ARKA

Arkha Jayanti Persada Tbk.

30

0.00

(0.00%)

3.26 M

Volume

10.53 M

Avg volume

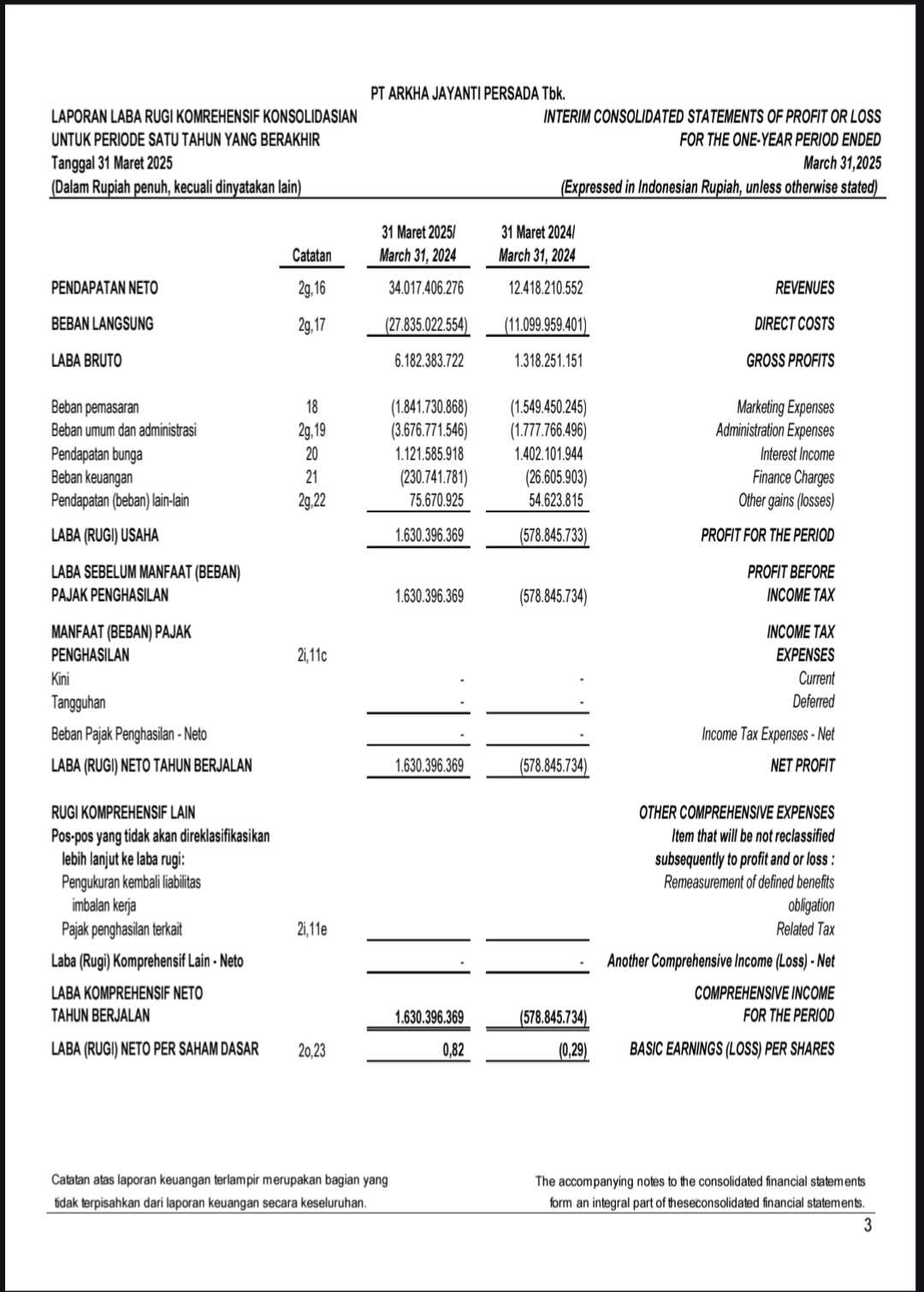

Company Background

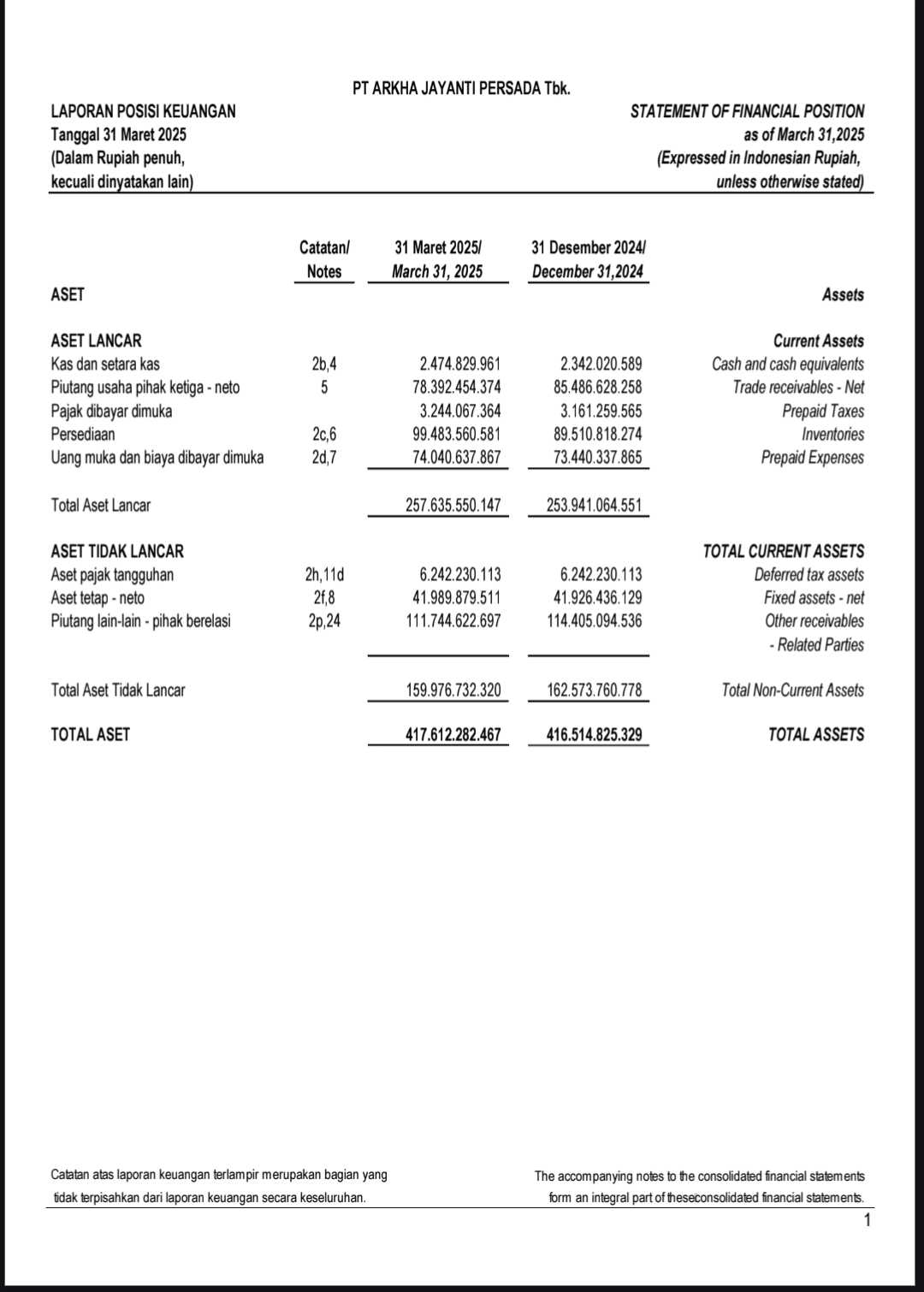

PT Arkha Jayanti Persada Tbk (ARKA) didirikan pada tanggal 24 November 1999. Induk perusahan Arkha Jayanti Persada Tbk yaitu PT Arkha Tanto Prima, PT Arkha Jayanti Persada Tbk (ARKA) Menjalankan usaha dalam bidang industri manufaktur dan fabrikasi komponen alat-alat berat, karoseri body dump truck, kontruksi baja, fabrikasi Oil & Gas equipment dan jasa pengangkutan batubara Perseroan memiliki jaringan kerja yang terdiri dari 1 Kantor Pusat, 2 unit pabrik yang berlokasi di Bogor

$ARKA

Didirikan pada tahun 2000, PT. Arkha Jayanti Persada (AJP) adalah perusahaan nasional Indonesia.

Kami telah mempertahankan sikap progresif terhadap bisnis dan berkomitmen pada integritas, profesionalisme, keunggulan teknik, keselamatan, kualitas, dan kepuasan pelanggan. Dengan tim sumber daya yang berkualitas dan pengalaman terkait dalam desain, proses, dan pengetahuan umum produk, kami telah memberikan nilai kompetitif bagi perusahaan di pasar ini.

Untuk memberikan solusi terhadap tantangan pelanggan kami, perusahaan dapat beroperasi di beberapa lini bisnis, yaitu:

Pembuatan Suku Cadang & Komponen

Konstruksi Baja

Produsen Peralatan Transportasi

Minyak & Gas

Proyek Telekomunikasi

$ARKA just info, ini emiten memang tidak mau keluar dari FCA 1, sideways setelah naiknya itu perlu 2-3bln. Cenderung turun saham ini. DWYOR, masuk di 20-25 hodl aja. Beli harga skrng jangan ya dek..

ada gk ya hubungan $ARKA dengan target prabowo buat mobil sendiri dalam 3 tahun kedepan? atau lebih ke $PART ya ? sarannya ges...

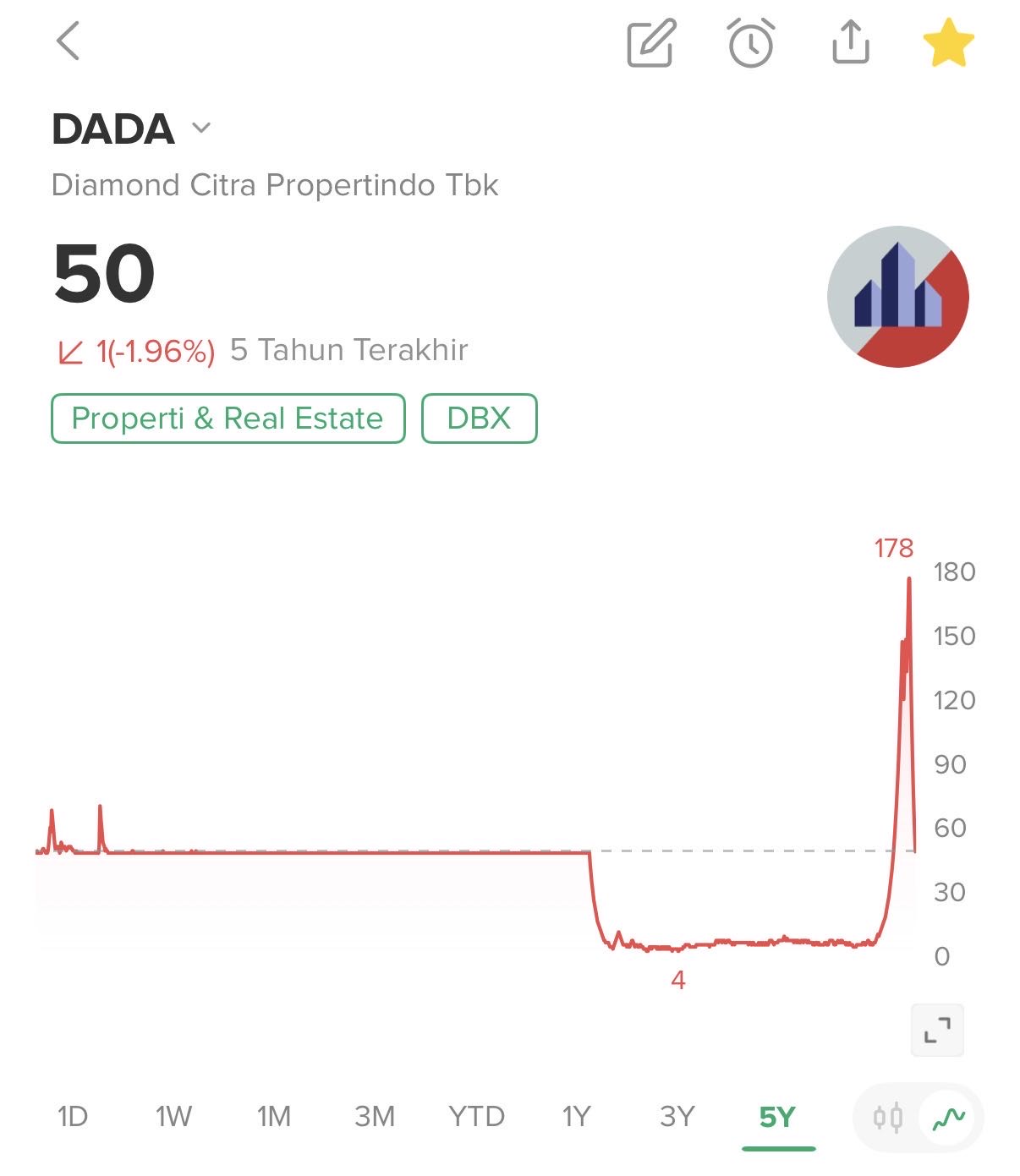

$DADA punya pola kapal selam yg akan masuk lagi ke Palung Mariana , silahkan di gambar.

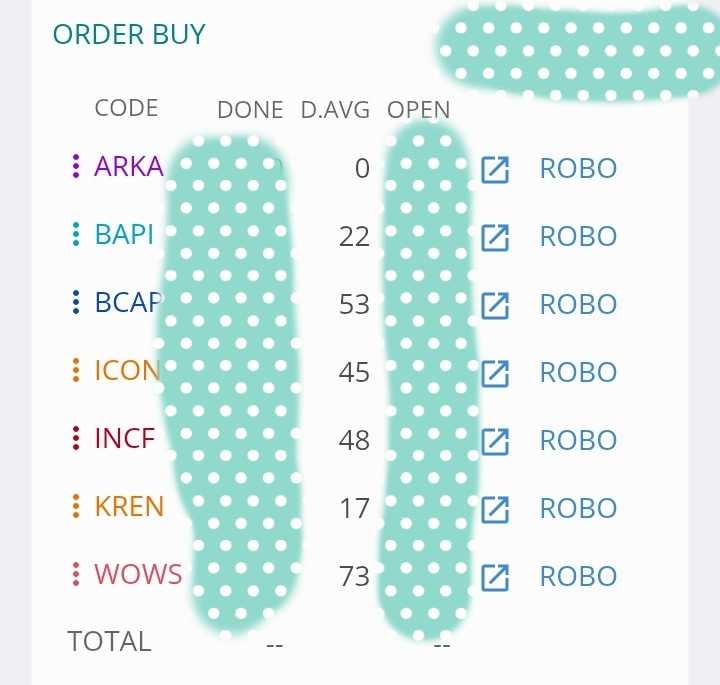

Teman setia $ARKA

CIE - Cuan Inside Exchange

$ARKA

ke 38 dalam tiga tahun? atau LEBIH TINGGI bahkan LEBIH CEPAT??

aku beli pake UANG DINGIN & IKHLAS jika DELISTING.

target TP udah ada. ... nah kalo dibeli terus ternyata turun lagi tau harus bagaimana. .. ga bakal bingung apalagi CL 🥴

⚠️ WARNING ⚠️

* ini BUKAN REKOMENDASI wajib beli

random tags$IHSG$BMRI

disclaimer : catatan pribadi ini hanyalah celoteh / prediksi nubitol, bukan ajakan beli atau jual.. . yuk mari kita sama2 mandiri 💞

(boleh diSHARE semoga bermanfaat)

$SAGE $BAPI $ARKA ini saham bakal lama naiknya, jadi mending pada CL aja, sayang uangnya nyangkut berbulan bulan bertahun-tahun 🤣🤣