ENAK

Champ Resto Indonesia Tbk.

424

-12

(-2.75%)

18,100

Volume

105,836

Avg volume

Company Background

PT Champ Resto Indonesia, Tbk (ENAK) didirikan pada tahun 2010 yang pada saat ini telah tumbuh dan berkembang pesat menjadi perusahaan grup restoran yang memiliki enam (6) merek milik sendiri dengan cita rasa yang berbeda dan saling melengkapi, yaitu: Raa Cha (Suki and BBQ), Gokana (masakan Jepang), BMK (masakan Indonesia), Platinum (masakan barat dan fusion), Chopstix (masakan Asia) dan Monsieur Spoon (bakery dan café). Pada akhir bulan Oktober 2021, Perseroan mengoperasikan 271 outlet yang tersebar di Pulau Jawa, Bali, Sumatera dan Sulawesi.

🔬 STOCKBOT ANALYTICS

🔥 MARKET PULSE: $DEWA — PT Darma Henwa Tbk

📅 Data per: 10 Maret 2026 | 🚦 Status: BEARISH CORRECTIVE — POST-BUYBACK PROFIT TAKING, FUNDAMENTAL JANGKA PANJANG SANGAT KUAT, KONTRAK Rp10,5T JADI BACKBONE REVENUE ⛏️🔴→🟡

⚡ STRATEGI STOCKBOT

REKOMENDASI: BUY ON WEAKNESS — SWING AKUMULASI DENGAN HORIZON 6–12 BULAN 🎯

Logika: News (+++) sangat berlapis — kontrak Arutmin Rp10,5T life of mine ditandatangani Januari 2026, buyback Rp950M tuntas lebih cepat dari jadwal, revenue unaudited 9M-2025 Rp4,65T dengan EBITDA margin 27,2%, target kapasitas 100% armada in-house Maret 2026 (tanpa subkontraktor), dan proyeksi UOB Kay Hian: revenue +105% YoY 2026. Namun trend harian: distribusi pasca-buyback selesai — harga turun dari puncak 620+ ke 438 setelah buyback rampung. Formula → News (+++) & Trend (Down post-peak) = BUY ON WEAKNESS — kontrak 10,5T bukan noise, ini revenue yang visible dan terkunci selama umur tambang.

⚔️ SKENARIO A: AGGRESSIVE MODE (Scalping/ODT)

Volatilitas 6 Maret: range 432–468 = 8,3% ✅ — sangat volatile, cocok untuk scalping aktif.

Entry Trigger: Breakout bersih di atas Rp 468–504 (area MA10/MA20 harian + PP Pivot Point) dengan volume spike >1 miliar saham sesi pertama 🚀.

Buy Zone: Rp 468 – Rp 503 (masuk setelah candle daily close di atas 468 dengan konfirmasi volume).

Take Profit Target 1: Rp 515–534 (area MA50 harian + Fibo R1 PP 0.236 — bungkus cepat).

Take Profit Target 2: Rp 538–540 (area distribusi sebelumnya + Fibo R2 PP 0.618 — bungkus sisa).

Hard Stop (SL): Close 1D di bawah Rp 417 (area S1 PP 0.382 bawah + low terakhir terdekat) → exit tanpa tunda.

🐢 SKENARIO B: STRATEGIC MODE (Swing — 6–12 Bulan / Long-Term Fundamental Play)

DEWA adalah turnaround story paling menarik di sektor jasa tambang IDX — dari hampir collaps ke profitabilitas dalam 2 tahun, didukung Grup Bakrie-Salim, kini punya kontrak life of mine Rp10,5T yang menjamin revenue floor bertahun-tahun ke depan.

Entry Logic: Deep Accumulation di Post-Buyback Correction Zone — harga saat ini (438) jauh di bawah rata-rata harga buyback perseroan ~Rp580/saham, artinya pasar mempersilakan kita beli lebih murah dari harga yang manajemen bayar sendiri.

Buy Zone: Cicil di Rp 400–445 (area support segitiga bawah chart + S2 PP 0.618 + zona demand kuat dari chart symmetrical triangle).

Resistance Target 1: Rp 534–545 — zona ARA buyback + ambil modal pertama.

Moon Target 2: Rp 700–850 (target teknikal dari symmetrical triangle breakout + proyeksi valuasi wajar berbasis EPS 2026E dari UOB Kay Hian di PER 12–15x).

Safety Exit: Close mingguan di bawah Rp 374 (area ARB zone + support kritis jangka panjang segitiga) → tesis fundamental berubah, exit dan review.

📰 INTELEJEN BERITA (Radar 1 Bulan Terakhir — Januari–Maret 2026)

🗞️ Headline Kunci 1:

[IMPACT: 🔴 SANGAT POSITIF — REVENUE TERKUNCI JANGKA PANJANG]

"Darma Henwa (DEWA) Teken Perpanjangan Kontrak Tambang dengan Arutmin Indonesia — Nilai Estimasi Rp10,5 Triliun, Berlaku Life of Mine — 252 Juta BCM Overburden + 50 Juta Ton Batubara" — 19–20 Januari 2026.

Ini bukan sekadar kontrak biasa — ini adalah kontrak life of mine yang berarti DEWA mengerjakan proyek Asam-Asam dan Kintap sampai tambang tersebut habis ditambang. Dengan volume 252 juta BCM overburden dan 50 juta ton batubara yang harus diproses, DEWA kini memiliki revenue visibility paling panjang dibanding semua emiten jasa tambang di IDX. Nilai Rp10,5T ini = 2,2x total pendapatan DEWA selama seluruh 9 bulan 2025 (Rp4,65T) — ini adalah kontrak game changer yang menjamin pertumbuhan jangka panjang.

🗞️ Headline Kunci 2:

[IMPACT: 🟢 POSITIF KUAT — SINYAL KEPERCAYAAN DIRI MANAJEMEN]

"DEWA Rampungkan Buyback Rp950 Miliar Serap 1,638 Miliar Saham — Selesai 13 Februari, 6 Hari Lebih Cepat dari Jadwal" — 12–16 Februari 2026.

Buyback selesai lebih cepat dari jadwal dan menyerap hampir seluruh alokasi (Rp949,99M dari Rp950M) adalah sinyal bahwa manajemen sangat yakin harga saat itu masih murah. Harga buyback rata-rata ~Rp579/saham. Fakta bahwa harga pasar saat ini (438) jauh di bawah harga average buyback perseroan menciptakan opportunity unik — kita bisa masuk lebih murah dari harga manajemen. Pasca-buyback, 1,638 miliar saham keluar dari float pasar = supply berkurang secara permanen.

🗞️ Headline Kunci 3:

[IMPACT: 🟢 POSITIF — MILESTONE OPERASIONAL KRITIS]

"DEWA Targetkan 100% Armada Pertambangan In-House (Zero Subkontraktor) di Q1 2026 — Kapasitas Produksi Naik 125 → 160 Juta BCM" — 6–7 Januari 2026.

Strategi "beli alat berat sendiri, singkirkan subkontraktor" adalah margin expander paling powerful di industri jasa tambang. Jika konversi 100% in-house tercapai Maret 2026, EBITDA margin DEWA yang sudah 27,2% di 9M-2025 berpotensi meningkat ke 32–35%+ — karena biaya subkontraktor yang sebelumnya 20–25% dari revenue dikembalikan menjadi margin perseroan. Ditambah kenaikan kapasitas +28% (125→160 juta BCM) = double boost: margin naik + volume naik secara bersamaan.

🗞️ Headline Kunci 4:

[IMPACT: 🟡 NETRAL — VALUASI PREMIUM PERLU DIWASPADAI]

"Analisis Bisnis: Harga DEWA di Rp500 Tercatat PER 65x — Masih Layak Dikoleksi atau Sudah Pricy?" — 2 Maret 2026.

Analis https://cutt.ly/2tTaypfz mempertanyakan valuasi DEWA yang di harga 500 tercatat PER 65x — tergolong sangat premium untuk emiten jasa tambang. Namun ini menggunakan laba 9M-2025 yang masih partial dan belum memasukkan full benefit kontrak Rp10,5T Arutmin. Proyeksi UOB Kay Hian: laba 2026 Rp758M → EPS ~Rp1,87/saham → di harga 438, PER forward 2026 = hanya 23x — jauh lebih reasonable.

💡 Dampak Fundamental:

DEWA adalah prime beneficiary dari dua megatrend: ① Mining services boom — peningkatan produksi batubara Indonesia untuk memenuhi demand Asia Tenggara; ② Armada in-house efficiency — transformasi dari model hybrid ke full in-house yang mendongkrak margin. Dengan kontrak Rp10,5T life-of-mine + proyeksi revenue +105% YoY 2026 dari UOB Kay Hian, DEWA memiliki fundamental visibility yang sangat jarang dimiliki emiten IDX lainnya. Risiko utama: harga batubara Newcastle yang masih tertekan bisa membuat Arutmin memotong volume, dan kurs USD/IDR yang volatile karena sebagian kontrak berbasis dolar.

🔗 Korelasi Makro:

DEWA bergerak pada empat tema makro: ① Harga batubara termal Newcastle — indirect driver: Arutmin (klien DEWA) butuh harga batubara tinggi agar mau produksi maksimal; ② Capex ekspansi Arutmin/Adaro/Kideco — semakin besar investment pertambangan klien, semakin besar volume pekerjaan DEWA; ③ Kurs USD/IDR — sebagian kontrak jasa tambang berbasis USD, rupiah lemah = revenue DEWA dalam rupiah naik; ④ Kebijakan RKAB dan izin tambang — kelancaran produksi klien DEWA sangat tergantung pada persetujuan RKAB tahunan dari pemerintah.

📈 BEDAH TEKNIKAL (Chart & Price Action)

📊 Tren Utama:

Symmetrical Triangle Pattern — Menunggu Konfirmasi Arah Breakout 🔵📐⚠️ — Chart DEWA membentuk pola Symmetrical Triangle yang sangat jelas di sepanjang Oktober 2025–Maret 2026. Terjadi puncak di ~Rp850 (Oktober 2025), kemudian series lower highs dan higher lows yang semakin menyempit membentuk triangle sempurna. Harga saat ini di 438 berada di bagian bawah triangle — ini adalah decision point yang kritis: apakah akan breakdown ke bawah support, atau bounce ke atas untuk menguji resistance atas triangle?.

🧱 Key Levels:

Support Kuat (Lantai): Rp 400–438 — lower boundary triangle + S2 PP 0.618 + low terakhir.

Support Kritis: Rp 374 (area ARB zone + breakdown territory).

Resistance Pertama (Atap): Rp 504–515 — MA10/MA20 harian + PP Pivot + upper lower zone.

Resistance Utama: Rp 534–545 (area Fibo R2 PP + puncak setelah buyback 13 Feb = resistance kuat).

Target Triangle Breakout: Rp 700–850 (proyeksi teknikal tinggi triangle jika breakout ke atas terkonfirmasi).

🕯️ Pola Candlestick & Indikator:

Candle harian 6 Maret: open 464, high 468, low 432, close 438 (-6,41%) — bearish body solid dengan shadow bawah tipis — selling pressure masih dominan, belum ada reversal candle yang valid. Volume 557,25M vs MA20 (801,96M) — di bawah rata-rata, distribusi tidak panik = tidak ada forced selling masif. RSI 32,9 = mendekati oversold — area di mana DEWA secara historis menemukan buyer kuat. MACD: -11,35 negatif — bearish momentum masih aktif, namun sudah 6+ minggu bearish = momentum exhaustion mulai terlihat.

📝 INSTRUKSI (KESIMPULAN):

"DEWA adalah kontraktor tambang dengan kontrak life-of-mine Rp10,5T dari Arutmin yang menjamin revenue bertahun-tahun, buyback Rp950M tuntas di harga rata-rata Rp579 sementara pasar kini menjualnya di 438 — ini adalah kesempatan masuk di harga lebih murah dari manajemen sendiri, dengan symmetrical triangle di lower boundary dan RSI 33 sebagai timing entry ideal untuk cicil akumulasi swing di 400–445 dengan target 534–850 dalam 6–12 bulan." ⛏️💎📐

⚠️ Disclaimer: Riset ini disusun oleh Algoritma StockBot. Keputusan investasi tetap di tangan Anda. DYOR.

$ROCK $ENAK

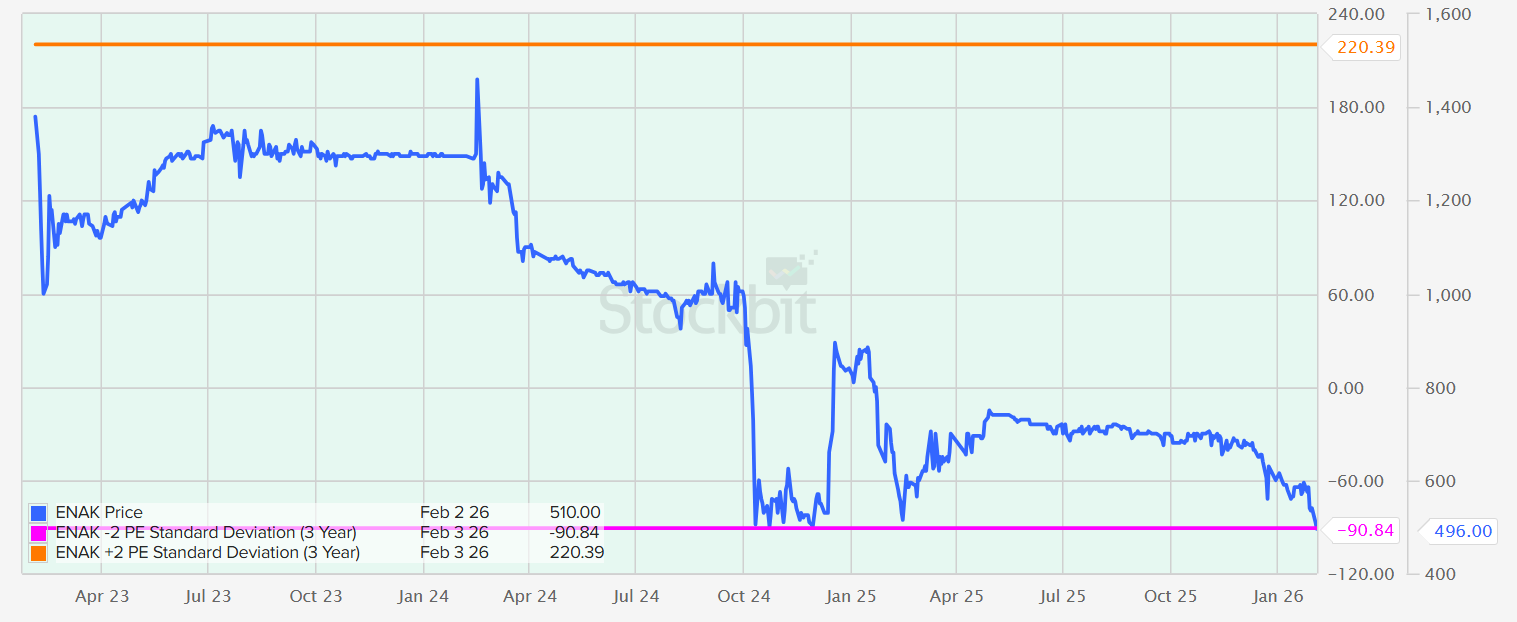

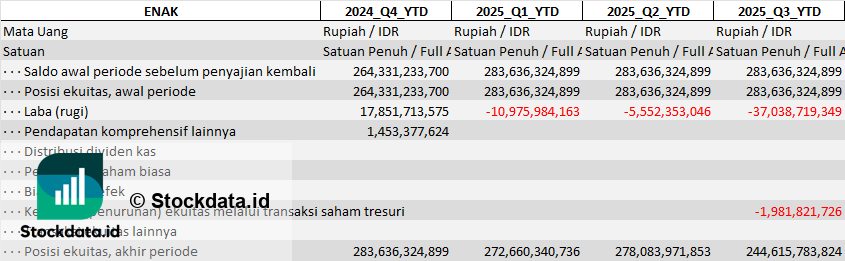

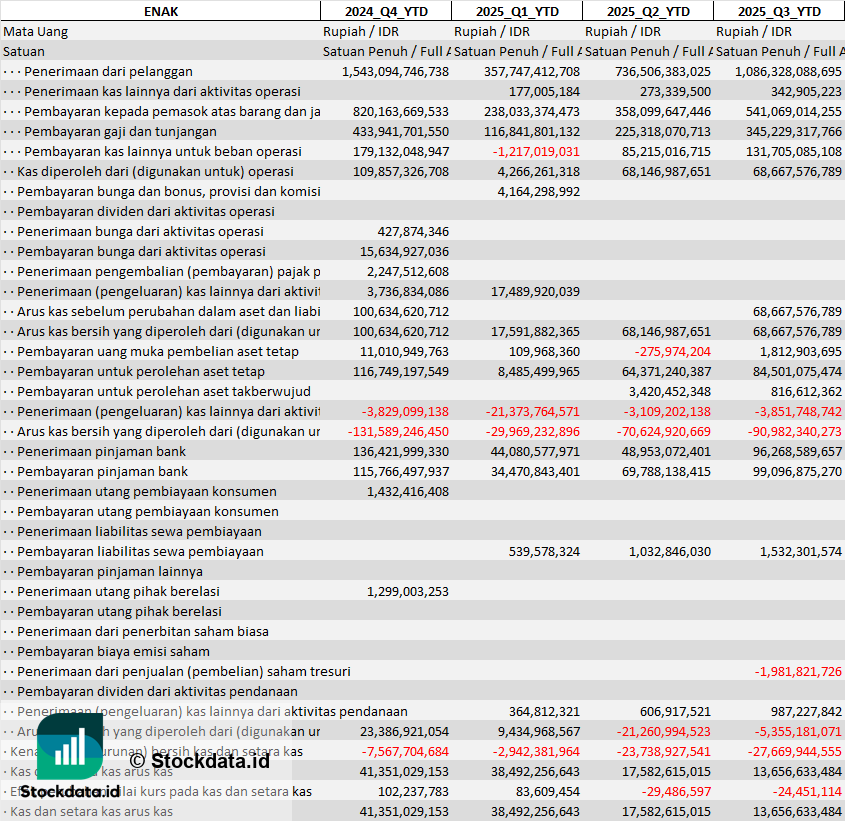

PT Champ Resto Indonesia Tbk - ENAK

Laporan Keuangan

- Neraca Keuangan

- Laporan Laba Rugi

- Laporan Arus Kas

- Laporan Perubahan Ekuitas

Follow kami untuk laporan fundamental emiten!

$ENAK

1/4

STOCKBOT QUANTUM ANALYTICS

🔥 MARKET PULSE: $BRMS

📅 Data per: 25 Februari 2026 | 🚦 Status: POSITIVE NEWS, TEKNIKAL SEDANG PULLBACK SIDEWAYS ⛏️

⚡ STRATEGI STOCKBOT

REKOMENDASI: SWING / BUY ON WEAKNESS TERUKUR

⚔️ SKENARIO A: AGGRESSIVE MODE (Scalping/ODT)

Gunakan bila intraday range >3–4% dan volume di atas rata‑rata 20 hari.

Entry Trigger: Breakout intraday kuat kembali di atas Rp1.050 dengan volume minimal 2× rata‑rata, mengkonfirmasi keluarnya harga dari penurunan cepat 1.080 → 1.010 dan penolakan di bawah MA20.

Buy Zone: Rp1.050 – Rp1.070 setelah tembus dan retest tipis (harga turun sebentar ke area 1.030–1.040 lalu mantul).

Take Profit Target 1: Rp1.120–Rp1.140 (puncak lokal konsolidasi Februari) sebagai bungkus cepat.

Take Profit Target 2: Rp1.200–Rp1.225, sejalan dengan level target teknikal yang disorot riset MNC Sekuritas dalam rekomendasi “BRMS berpotensi rebound, target Rp1.225”.

Hard Stop (SL): Jebol lagi dan close intraday di bawah Rp980 (target breakdown kotak 15‑menit yang Anda gambar) = sinyal distribusi berlanjut, wajib buang kiri.

🐢 SKENARIO B: STRATEGIC MODE (Swing/Trend Following)

Layak untuk yang ingin riding story ekspansi emas/tembaga BRMS 2026–2028.

Entry Logic: Buy on Weakness/Accumulation di dekat support kuat 900–980 ketika muncul candle reversal (hammer/bullish engulfing) dan volume jual mulai menurun; area ini sejalan dengan level stop loss yang disarankan analis (cut bawah Rp900).

Buy Zone: Cicil di Rp950 – Rp1.020, memanfaatkan sentimen bahwa tekanan harga lebih disebabkan noise berita lingkungan + koreksi YtD kecil (−1,82%) dibanding perubahan fundamental proyek.

Resistance Target 1: Rp1.150–Rp1.200 untuk ambil modal ketika harga kembali ke upper band konsolidasi dan mendekati area yang banyak disebut dalam riset sebagai fair value jangka pendek.

Moon Target 2: Rp1.400–Rp1.500 bila ekspansi pabrik emas Poboya (kapasitas naik ke 2.000 ton/hari akhir 2026), tambang bawah tanah high‑grade, dan proyek Gorontalo berjalan mulus, serta sentimen harga emas global yang berpotensi ke kisaran tinggi (proyeksi hingga USD 5.000/oz) terefleksi penuh.

Safety Exit: Close candle harian di bawah Rp900 (turun bersih dari support psikologis dan MA200) menandakan pasar mulai mendiskon serius risiko regulasi/eksekusi proyek; lebih aman keluar dan tunggu struktur baru.

📰 INTELEJEN BERITA (Radar Lengkap 1 Bulan Terakhir - 2026)

🗞️ Headline Kunci (≤1 bulan):

IMPACT: Negatif–Sentimen Lingkungan (Tapi Terbantahkan)

Sejumlah media menulis penyegelan sebagian area tambang emas PT Citra Palu Minerals (CPM), anak usaha BRMS, oleh Satgas Penertiban Kawasan Hutan (PKH) dan menyebut adanya sanksi dari Kementerian Lingkungan Hidup.

Manajemen BRMS menegaskan tidak pernah menerima surat sanksi dari KLHK dan aktivitas penyegelan hanya menyasar aktivitas ilegal pihak ketiga di area hutan, bukan operasi resmi CPM; perusahaan menyebut KK CPM tetap berlaku hingga 2050 dan operasi berjalan normal.

IMPACT: Positif–Konfirmasi Operasi & Ekspansi

BRMS menyatakan CPM masih beroperasi normal di Poboya, sementara satu pabrik emas sedang dinaikkan kapasitasnya dari 500 ton/hari menjadi 2.000 ton bijih/hari sampai akhir 2026, dan konstruksi tambang emas bawah tanah berkadar tinggi (3,5–4,9 g/t) ditarget mulai beroperasi tahun depan.

IMPACT: Positif–Outlook Produksi & Valuasi

Artikel riset menyebut BRMS menargetkan produksi emas 80.000 oz pada 2026 (naik dari 64.000 oz 2024 dan 70–72 ribu oz 2025) dengan pendorong utama peningkatan kapasitas dan tambang baru; analis menilai ekspansi agresif bisa mendongkrak valuasi, meski keberhasilan proyek dan manajemen utang sindikasi menjadi kunci.

IMPACT: Netral–Tekanan Harga Jangka Pendek

Riset teknikal menyatakan BRMS masih terkoreksi tipis YtD sekitar −1,82% ke level 1.080, sementara asing justru mencatat net buy hampir Rp950 miliar YtD; rekomendasi: waspadai tekanan jual asing jangka pendek tapi manfaatkan potensi rebound, dengan stop loss di bawah Rp900.

💡 Dampak Fundamental:

Proyek emas Poboya: kenaikan kapasitas pabrik dari 500 menjadi 2.000 tpd sampai akhir 2026 serta pengembangan tambang bawah tanah high‑grade (3,5–4,9 g/t) diproyeksi mengangkat produksi emas secara signifikan dalam 2–3 tahun ke depan (target 80.000 oz 2026 dan naik bertahap setelahnya).

Pembiayaan: BRMS mengandalkan fasilitas pinjaman sindikasi sekitar USD 600–625 juta untuk ekspansi emas dan proyek Gorontalo, sehingga suksesnya ramp‑up produksi dan cashflow sangat krusial agar rasio utang tetap sehat; analis menyoroti ini sebagai fase “execution risk” paling kritis 2026–2028.

Diversifikasi: Selain emas, Gorontalo Minerals menyiapkan produksi tembaga pasca 2028 dengan cadangan sekitar 100 Mt dan sumber daya 400 Mt, memberi BRMS opsi pertumbuhan jangka panjang di tengah tren energi hijau yang tinggi permintaan tembaga.

🔗 Korelasi Makro:

Gold super‑cycle thesis: Sejumlah lembaga memproyeksikan peluang harga emas global menuju level sangat tinggi (bahkan skenario ekstrem hingga USD 5.000/oz) dalam beberapa tahun, yang jika terealisasi akan menjadi katalis besar bagi emiten emas ber‑leverage produksi seperti BRMS.

Di sisi lain, ketatnya regulasi lingkungan di sektor tambang Indonesia membuat setiap isu izin/lingkungan—seperti kasus penyegelan kawasan hutan—mudah memicu volatilitas harga saham, sehingga kepastian izin dan kepatuhan operasi menjadi faktor penting bagi persepsi risiko BRMS.

📈 BEDAH TEKNIKAL (Chart & Price Action)

📊 Tren Utama:

Daily chart menunjukkan BRMS sempat rally dari kisaran 700‑an ke puncak sekitar 1.400–1.500 pada akhir 2025, lalu memasuki fase koreksi–sideways di kisaran 950–1.250; penutupan terakhir sekitar Rp1.010 (−4,72%), masih di atas MA200 namun berada di bawah MA20/MA50.

Struktur saat ini lebih mirip sideways melebar ketimbang downtrend murni: higher low medium term (dibanding 2025) tetap terjaga, tetapi short‑term momentum melemah setelah beberapa kali gagal tembus 1.200‑an.

🧱 Key Levels:

Support Kuat (Lantai):

Rp950–Rp980 sebagai support kotak intraday yang Anda tandai dan dekat EMA penting; di bawah itu, Rp900 menjadi support psikologis dan level stop loss yang sering disebut analis.

Resistance (Atap):

Rp1.120–Rp1.150 sebagai atap konsolidasi Februari; di atasnya, Rp1.200–Rp1.250 menjadi zona resistensi mayor yang jika ditembus dengan volume kuat akan mengkonfirmasi kelanjutan trend naik menuju 1.400+.

🕯️ Pola Candlestick:

Candle harian terakhir merah dengan body cukup besar dari high 1.085 ke close 1.010, menunjukkan distribusi setelah fase sideways sempit; volume meningkat, selaras dengan gambar 15‑menit Anda di mana harga breakdown dari rectangle 1.040–1.110 dan menarget sekitar 980.

Namun selama penurunan tertahan di 950–980 dan muncul candle rejection (shadow bawah panjang) di area ini, pola masih bisa dibaca sebagai pullback sehat di tengah news flow fundamental yang justru semakin positif (klarifikasi izin, ekspansi kapasitas).

📝 INSTRUKSI (KESIMPULAN):

“Sentimen berita BRMS saat ini paradoksal—headline negatif soal penyegelan area hutan memicu koreksi harga, tetapi klarifikasi resmi menunjukkan operasi dan kontrak karya aman sementara proyek ekspansi emas/tembaga terus maju—manfaatkan tekanan ini sebagai peluang buy on weakness bertahap di 950–1.020 dengan disiplin stop di bawah 900, dan targetkan distribusi bertahap ketika harga kembali mendekati 1.150–1.250 seiring katalis produksi emas tambahan mulai terefleksi.”

⚠️ Disclaimer: Riset ini disusun oleh Algoritma StockBot. Keputusan investasi tetap di tangan Anda. DYOR.

$ENAK $BAJA

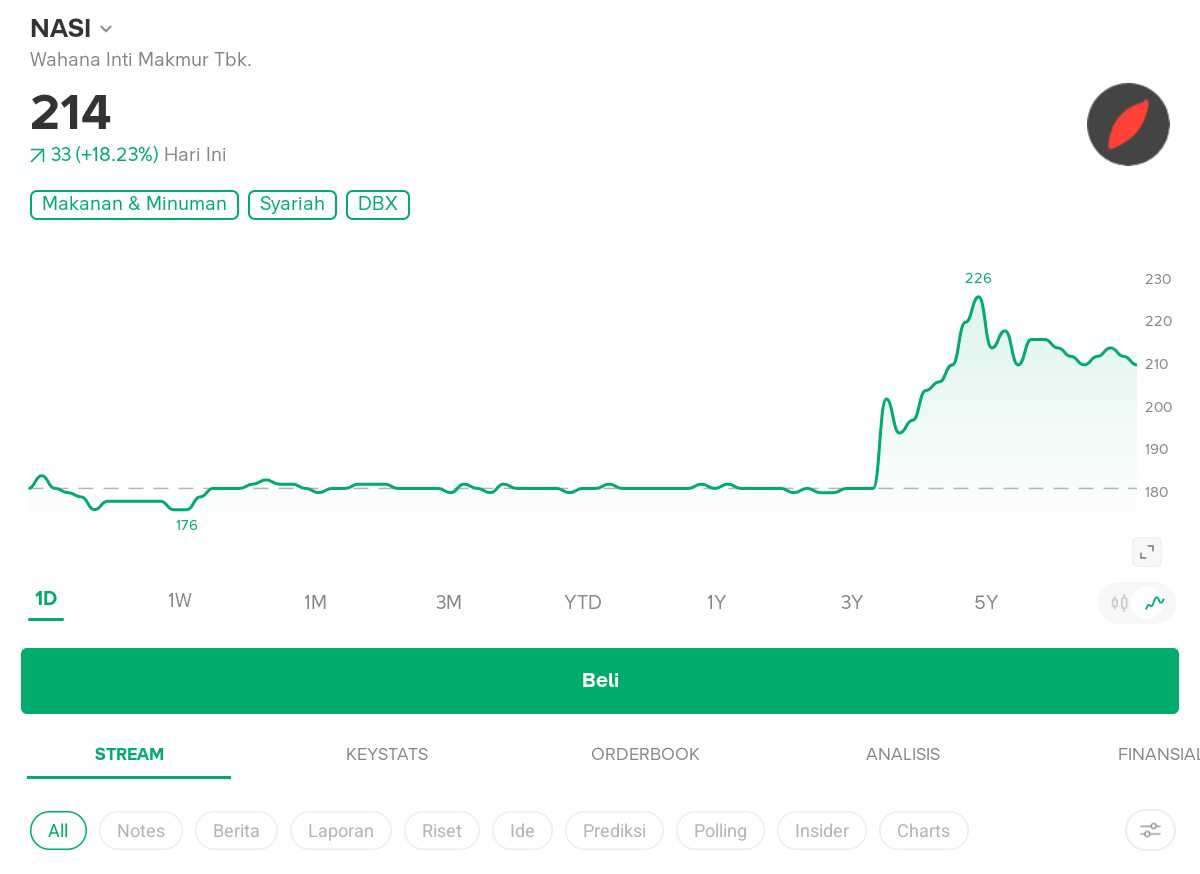

$ENAK 12 Feb 26

Investor: BAROKAH MELAYU FOODS

Action: Transfer

Shares Traded: +1,181,173,300 (+54.5157%)

Current: 1,181,173,300 (54.5157%)

Previous: 0 (0%)

Broker: CC

Investor Type: Foreign

Source: KSEI

$ENAK 12 Feb 26

Investor: BAROKAH MELAYU FOODS

Action: Transfer

Shares Traded: -1,174,868,800 (-54.2247%)

Current: 0 (0%)

Previous: 1,174,868,800 (54.2247%)

Broker: AI

Investor Type: Foreign

Source: KSEI

$ENAK 12 Feb 26

Investor: BAROKAH MELAYU FOODS

Action: Transfer

Shares Traded: -6,304,500 (-0.2910%)

Current: 1,174,868,800 (54.2247%)

Previous: 1,181,173,300 (54.5157%)

Broker: RG

Investor Type: Foreign

Source: KSEI