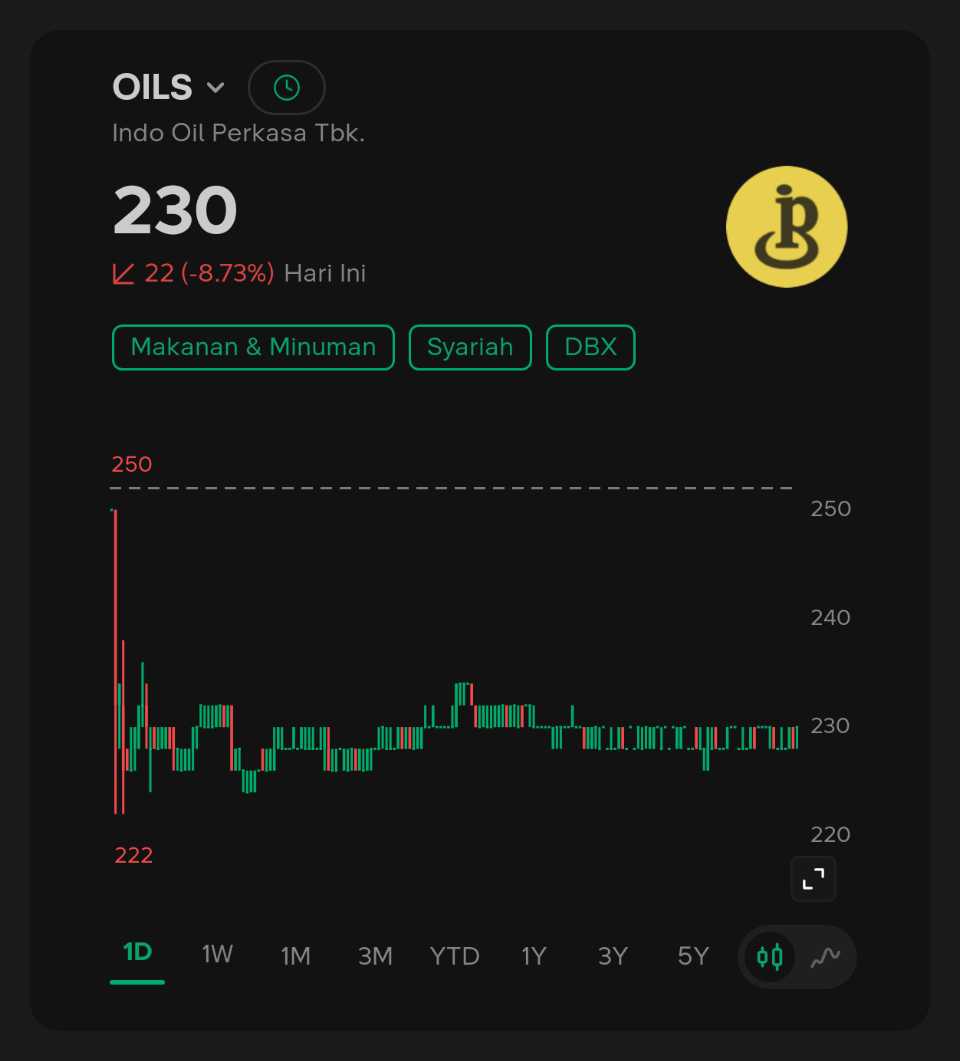

OILS

Indo Oil Perkasa Tbk.

230

-22

(-8.73%)

42.23 M

Volume

16.53 M

Avg volume

Company Background

Didirikan pada tahun 2016, PT Indo Oil Perkasa Tbk. (OILS) merupakan produsen minyak berbasis kelapa yang berfokus pada distribusi/ekspor minyak kelapa dengan standar mutu dan kualitas yang terjamin. OILS telah mengalami banyak pertumbuhan yang luar biasa. Banyak fasilitas dan terobosan yang telah dilakukan untuk memproduksi produk turunan kelapa yang berkualitas.

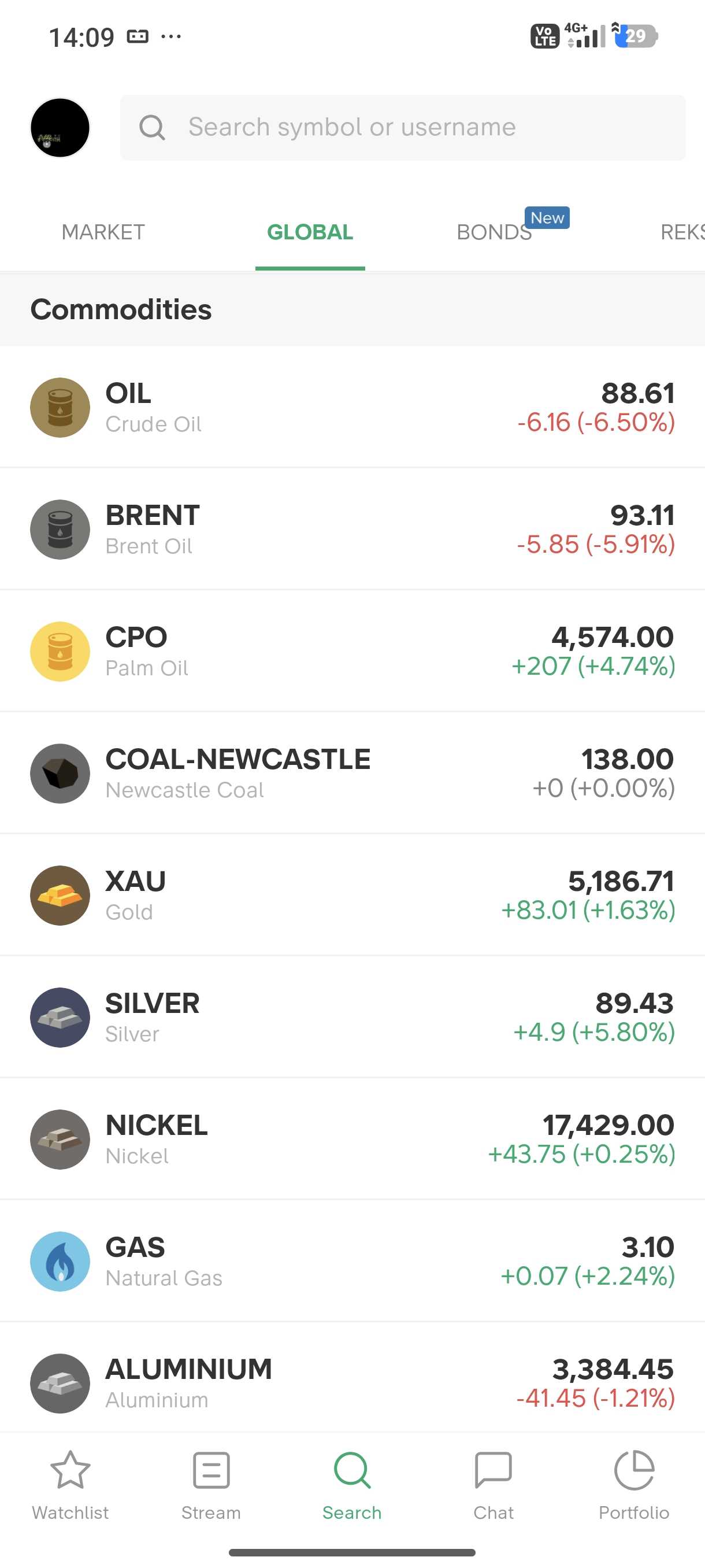

@Khaibar18 smoga saja perang cepat berakhir. dan si trump tau diri jgn meningkatkan ekskalasi lagi.

tapi ya siapa yang tidak happy saham2 batubara yg dihold naik tinggi karena peristiwa ini, namun ijo2 di porto kayaknya gak sebanding dengan potensi kenaikan BBM dan harga barang2 lainnya jjika krisis minyak benar2 kejadian.

CMIIW...

$ITMG $ESSA $OILS

$OILS ritel memang lucu Iran perang isreal..selat Hormuz ditutup, digadang2 newsnya minyak akan naik,langsung klik tanpa liat dulu..tau2nya ritel beli minyak kelapa..disini dapat kita ambil hikmahnya,apapun rumor tentang emiten kalau ritel sama bandar tidak masuk..tetap harga sahamnya tidak akan naik..

$OILS harga minyak dari -10% terus berkurang, kok aga anomali yaa, sepertinya akan nge gas lagi, war lanjut lagi